Dividend Solar and Figtree Financing just agreed to merge.

Dividend is a solar financing firm offering residential loans that include performance guarantees and warranty management. Figtree provides property-assessed clean energy (PACE) financing for energy-efficiency improvements, including solar power and water conservation upgrades. PACE financing allows home or business owners to access long-term financing that is repaid through their property taxes.

The merger represents the first-ever combination of a residential solar lender and PACE financing provider. The deal includes a commitment of up to $200 million from LL Funds (founded in 2009 by Morgan Stanley alums.) As part of the transaction, Shivraj (Raj) Mundy of LL Funds will join Dividend as its executive chairman.

Dividend will soon launch a residential PACE program in California before expanding it nationally.

Direct ownership via loans (and other mechanisms like PACE) is gaining traction as PV systems continue to get cheaper while financing options continue to improve. Third-party financing is still the dominant form of financing for residential solar, but by 2020, GTM Research forecasts that direct ownership will eclipse third-party ownership.

When GTM spoke with Dividend Solar in 2014, the company was looking to challenge the existing residential solar financing structure with an approach it called "solar-ownership-as-a-service."

Co-founder Steve Michella of Dividend said, "The solar financing market is remarkably mispriced." He added, "The lease/PPA model has been tremendous for the growth of solar in the U.S., but it’s becoming increasingly clear that solar ownership offers significantly greater long-term value to homeowners." Michella continued, "Our loan solution walks, talks and looks like a lease but can provide a homeowner with significantly better economics.” According to Michella, the Dividend Solar product allows smaller solar installers to compete with the vertically integrated financiers.

As we've reported, around 60 percent of consumers would prefer to own a residential rooftop system rather than lease it, assuming savings and performance are similar, according to a survey of California homeowners conducted by Mosaic.

With the merger, Eric White, Dividend Solar’s president, said, “We can now offer a suite of products to our customers, creating a ‘one‐stop shop’ where commercial and residential property owners can secure the upfront financing they need for renewable energy and efficiency upgrades.” Residential solar, energy efficiency and other PACE-eligible products will fall under the Dividend Solar platform. Commercial PACE projects will continue to be financed under the Figtree brand.

Residential PACE financing has doubled from $1 billion less than a year ago to more than $2 billion today, according to PACENow, a nonprofit that tracks the PACE market. Commercial PACE, with larger but slower-moving projects, has scaled up to $250 million, up from about $150 million at the end of 2015.

Nicole Litvak, solar analyst at GTM Research, notes, "PACE loans are typically used to target customers with lower credit who wouldn't qualify for another loan or PPA, so this allows Dividend to broaden its customer base. It also allows the two companies to combine their installer networks."

Michella told GTM, "By providing access to low-cost financing that was otherwise exclusive to the large tax equity players, Dividend Solar is helping to accelerate the rise of the regional solar installer."

As we reported yesterday, GTM Research sees regional installers now growing faster than top national installers such as SolarCity, Vivint Solar and Sunrun. According to the CEO, "In reality, the ‘small’ installer [category] consists of large market players such as Trinity Solar, Baker Electric, Vision Solar and PosiGen that have $100+ million in annual revenue. Many in this ‘long tail’ are highly sophisticated, with Fortune 500 company technology tools, business processes and proven leadership teams and former CEOs leading their strategy,” said Chris Doyle, chief commercial officer at Dividend. “The market is not just SolarCity...then everyone else.”

“Our strategy has been focused on the local and regional installers, who we feel are best positioned to take share,” said Dividend's White. “If your bathroom sink breaks, you don’t call a national plumber; you call the company down the street. The same largely goes for solar. We have built a platform that allows these local and regional contractors to compete and win, and to offer a better product to homeowners." White added, "Our approach to PACE financing will be very similar to the approach we took in 2014 when we entered the market to provide an alternative to leases and PPAs. We will offer a better, more simple approach to PACE that includes many of the value propositions that our current financing provides: simple process, hassle-free ownership, and economic upside of ownership."

“We’re at the point where growth in the distributed energy industry is far less reliant upon the limited number of tax equity investors to finance quality assets that produce boringly stable cash flows,” said Michella.

