In September, we broke the news of OneRoof Energy’s $50 million round A and project fund, along with its plan to bring third-party residential solar financing to the roofing companies that spend most of their time up on people’s rooftops.

Since then, the San Diego, Calif.-based company has been pushing forward on the concept, linking an October partnership with CertainTeed, a subsidiary of French building materials giant Saint-Gobain, as well as with regional roofing companies in its target markets of California, Hawaii, Arizona and Massachusetts.

In April, OneRoof raised $3 million from new investor Black Coral Capital, with plans to raise its second fund some time this year. Last week, CEO and founder David Field put the target size of that round at $100 million. He also said that OneRoof was on track to have about 4,000 residential rooftop solar systems installed by year’s end, and planned to expand to more states in the coming months.

Field also said that OneRoof was expanding its work with Hanwha SolarOne, a subsidiary of investor Hanwha International. The South Korean industrial giant joined U.S. Bancorp, The Quercus Trust, Yellowtree Energy, and Spring Ventures in funding OneRoof’s initial $50 million, and the two have been working together on solar roofing sales for some time.

In their newest financing program, OneRoof and Hanwha are bringing in the balance of systems (BOS) costs into the lease fund, he said. That means that Hanwha is covering the PV panels, the inverter, the racks, the rails and all the rest of the capital costs, all directly financed, he said.

The idea is to help roofers and solar installers cover up-front costs with the deep pockets represented by partners like Hanwha, Field said. The same kind of logic applies to companies like CertainTeed financing multiple additional costs of solar into run-of-the-mill roofing projects — including the all-important warranty costs, he noted.

OneRoof is also working with Hanwha SolarOne’s new partner Silent Power on battery systems to back up solar installations, Field said. “In certain market, there’s a real need for battery backup power — to the extent you can integrate it with the solar system, it’s a real benefit,” he said, though he wouldn’t discuss any specifics.

There would appear to be plenty of room for OneRoof and competitors like SolarCity, SunRun, Sungevity, Clean Power Finance, Vivint and others that are offering solar panels for no up-front cost to customers in exchange for long-term contracts to buy their power at fixed rates.

Bloomberg New Energy Finance estimated earlier this month that the market for solar-backed securities could reach $4.6 billion by year’s end, combining roughly $1.16 billion in third-party solar financing projects and about $3.6 billion for solar projects being financed this year. We’ve seen funding announcements coming fast and furious so far this year, most recently last week with SolarCity and SunRun each securing commitments for $200 million in financing.

Here’s some of our previous reporting on OneRoof and the growing market for third-party financed solar:

Installing solar panels on residential rooftops is not an easy task. It requires specialized skills in design, electronics, and construction that have made this type of work the domain of a select and relatively expensive group of craftspeople.

Instead of relying on the few thousand specialized solar installers, what if you opened up that pool of contractors to the tens of thousands of roofers who are hungry for work in this economy and already have rooftop and construction skills?

OneRoof Energy works with roofers to lease and install residential photovoltaic systems. The firm builds and maintains the systems for homeowners and works with builders and roofers to integrate the roofing and solar installation into one streamlined process. As with most solar PPAs, there are no upfront costs, and monthly bills are roughly equal to or lower than current electric bills. A warranty covers the roof and the solar installation.

Mark Goldman of Armageddon Energy told us last year, "Starting now, you'll see roofers and other trade professionals like plumbers and electricians become the heart of the solar installation workforce. Now that module prices are economic, the only way to reduce the cost of solar is to cut sales and installation overhead. These guys have the tools and the skills to get the job done quickly and efficiently from one end of the country to the other."

This form of financing was largely nonexistent in solar a decade ago, but SunEdison pioneered the process for commercial installs and firms like SunRun, Sungevity, SolarCity and, more recently, Clean Power Finance and OneRoof Energy have joined the fray with their own slant on the finance tool for residential solar.

