The investigation will continue.

The International Trade Commission ruled on Thursday to continue the investigation concerning China's production and pricing of solar modules. SolarWorld, the claimant, looks to enlarge the scope of the initial tariff finding -- claiming that Chinese module manufacturers are able to use Taiwanese cells in their modules and circumvent U.S. trade duties.

Richard Weiner, a partner at Sidley Austin, a law firm representing the Chinese solar industry, writes:

Today’s preliminary decision by the U.S. International Trade Commission was entirely expected; the ITC almost never derails an investigation at the kickoff phase. We remain convinced that fairly traded imported solar products from China and Taiwan are vital for America to continue its shift away from fossil fuels and that SolarWorld’s marketplace failures are entirely of its own making. This investigation now shifts to the U.S. Department of Commerce where we will continue to oppose SolarWorld’s efforts to close the U.S. market, a market that, in any event, it has no hope of supplying.”

SolarWorld commended the trade vote as an important step in favor of U.S. solar manufacturing that "recognizes that imports of Chinese solar products are injuring domestic U.S. manufacturers." The company's statement continued:

China has no production cost advantage, and high-standard companies such as SolarWorld remain the industry’s technology leaders, but government-sponsored Chinese producers have used illegal, export-intensive subsidies and artificially and temporarily low pricing tactics to undermine them.

"Step by step, U.S. solar producers are returning to a day when they no longer are forced to compete with the government of China,” said Mukesh Dulani, president of SolarWorld Industries America Inc., based in Oregon. “Our own factories here in Oregon are surrounded by several campuses of Intel, the world’s largest semiconductor producer and a U.S. manufacturing success story. So please do not tell us that U.S. manufacturers who pioneered and built the solar industry cannot compete globally under conditions of fair trade.”

SolarWorld concludes its email with these stirring words:

Diese Mitteilung ist vertraulich und nur für den oben genannten Adressaten bestimmt. Für den Fall, dass Sie als Empfänger dieser Nachricht nicht mit dem oben genannten Adressaten identisch oder mit der Aushändigung an ihn vertraut sind, weisen wir darauf hin, dass jede Verbreitung oder Vervielfältigung sowie die Nutzung darin enthaltener Informationen untersagt ist. Wenn Sie diese Nachricht fälschlicherweise erhalten haben, informieren Sie bitte sofort den Absender und löschen diese E-Mail. Wir danken für Ihre Mithilfe.

Jigar Shah, President of the Coalition for Affordable Solar Energy, made the following statement:

With the ITC’s preliminary ruling in favor of SolarWorld’s petition to impose tariffs on imported solar products, it is now official: a German company is one step closer to manipulating U.S. trade procedure in order to prop up its own failing business and inflict harm on a job-creating industry. By raising the cost of solar for American homeowners, SolarWorld is poised to inflict critical damage on an industry which last year added more than 20,000 solar installation, sales, and distribution jobs to the U.S. economy. These hard-working Americans now look to President Obama to broker a common-sense solution which will avoid damage to the economy and allow the deployment of clean renewable energy to continue into the 21st century.

Just this past week, the U.S. Trade Representative publicly condemned the protectionist solar policies of India, because, in his words, protectionist policies would ‘actually impede India's deployment of solar energy by raising its cost.’ CASE implores the U.S. government to adopt the same perspective before a burgeoning U.S. industry is harmed for the benefit of one German company.

Roger Pang, director of business development at Andalay Solar, based in San Jose, California, wrote a letter to GTM on the topic, which read in part:

For those not in the industry, SolarWorld is "America’s Largest Solar Manufacturer since 1975,” according to the company’s website. This is true, and the folks at SolarWorld make a very good product. What is also true is that SolarWorld USA is a subsidiary of SolarWorld AG, which is listed on the Frankfurt Stock Exchange. SolarWorld’s manufacturing is in Oregon, employs hundreds of Americans, but its profits go across the Atlantic. So, what we have is a German company using U.S. trade tariffs and labor specifically against manufacturers who produce in China to generate a barrier and increase its own profits.

GTM Research SVP Shayle Kann writes:

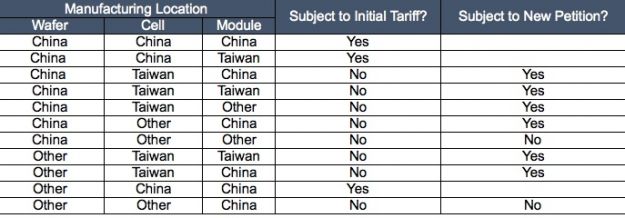

This petition could significantly impact the U.S. solar market, in large part because of its scope. In contrast to the initial tariffs, which apply only to crystalline silicon PV cells manufactured in China, this petition broadens the scope both geographically (adding Taiwan) and vertically (adding both wafers and modules). Here is the language directly from the petition:

"The merchandise covered by these investigations is crystalline silicon photovoltaic cells and modules, laminates, and/or panels consisting of crystalline silicon photovoltaic cells, whether or not partially or fully assembled into other products, including building integrated materials. For purposes of these investigations, subject merchandise also includes modules, laminates and/or panels assembled in the subject country consisting of crystalline silicon photovoltaic cells that are completely or partially manufactured within a customs territory other than that subject country using ingots that are manufactured in the subject country, wafers that are manufactured in the subject country, or cells where the manufacturing process begins in the subject country and is completed in a non-subject country."

At a minimum, SolarWorld seeks import duties on Taiwanese cells, which would eliminate the Taiwan tolling strategy currently employed by most Chinese suppliers. In addition, in order to prevent Chinese manufacturers from simply shifting their cell tolling to another country, the petition also seeks tariffs on modules that use Chinese ingots or wafers, regardless of where the cell manufacturing takes place. There is one point of confusion here: the language in that last sentence is not clear on whether the module itself must be assembled in China in order for the product to be subject to the tariff. To help clarify, here is our interpretation of the petition scope:

Source: GTM Research

Kann concludes:

Of course, this could all be rendered moot if the U.S. and China were to reach a negotiated solution. This was the result in Europe and might well be the result here as well (in fact, that would be my bet). But in the meantime, we would caution not to make the mistake of taking this petition lightly -- it is likely to reshape the U.S. solar market in one way or another.

Read more of Kann's analysis of the case here.

The Department of Commerce is expected to make a preliminary determination on anti-subsidy duties in late March.

***

Shayle Kann is the Senior Vice President of Research at Greentech Media, where he leads GTM Research. GTM Research clients have access to the analyst team’s ongoing coverage and analysis of the AD/CVD petition and its likely market impacts. For more information, contact Justin Freedman at [email protected].