The latest solar tariff announcement from the U.S. Department of Commerce is already impacting module prices in the U.S. According to the GTM Research report The 2014 U.S. China Solar Trade Dispute: Status, Strategies and Market Impacts, the June 2 preliminary ruling on countervailing duties will cause Chinese suppliers to increase prices for delivery in the U.S. and consider a number of different value chain strategies.

If the eventual margins, including both the countervailing duty and antidumping components, exceed the preliminary countervailing duty margins of 27 percent on average, suppliers are unlikely to preserve their previous shipment strategies. GTM Research expects that some suppliers will elect to ship all-China products into the U.S. and pay the under-order import tariffs imposed in the 2012 solar trade case, while others will sell via internal or OEM manufacturing in locations such as India, South Korea, Poland or Mexico.

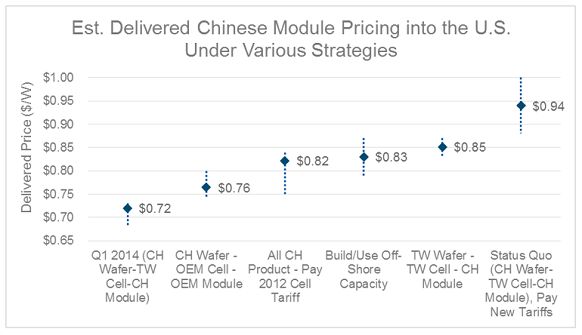

GTM Research identifies and evaluates four individual strategies and their likely adopters. The price impact of these strategies ranges from 7 percent to 20 percent, but the most affordable strategies are not available to all companies. GTM Research anticipates an average overall price increase of 14 percent on modules shipped into the U.S. by Chinese suppliers.

FIGURE: Estimated Delivered Module Pricing Into the U.S. Under Various Strategies

Source: The 2014 U.S. China Solar Trade Dispute: Status, Strategies and Market Impacts

“Whereas the 2012 trade case ruling caused almost all Chinese firms to respond with the uniform strategy of using Taiwanese cells while maintaining the other PV value chain steps (wafer, ingot, module) in China, the current scope of the 2014 case will likely result in a variety of strategies adopted by Chinese module vendors to continue serving the U.S. solar market,” said Shyam Mehta, Lead Upstream Analyst at GTM Research and co-author of the report. “While the strategies vary, one constant remains across all scenarios: pricing for Chinese modules shipped to the U.S. is highly likely to increase starting in July 2014. Consequently, the primary competitive advantage of Chinese suppliers in the U.S. market -- lower pricing by as much as 25 percent historically -- could be greatly diminished.”

Chinese companies supplied 31 percent of the modules installed in the U.S. in 2013, and more than 50 percent in the distributed solar market. The report finds that non-Chinese suppliers are likely to gain share as a result of the erosion of Chinese price advantage in the U.S. market. Likely beneficiaries include REC, SolarWorld, Suniva and LG Solar in the distributed solar market, and First Solar in the utility market.

While a 7 percent to 20 percent increase in module prices from Chinese suppliers will have reverberating effects throughout the U.S. solar market, it will be most disruptive in the highly cost-sensitive utility solar market. GTM Research expects some projects to seek alternate module suppliers, while others may fail entirely.

“Unless the Department of Commerce revises the scope prior to its final determination, there is no question that tariffs imposed in this case will have a larger impact than those already in place from the 2012 ruling,” said Shayle Kann, Senior Vice President at GTM Research and the report’s co-author. “SolarCity, for example, has already announced a 100-megawatt supply deal with REC Group, while RGS Energy has done the same with SolarWorld. This portends a broader shift in the pricing and competitive landscape for U.S. solar module supply as a result of the preliminary countervailing duty decision on June 2.”

GTM Research cautions that the case remains unresolved, and a number of factors could alter the resulting strategies and market impacts. Among the key questions still to be answered:

- Will the U.S. and China reach a negotiated settlement to replace the all import tariffs?

- Will the final countervailing duty margins differ from the preliminary determination?

- What will be the magnitude of the antidumping margins for China and Taiwan?

- Will the Department of Commerce retain the existing scope or make alterations in the final determination?

For more information about this report, visit http://www.greentechmedia.com/research/report/the-2014-u.s.-china-solar-trade-dispute