Trina Solar and Tigo Energy are claiming that their integrated module was just added to Clean Power Finance's approved vendor list. The new module is manufactured with a Tigo DC optimizer built into the factory-installed junction box.

"This listing is a validation of the bankability of our Trinasmart modules," Trina Solar Americas President Mark Mendenhall said.

But there's one small problem: CPF says it does not have an approved vendor list.

Attempting to unravel this conundrum leads to the real story -- and why Trina is making this claim.

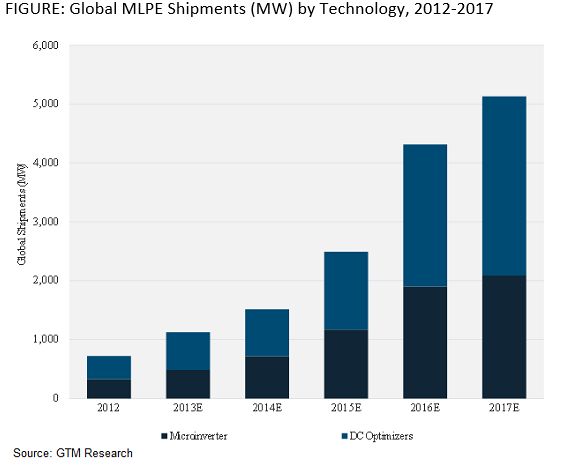

Module-level power electronics architectures, which put a DC optimizer and/or a microinverter in each panel of a solar installation, are rapidly gaining market share.

“We estimate combined shipments of microinverters and DC optimizer units destined for U.S. residential systems [in 2013] to have topped 430 megawatts -- well exceeding 50 percent of the installations in the segment,” GTM Research Senior Analyst MJ Shiao recently reported. He added, “More than a dozen financial lease or loan providers back Enphase systems.”

Source: GTM Research report The Microinverter and DC Optimizer Landscape 2014

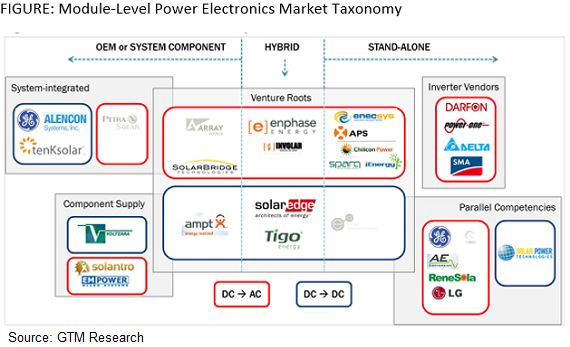

The Enphase microinverter dominates the AC space, but devices from SolarBridge, ABB/Power-One, and SMA are gaining share. In the DC domain, optimizers from SolarEdge and Tigo currently dominate, but Ampt and others are moving up.

Module-level power electronics, which can bring impressive cost savings to residential and small commercial/industrial solar installations, have largely won acceptance as an add-on solution, according to GTM Research’s The Microinverter and DC Optimizer Landscape 2014 by MJ Shiao and Paul Grana.

However, MLPE have gotten a mixed reaction from the third-party finance sector, which, GTM Research estimates, accounted for at least two-thirds of 2013 residential installations. Vivint and CPF are third-party-funding players that have largely supported MLPE add-ons, while SolarCity and Sunrun “have limited their use of module-level power electronics in various ways,” Shiao reported.

To cut installation time and costs, manufacturers have begun turning out advanced modules with factory-integrated power electronics. Though they are widely expected to play a key role in solar’s future, smart modules with fully factory-integrated MLPE have not yet been accepted by the marketplace.

Among the third-party funders, Sunnova is leading the way, recently adding the Trinasmart module to its approved vendor list, according to James Bickford, Tigo's Director of OEM Channels. Sunnova also has ET Solar and BenQ Solar AC modules with factory-integrated SolarBridge microinverters on its list, according to SolarBridge Marketing VP Craig Lawrence.

SunPower’s AC module, with an integrated SolarBridge microinverter, is approved for SunPower third-party residential installations. But the SunPower high-efficiency X-21 module’s Maxeon cells resolve many of the same issues as MLPE, according to Zach Campeau, Module Group Product Manager.

If CPF, one of the top third-party funders, validated the Trinasmart module, it would be a big step forward for Trina and for advanced modules as a whole.

“Trina is on the CPF approved vendor list,” Trina Marketing Director Jing Tian told GTM.

After the CPF “procurement team” did a paper review of Trina’s reliability data, customer site studies, and two sets of certification data, Tian explained, “they felt comfortable about adding the Trinasmart module.”

“CPF already had Trina on its approved vendor list,” Tigo’s Bickford added. “Trina’s 25-year warranty and bankability almost made adding the Trinasmart module a no-brainer. Their warranty and the balance sheet of a billion-dollar publicly traded company supports the product and mitigates the financial risk.”

The CPF review process was similar to what Trina has gone through with other third-party funders, Tian said. “It is critical to get third-party financing approval because it is such a big part of the market. CPF being the first is great, and we are well on our way to other approvals and wide adoption of the technology.”

The problem, according to CPF Communications Director Alison Mickey, is that “CPF is technology-agnostic and does not have its own approved vendor list.”

CPF’s funds decide which equipment manufacturers to include on their lists, and they approve companies, not individual modules, Mickey explained. “Trina was already an approved company, so its Trinasmart module is added to the funds' lists automatically.”

CPF doesn’t have an approved list; they have a list of acceptable vendors for each fund, SolarBridge’s Lawrence confirmed. “We are working with them, and with Sungevity, Sunrun, NRG, and the other major third-party players,” he added. “They are all very interested in adding advanced modules, but they’re being cautious, and I would be, too.”

Their caution is "a hurdle," Lawrence acknowledged. “But SolarBridge has reliability data, and a lot of them are excited about that even though they are risk-averse.”

CPF may or may not have validated Trinasmart, but it is clear why Trina and Tigo are claiming the validation. “Being approved and financeable by residential financiers is a really important step for any hardware vendor,” Shiao said.

But that is only the beginning of the real story. Non-third-party financing options and solar ownership loans are also emerging that “don’t have the same kind of gatekeepers on equipment choices and leave it to the consumer,” Lawrence said.