Earnings season is upon us again, and it comes as no surprise that difficulties persisted for PV manufacturers throughout the first quarter.

The market continues to be structurally oversupplied and the outlook for 2012 installations is generally flat over 2011. With policy adjustments and uncertainties in the key markets of Germany and Italy, the mood is particularly tense. Amidst continued market challenges, this month, GTM assesses industry trends from the initial earnings releases of the following four companies.

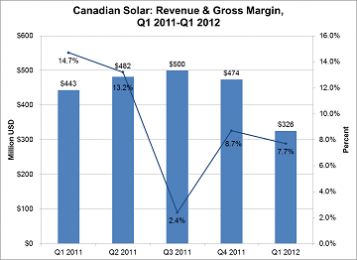

Canadian Solar

Canadian Solar, the vertically integrated manufacturer of wafers, cells, modules, and systems, shipped 343 megawatts in the first quarter of 2012, an increase of 41 percent year-over-year and a decrease of 21 percent quarter-over-quarter, with 7.4 megawatts going into its total solutions business. Persistent pricing pressure continued to adversely affect the company’s balance sheet, with gross margins of 7.7 percent, down seven basis points year-over-year and one basis point quarter-over-quarter. The company reported a Q1 blended all-in cost of $0.73 per watt, catching up to the cost structure of thin film competitor, First Solar. This achievement speaks to the significant cost reduction potential of c-Si; management attributed this cost reduction to improvements in factory automation and guided a further reduction to $0.55-$0.60 per watt by the end of the year. However, Canadian Solar’s industry-leading cost structure is also likely influenced by its relationship with GCL-Poly, from which it buys a significant portion of its wafers.

Source: GTM Research

As the global PV equipment market remains an increasingly difficult space in which to play, Canadian Solar has outlined a shift away from module sales and into the project business. Full systems sales made up approximately 10 percent of revenues in 2011, with the company calling for growth to 25 percent in 2012 and 40 percent in 2013. Going forward, management also stated that it expects nearly three megawatts of projects turning into revenue every quarter in 2013 and 2014. Furthering its downstream push, Canadian Solar looks to be buying up projects in order to create a captive pipeline for its modules -- in April, the company formed a joint venture with SkyPower Ltd. for a majority stake in sixteen Ontario projects. It remains to be seen whether Canadian will expand its downstream push into markets outside of North America.

To continue reading about Q1 2012 manufacturer earnings, please subscribe to PVNews.

***

Now in its 30th year of publication, PVNews continues its tradition as the solar industry's premier periodical. Focusing exclusively on the global PV industry and drawing on the expertise of the GTM Research solar analyst team, at only $395/year, PVNews is undoubtedly the industry's best value for in-depth market research. The newsletter includes the following key components in each issue:

· A hand-picked news digest from the solar and related industries, following key developments that are shaping the future of PV

· Market research data, insights, and analysis, drawn from the GTM Research annual solar research program

· Exclusive market trackers: Monthly North American and European Feed-In Tariffs, Monthly U.S. Utility Pipeline, Annual Cell and Module Capacity and Production, Module Supply Agreements, and Monthly Large-Scale Project Announcements

· Market commentary from analysts and industry leaders

Subscribers around the world agree that PVNews is the best value in market monitoring, and that it's essential reading for decision-makers in the evolving global renewable energy market. Subscribe today at http://www.greentechmedia.com/research/report/pv-news.