There has been a wave of recent solar loan and PACE news:

- Renovate America, a provider of residential PACE financing in the U.S., announced the closing of its seventh securitization of PACE bonds. The securitization includes $305,313,000 in Class A Notes rated AA (sf) by Kroll and AA (sf) by DBRS, secured by 13,432 PACE assessments levied on residential properties in 31 California counties. The PACE assessments have an average balance of approximately $24,433, a weighted-average annual interest rate of 7.96 percent, and a weighted-average original term of 14.95 years.

- Renew Financial completed its second securitization of residential PACE bonds. The $123 million securitization, backed by over 4,800 PACE-financed home energy improvement projects, was rated AA (sf) by Kroll and has a coupon of 3.75 percent.

- SolarCity's new residential solar loan has the option of a 10-year term or a 20-year term with annual percentage rates as low as 2.99 percent and 4.99 percent, respectively, along with no prepayment penalty. The loans come with a service package including a 20-year warranty, production guarantee, and continuous monitoring. Mosaic is the initial lender.

- Sungage Financial, a provider of solar loans, added module manufacturer Vikram Solar to its approved vendor list.

- Ygrene, a provider of PACE financing, recently received a $250 million credit facility to continue to scale its residential and commercial clean energy financing. The credit facility follows on an existing $150 million credit facility that Ygrene uses to support its projects, which are currently in California and Florida.

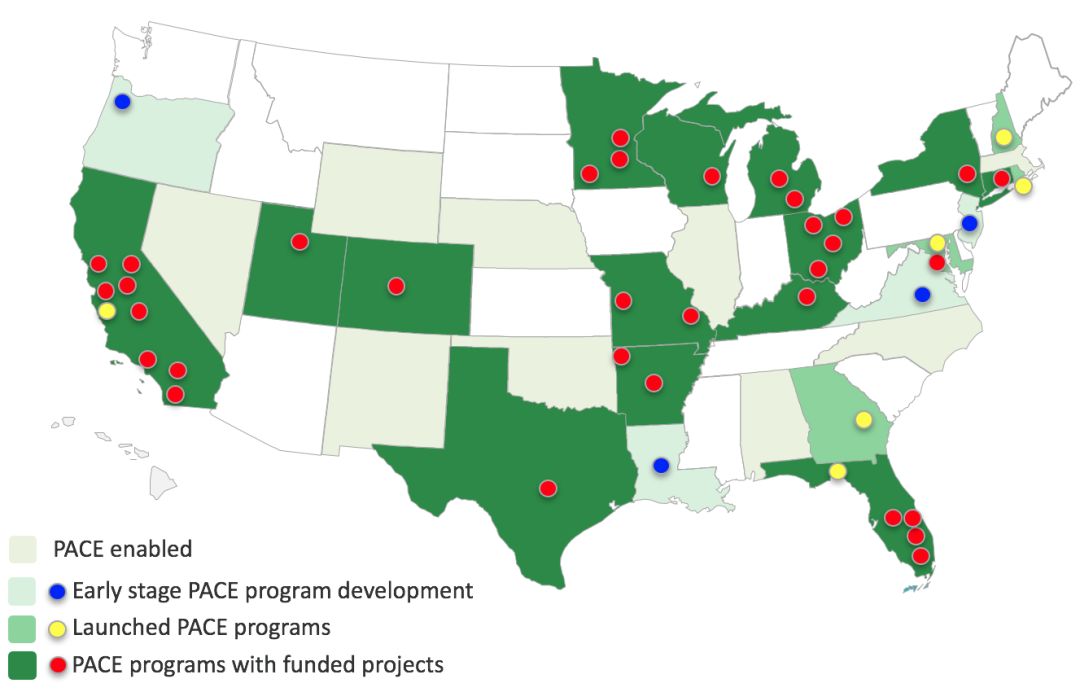

As GTM's Katie Tweed has reported, residential PACE is slowly coming to other states too. Guidance from the federal government last year through the Federal Housing Administration has helped make PACE financing attractive in more places.

In April, Nebraska became one of the states that approves PACE financing, according to Midwest Energy News. PACE legislation has been passed in 29 states and the District of Columbia, with more expected this year.

Along with the strong growth of the renewables market and energy financing industry comes a measure of consolidation and volatility. This will not be the last merger or deal of this nature this year.

Source: PACENow