Since the beginning of electricity grids, demand has fluctuated, and supply has been made to follow along. But for decades, economists and some grid engineers have dreamed of having demand play a more active role in balancing the system. With increasing use of intermittent renewable energy resources, now is the time to make that demand-response dream come true. But we can only get there if we clear up a common misconception in the world of electricity policy:

Paying customers to reduce their demand -- such as through the common peak-time rebates -- is not the same as time-varying electricity prices. PTR programs are a very inefficient alternative to charging time-varying rates that reflect the true time-varying cost of electricity.

Despite their flaws, PTR programs, and their close relative aimed at businesses, demand bidding programs, are growing. In California, PG&E, Southern California Edison, and San Diego Gas & Electric have demand bidding. PTRs are available in Maryland, New Orleans, Ohio, and many other parts of the country.

What’s wrong with paying for demand reduction?

Where to start?

No, I mean that literally -- where to start? What’s the baseline level from which you start paying for reduction? In nearly all programs, baselines are based on the customer’s consumption in the recent past, usually on other high-demand days.

But such “endogenous” baseline setting distorts incentives for conservation. When my baseline for peak-time reduction is based on consumption during other high-demand days, it undermines my incentive to conserve on those other days. Frank Wolak demonstrated that this effect is significant in his study of Anaheim. It can even lead to some users intentionally increasing consumption during baseline-setting times, as was uncovered at the Baltimore Orioles baseball stadium, which was turning on stadium lights during electricity shortages in order to be paid to then shut them off.

Camden Yards: Home of the Baltimore Orioles and a scofflaw energy manager

The distorted incentives also undermine long-term investments in energy efficiency. Sure, a more efficient air conditioner will cut my usage at critical times when the utility is paying rebates, but it will also cut my usage at baseline-setting times, which will lower my rebates, thus reducing my incentive to upgrade the A/C. In contrast, time-varying pricing -- where prices are reduced in most hours, but higher during high-demand times -- results in bigger (and more appropriate) rewards for buying the efficient A/C.

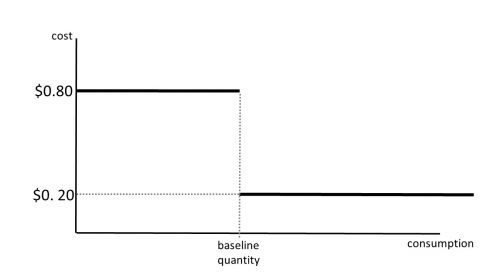

Once the baseline is set, another problem pops up: The incentive to conserve changes drastically around the baseline quantity. Rebate programs pay for reductions below the baseline, but don’t charge extra for going above the baseline. Take a typical hot summer day when a conservation rebate day is announced. On top of the customer facing a price of, say $0.20 per kilowatt-hour, she now will get a rebate of $0.60 per kilowatt-hour for the difference between her baseline and her actual consumption, but only if she cuts consumption below the baseline quantity. That means that below the baseline quantity, the incentive to save is $0.80 per kilowatt-hour -- the electricity price she saves by consuming one less kilowatt-hour plus the rebate she gets for doing so. But above the baseline, the incentive to save is still just $0.20.

The economic cost of consuming a kilowatt-hour changes drastically at baseline quantity

The way PTR baselines are set, on a typical critical day, nearly half of all customers will be far enough above their baseline quantity that they won’t have any shot at getting the rebate and therefore won’t have any extra incentive to cut consumption. In addition, many of the customers who do end up below baseline and receive a rebate will be there by accident, for instance, because they just happen to have been away from home that day. In demand reduction studies, these people who receive subsidies for doing something they would have done anyway are called “free riders.” Wolak and other studies have shown that most of the demand reducers who get paid the rebate are actually free riders.

The drastic change in the effective price at the baseline quantity has another effect that goes against fairness: it rewards random variation in consumption. Here’s a hypothetical example.

Catherine’s consumption during the baseline-setting period has established a baseline quantity of 50 kilowatt-hours during each of two conservation rebate days. She is a reliable sort who dutifully reduces her consumption to 45 kilowatt-hours on each conservation rebate day. The rebate is $0.60 per kilowatt-hour “saved,” so for cutting her consumption to 45 kilowatt-hours on each day, saving a total of 10 kilowatt-hours on the two days, she receives a total rebate of $6.00.

Max is the flighty, unpredictable type. He has also established a baseline quantity of 50 kilowatt-hours, but on one of the two rebate days, he’s away from home anyway and his consumption drops to 20 kilowatt-hours. On the other day, he stays home and cranks up the A/C, raising his consumption to 70 kilowatt-hours. His average consumption on the two days is 45 kilowatt-hours per day, just like Catherine, but his total rebate is $18.00, all received for his 20 kilowatt-hour day.

Max’s rebate is three times as large as Catherine’s, even though his average reduction on the rebate days is the same. That’s because when Max decreases his consumption, he gets the $0.60 rebate for every kilowatt-hour below the baseline, but when he goes above baseline he doesn’t have to pay the extra $0.60. The sudden change in the effective price at the baseline quantity rewards people with unpredictable demand relative to people who have reliable consumption patterns. If during each hour the price were the same for all kilowatt-hours that Catherine and Max consume, Max would be getting the same bill savings as Catherine. That’s what would happen if Max and Catherine were on time-varying pricing instead of PTR.

If PTRs are so bad, why are they so popular?

Because they hide the true cost of electricity. Rather than setting a higher price on the hottest days of the year, reflecting the truly higher cost of providing electricity on those days, PTR pays out for conservation (real or imaginary) on those hot days and raises the price a bit on all other days to cover the cost. Thus, customers who consume a higher share of their electricity on non-peak days (e.g., those who use less, or no, air conditioning) subsidize heavy peak-time users who manage to be slightly less heavy users on a specific peak day.

Some defenders of PTR say it is the way to transition to time-varying electricity pricing. I’m very skeptical. Once a customer gets used to being paid for reducing consumption on peak days, it is very difficult to change to a system that just charges higher prices on those days. There may be a utility that has managed to move from fully implemented PTR to time-varying pricing, but I’m not aware of any example.

To integrate intermittent renewable energy sources, we really need to start taking demand-side participation seriously. PTR is an inefficient route to that end that will end up paying for a lot of faux “demand reduction.” Time-varying pricing is the direct route to the goal. Sacramento Municipal Utility has recently had a very successful rollout of critical-peak pricing, one form of time-varying pricing, which the real Catherine has blogged about. My own research suggests that time-varying pricing would reduce bills for the majority of residential and industrial customers, and that it would raise bills by more than 20 percent for only a few percent of customers. Those are the customers who consume the most at peak times and impose the most cost on the system. Prices that reflect the cost of electricity would be a more effective way to integrate renewables and a fairer way to allocate the costs.

***

Severin Borenstein is E.T. Grether Professor of Business Administration and Public Policy at the Haas School of Business and Co-Director of the Energy Institute at Haas. He is also Director of the University of California Energy Institute. His research focuses on business competition, strategy, and regulation. He has published extensively on the airline industry, the oil and gasoline industries, and electricity markets. Since 2012, he has served of the Emissions Market Assessment Committee that advises the California Air Resources Board on the operation of California’s Cap and Trade market for greenhouse gases.

Reprinted with permission. Original column appears here.

Borenstein adds, "If you want an even geekier discussion of the problems with PTR, I recorded a screencast video on the subject for my MBA course on Energy & Environmental Markets."