U.S. coal production has peaked, and the miscalculations that have led to estimates of a 200-year supply could create a serious electricity deficit for the nation, according to a new report from advocacy group Clean Energy Action.

“The belief that the U.S. has a ‘200-year’ supply of coal is based on faulty reporting by the EIA,” concludes the report, Warning: Faulty Reporting of U.S. Coal Reserves. “Most U.S. coal is buried too deeply to be mined at a profit and should not be categorized as reserves, but rather as ‘resources.’”

“The U.S. Energy Information Administration’s estimate of the nation’s coal is ‘a faulty fuel gauge’ because the U.S. is rapidly approaching the end of economically recoverable coal,” explained report co-author Leslie Glustrom of Clean Energy Action. “We’re acting like we have a full tank. No one knows exactly when empty will come, but we should be prepared.”

The economic viability of the U.S. coal resource is compromised because “it is buried too deeply and costs too much to mine it,” Glustrom said. Peabody Coal CEO Greg Boyce’s Q3 2013 earnings report call remarks about reduced capital expenditures in Wyoming’s Powder River Basin seem to confirm that coal is becoming “too expensive to mine,” according to Glustrom.

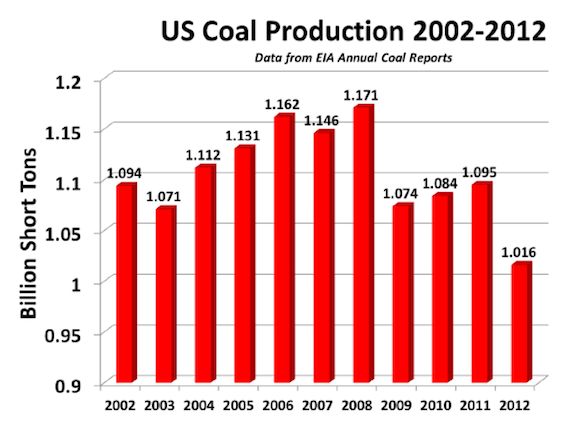

“Nationally, coal production appears to have peaked in 2008 at 1.171 billion tons,” the report states. “U.S. coal production in 2012 had fallen by about 155 million tons to 1.016 billion tons.”

EIA data puts production for the first half of 2013 at 488 million tons, Glustrom added. “We are not even on track to get to a billion tons. That would be back to 1993 levels.”

Source: Clean Energy Action's Warning: Faulty Reporting of U.S. Coal Reserves

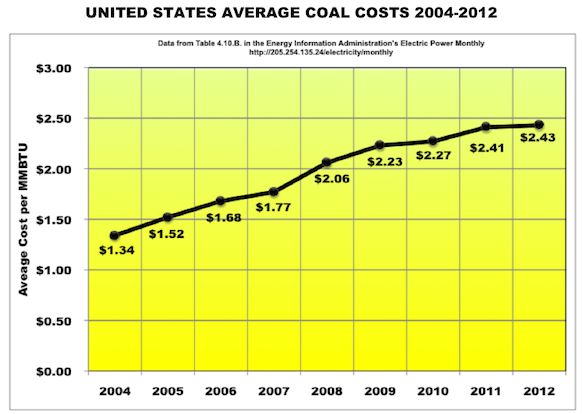

The EIA’s projection of a 200-year supply of coal is overly dependent on data from the 1980s and 1990s, when the price remained around $1.00 per million British thermal units (MMBTU) because coal producers were “ripping open surface mines,” Glustrom said.

But there was an inflection point in 2004. Since then, the cost of coal used by electric utilities rose more than 7 percent per year, two to three times faster than inflation, the reports states. Three key factors continue to drive costs up and production down: increased production costs, increased transportation costs, and increased export pressure.

“Easily accessible coal has already been mined and burned. Now reaching the remaining coal is becoming increasingly difficult and expensive,” the report claims. And the price of diesel fuel for the trains that transport most U.S. coal is rising. Finally, supply-constrained European, South American and Asian countries “are often willing to pay more for coal.”

The top sixteen states, which combined produce over 95 percent of U.S. coal, are cumulatively “past their peak production,” the report asserts.

Eastern coal is typically in the $3.00 per MMBTU to $4.00 per MMBTU price range. Western coal is slightly less, but its cost is rising, especially in states that incur transportation costs by importing from the West.

Examples are New Jersey, where the price rose 7.5 percent per year to $4.05 per MMBTU since 2004, and Mississippi, where coal it rose 12.5 percent per year to $4.45 per MMBTU.

New technology is not a viable solution, according to the report: “Even if coal were perfectly clean -- or could be made to be so -- it would still be the wrong choice due to serious questions about long-term U.S. coal supplies."

Source: Clean Energy Action's Warning: Faulty Reporting of U.S. Coal Reserves

Another factor compromising coal’s economic viability is that the top three U.S. coal companies have huge debts coming due between now and 2021 at interest rates much higher than those available to better-positioned companies, the report contends.

Peabody Energy, the biggest U.S. coal company, has $650 million of 7.375 percent debt due in 2016; $1.5 billion of 6 percent debt due in 2018; $650 million of 6.5 percent debt due in 2020; and $1.34 billion of 6.25 percent debt due in 2021.

Second-ranked Arch Coal Inc. has $600 million of 8.75 percent debt due in 2016; $1 billion of 7 percent debt due in 2019; $375 million of 9.875 percent debt due in 2019; and $500 million of 7.25 percent debt due in 2020.

“U.S. coal production very likely has peaked,” Glustrom said. “And it is no longer cheap. Arch, they say, is in the land of the walking dead.”

U.S. decision-makers should, the reports says, develop “scenarios that require moving the U.S. beyond coal in significantly less than twenty years.”

Based on recent wind and solar bids in the western United States, the report adds, once coal costs rise above about $1.50 per MMBTU, “it can no longer be assumed that coal is the lowest-cost way to generate electricity.”