Arizona Public Service filed a general rate case today, which the utility says will create a more sustainable grid system by reforming the residential rate structure and eliminating the cost shift between solar and non-solar customers.

The plan seeks to introduce mandatory demand charges on all of APS’ residential and small business customers. The proposal also calls for shortening and shifting on-peak hours from the existing on-peak window of 12 p.m. - 7 p.m., to 3 p.m. - 8 p.m. when APS customers are using the most energy.

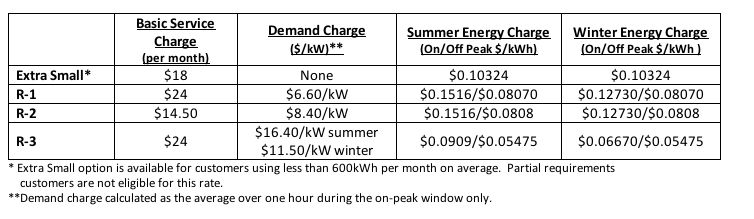

The rate case offers three different demand rate options (outlined below). Solar customers are required to go on the third and highest demand rate. According to the utility, this is designed to send a price signal that enables solar customers to save money by right-sizing their system and adopting load management technologies.

Figure: APS Demand Rate Options

The primary goal of APS’ rate review is “to make more meaningful progress on managing our system’s peak demand, because if we can save money on the amount of resources we have to invest in or operate to meet our system peak, our customers save money,” said APS' director of state regulation and compliance, Greg Bernosky. “We think with this case we have an opportunity to make those adjustments and start moving in that direction.”

In addition to mandatory demand charges, the rate plan would reduce the amount of compensation rooftop solar customers receive for excess energy they send back to the grid. The net metering credit would drop from the current retail electricity rate to the wholesale rate of between 2.5 cents and 3 cents per kilowatt-hour.

All existing solar customers and customers who install their solar systems up until July 1, 2017 would be grandfathered in under their current rate plan for 20 years from their installation date. Changes outlined in the rate case would only apply to new rooftop solar customers after next summer’s effective rate date.

“We worked with local solar industry to come up with a plan that is as fair as possible and works for them,” said Bernosky.

“We expect solar will still be around and flourish with what we’ve proposed here,” he added.

According to APS, the solar rate changes are needed to address the growing cost shift from solar to non-solar customers. APS currently has 40,000 rooftop solar customers. At the current rate of adoption (1,300 to 1,500 systems per month), the utility has calculated that non-solar customers would collectively pay an additional $1 billion over the next 20 years to accommodate the growth in solar.

The cost shift is also reflected in APS’ rate request. The overall bill impact of the proposal is a net increase of 5.74 percent since APS’ last rate case five years ago. Residential customers will see a 7.96 percent bill increase -- increasing from $139.32 to $150.41 on average. Of the $11.09 rate increase, APS found $1.74 is due to the solar cost shift.

“We understand there are a number of different perspectives on this,” said Bernosky. “But the fact is that when we did our cost-of-service analysis and ran the numbers based on our actual test year…[we found] we are now essentially having to spread out additional costs among all other residential customers. Their bill will, therefore, be higher because of that.”

“No one [at APS] will tell you they don’t expect solar to be a big part of our portfolio going forward, but we have to get ourselves operationally positioned for it and need to get rate structure designed around it, and for other technologies, like storage, that are around the corner,” he said.

Arguably, net metering mutes the price signal for customers to adopt distributed energy technologies other than solar, because customers receive the credit regardless of when they put excess energy onto the grid and whether or not it’s needed. At the same time, demand charges can arguably play a role in unleashing the potential of a wide suite of distributed energy technologies by creating time-variant pricing signals that also benefit the grid.

To test the capabilities of these new technologies, APS is conducting its own 75-home field research project by integrating technology packages -- including energy storage, load management decides, smart inverters and smart thermostats -- to modify load shapes to better align with grid requirements. All 75 participating homes will be on the new demand rate.

APS is seeking $3.2 million to conduct this "Solar Innovation Study." The utility is also seeking $30 million for its Solar Partner Program, via which APS installed 10 megawatts of residential solar with smart inverters on select feeders to study how this fits with the utility’s grid modernization plan.

Bernosky said APS has been watching how high penetration levels of distributed solar have affected grid systems in California and Hawaii, and it is looking to get out ahead of any potential grid issues.

“One of the most important things for us as a company is that we want more renewables. We want more solar because that’s what our customers want, and we’re trying to look for a way to make our company and our structure and our pricing model support that in a sustainable manner,” said Stefanie Layton, director of revenue requirements at APS. “We know that the way the system is structured right now, it’s going to collapse on top of itself. […] A lot of the changes we’re making right now are to ensure we can support solar over the long term.”

Many in the solar industry are likely to disagree. Retail-rate net metering is one of most important drivers of the rooftop solar industry in Arizona and around the country. Demand for rooftop solar could drastically fall with the reduced net metering credit. When combined with a demand charge, solar installers have reason to fear that rooftop solar will no longer be economically attractive.

Salt River Project, another Arizona utility, represents a cautionary tale. Last year, the utility implemented a $29 demand charge specifically on rooftop solar customers, which effectively brought the solar market to a halt. A recent report found that only 14 percent of customers are finding ways to save money on the plan.

The APS charges are lower than SRP’s, however. APS also argues that it is well-suited to offer a fair and effective demand rate for all customers because it has years of experience implementing and educating around the charge. APS has had an optional demand rate in place for more than a decade, with 120,000 customers currently on that plan.

The APS rate proposal also includes additional flexibility. The proposal allows for low-energy-use customers to be exempt from the demand rate and for all customers to be exempt on holidays and weekends.

In an ongoing UniSource Electric rate case, the Arizona Residential Utility Consumer Office opposed the utility’s demand charge proposal, arguing that UniSource doesn’t have the experience to implement universal demand charges without further study and a robust customer education plan. Arizona Corporation Commission (ACC) Chairman Doug Little wrote a letter effectively dismissing universal charges in the UniSource case.

Active parties in the UniSource case, which includes APS, are now conferencing on a solution. This summer, Arizona utilities and clean energy interest groups will also launch a value-of-solar docket that could inform the net-metering compensation debate. In addition, APS and SolarCity have launched separate talks on the future of solar policy in the state.

“Those conversations…are exploratory in nature, at least at the onset. Anything that comes out of that is still subject to ACC jurisdiction and approval,” said Bernosky. “I think there’s a lot of ground still left to cover there if anything does materialize to bring forward in our case.”

In addition to the rate changes, APS’ rate request is seeking $3.6 million in upgrades and maintenance for the energy grid, including $48 million per year in financial assistance to help limited-income customers and to complete a $500 million investment to modernize APS’ Ocotillo natural-gas power plant.