A House of Representatives subcommittee hearing produced some real insights into how safe renewables are for the U.S. electrical grid.

The House Subcommittee on Energy and Power invited testimony on "Grid Reliability Challenges in a Shifting Energy Resource Landscape."

Insight: Both parties realize that the U.S. grid’s electricity generation sources are shifting.

Abundant new natural gas has created change quickly, said Dominion Energy CEO Gary Sypolt, testifying for the Interstate Natural Gas Association of America (INGAA). There is a threat to reliability from variable renewables, he testified, but natural gas can meet U.S. electricity needs -- if market rules allow the industry to recover the costs for needed new pipeline infrastructure. Today’s natural gas prices are too low to cover it.

Insight: Cheap natural gas comes with costs.

“The ‘shale gale’ will not be the last game-changer,” Electric Power Supply Association (EPSA) President/CEO John E. Shelk testified. “What’s next in cleaner coal, solar, smart grid, storage, modular nuclear reactors, natural gas technologies, electric vehicles, efficiency, distributed generation and demand-side management?”

Ratepayers can only be protected from the risk inherent in change through competitive power markets, he explained. Regulators and policymakers have to let the market act.

Insight: Things are going to keep changing.

U.S. manufacturers are concerned about the cost of reliability, according to testimony from Industrial Energy Consumers of America President Paul N. Cicio. LNG exports, he warned, are going to increase reliability concerns and drive up natural gas and electricity prices.

Insight: Cheap natural gas isn’t likely to stay cheap.

Because electricity generation is the biggest contributor to climate change, Center for American Progress Senior Fellow Dan Weiss testified, any discussion that ignores global warming “is like a discussion about personal wellness that ignores cigarette smoking, diet and exercise.”

Storms and extreme weather events could cost the U.S. economy $20 billion to $55 billion annually, but every $1 spent on pre-disaster mitigation, like investment in renewables, can save an average of $4 in damages, Weiss testified. Taxpayers spent $442 billion in tax breaks and subsidies for oil and gas over the past 90 years but only $5.6 billion for renewables over the past fifteen years. From 1950 to 2010, natural gas got $121 billion in government support and coal got $104 billion, while wind, solar, and ethanol got only $74 billion.

Insights: The government has always invested in the energy it needs; It’s OK to talk climate change in Washington again.

Wind energy in 2012 provided over 20 percent of the electricity in two states and over 10 percent in nine more, said American Wind Energy Association Interim CEO Rob Gramlich. It reached over 55 percent grid penetration on Colorado’s system and over 35 percent on the Texas system without issues. Studies show that wind energy can increase many times over without negative impacts.

“It is much cheaper to accommodate the slow and predictable variations in wind output than the instantaneous loss of conventional power plants that can occur at any time,” Gramlich said. A Texas grid study found it added about six cents out of a typical $140 monthly electric bill. Other studies show the cost of backup for conventional power sources is 40 times higher, at around $2.50 per monthly bill.

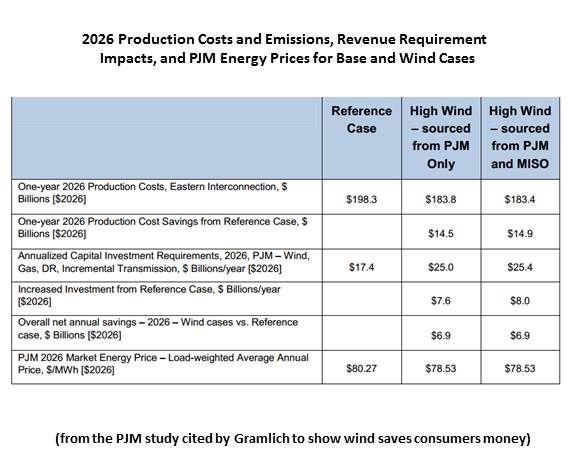

Studies show that doubling wind energy in the Mid-Atlantic and Great Lakes states could save consumers a net $2.6 billion per year, Gramlich said, and 20 percent wind on New England’s grid would cut electricity prices by more than 10 percent.

Insight: Wind cuts costs with no threat to reliability and is part of the climate-change solution.

Policies that subsidize development of intermittent resources, especially wind, reduce the reliability of the power system, economist Jonathan A. Lesser told the committee. To compensate, grid operators have to have fossil fuel backup, usually natural gas.

“As more intermittent resources are built, they increase the severity of reliability issues and increase per-megawatt-hour integration costs, as well as total integration costs,” Lesser testified in direct contradiction to Gramlich.

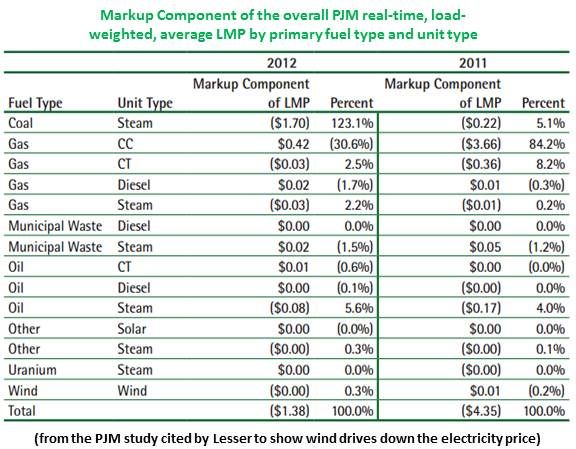

Lesser, who claimed to be independent but has been funded by the fossil and nuclear industries, argued that wind is a mature industry without need of subsidy, that wind and other subsidized renewables do not lower power market prices because government intervention drives out competition, and that subsidized renewables only create jobs while the subsidies last, which lead to higher long-run electric prices that impede job growth.

Lesser recommended requiring all generators to pay for reliability-related integration costs and eliminating all subsidies.

Insight: The renewables industries and the fossil and nuclear industries have starkly different takes on the issue of intermittency.

The typical partisan question-answer session followed the testimony.

“Subsidizing intermittent generation is exacerbating reliability problems, causing increases in integration costs, and jeopardizing the stability of competitive electric markets,” Lesser told the committee. “The wind PTC is especially egregious.”

“Since the days of Thomas Edison, grid operators have had to constantly adjust the output of power plants to respond to fluctuations in electricity demand and the sudden failures of large conventional power plants,” Gramlich said. “Grid operators that use efficient practices have found they can reliably add large amounts of wind energy with virtually zero need for backup power beyond what is already needed.”