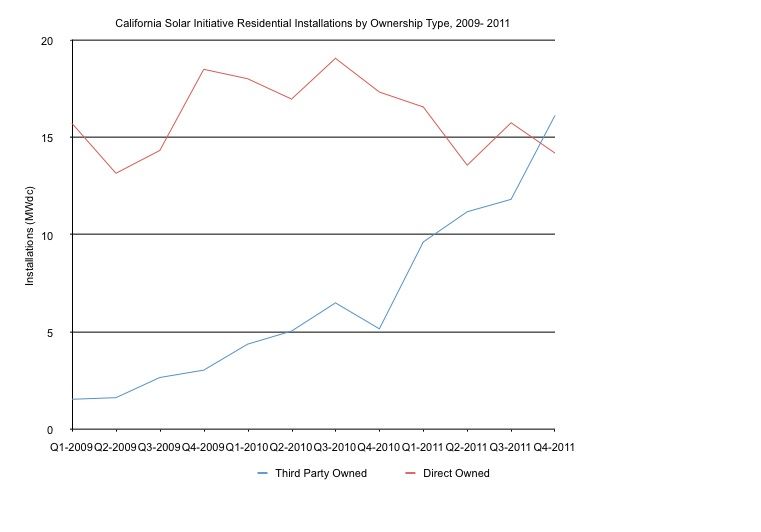

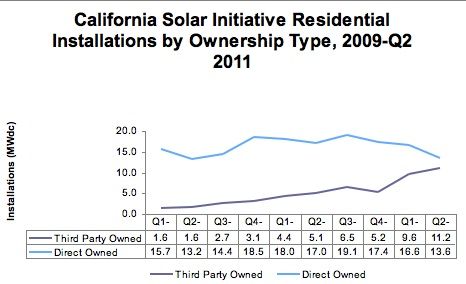

Third-party financing of solar, be it some form of lease or power purchase agreement (PPA), is becoming the leading method by which homeowners can afford to install solar. June of 2011 was the first month in which more Californians elected to go with a third-party-owned solar installation rather than a cash purchase, according to PV Solar Report.

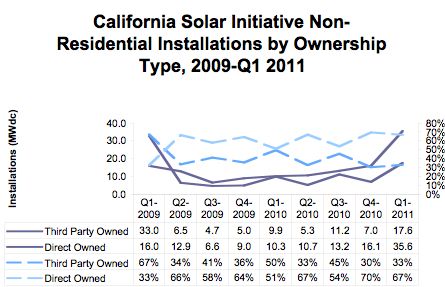

This chart from GTM Research shows the growth of third-party financing in non-residential CSI deployments -- 17.6 megawatts in the first quarter of 2011, up from 7 megawatts in the previous quarter.

Here's some more data out through Q2 2011, again drawn from GTM Research's Solar Market Insight on residential third-party ownership in megawatts.

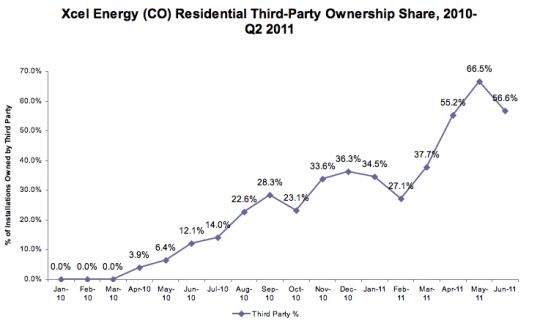

More data from GTM Research's Solar Market Insight, this on Xcel, the Colorado utility's third-party solar ownership share:

Recently, SolarCity told Greentech Media that 12,000 of their more than 15,000 solar projects completed or underway have chosen financing options. SolarCity's numbers are from across the U.S. and vary in size from residential to commercial.

OneRoof, if successful, would seem to give Hanwha SolarOne a new channel to the American residential market and provide a new addition to the small field of residential PPA firms, which include SolarCity, SunRun, Sungevity, and Clean Power Finance. Smaller players include Solar Universe, Ontility, SunPower, SolarCraft, Sun Edison, Centrosolar, and Suntech’s BriteLease program.