"Disruption" is one the most overused words to describe how radical technological change can unseat incumbent businesses. It also happens to be one of the most accurate.

Today, companies are continually reminded by an army of consultants, analysts, startups and tech bloggers about the power of disruption. Every executive decision is now judged through the historic lens of innovation, becoming a case study for how companies learn from technological or market changes in the past.

There’s no shortage of examples: personal computers, newspapers, books, movies, music, postal delivery, heavy machinery, steel, telecommunications, automobiles and airlines are just some of the industries that have undergone rapid -- sometimes violent -- transformations that have weakened or destroyed incumbent businesses. There is now an entire industry devoted to identifying and managing these shifts.

Not content with the traditional way of describing this change, two business experts recently coined a new phrase: “big bang disruption.”

“Today, startups with minimal experience and no capital can unravel your strategy before you can grasp what’s happening. And it’s happening in nearly every industry,” explains a video promoting their book.

The big bang may finally be coming to engulf the utility sector, argue many. Long insulated by heavy regulation, modest technology change and predictable consumer behavior, utilities are finally facing the same kind of competitive pressures that have changed other industries.

Solar PV, distributed storage, electric vehicles and home energy management platforms are giving many consumers direct technology choice for the first time -- enabling third-party companies to erode the market share of incumbent utilities that have mostly operated in a limited competitive environment.

In one of many similar reports on distributed generation from Wall Street investment banks, analysts at Morgan Stanley used the words “disrupt” or “disruption” ten times to describe the pace of change currently underway.

"Energy storage, when combined with solar power, could disrupt utilities in the U.S. and Europe to the extent that customers move to an off-grid approach. We believe Tesla’s energy storage product will be economically viable in parts of the U.S. and Europe, and at a fraction of the cost of current storage alternatives," wrote the analysts.

Analysts aren’t the only ones talking about disruption. NRG Energy CEO David Crane, an executive who likes to challenge his industry, is also fond of using the term: “I think the grid gets disrupted. The only question is, do you want to be the disrupter or do you want to get disrupted,” he told the Washington Post.

In recent months, NRG has acquired the eighth-largest solar installer in the U.S., bought a portable solar company and issued a $100,000 reward to anyone who could refer a “disruptive” executive for its retail business:

We have witnessed disruptions in multiple industries over the past 30 years -- telecom, information technology, and cable and entertainment to name a few -- and we are looking for the leader who can harness the power of disruptive technology and apply it to NRG Home for the benefit of our customers and the greater good of society.

The Edison Electric Institute also penned a report on disruptive challenges last summer, calling distributed generation and efficiency "potential 'game-changers' for the U.S. electric utility industry."

But what does “disruption” actually mean for utilities? And how should they think about it?

For American utilities, it currently means flattening (sometimes declining) retail demand and stagnating revenues. In Europe, where high penetrations of distributed generation have thrown wholesale markets into turmoil, utilities have taken billions of dollars in losses. Those are clear disruptions that threaten the financial stability of power companies -- but they don’t yet signal the end of traditional utilities, as some believe.

Many have tried to define disruption for other industries by using examples throughout history. But as Jill Lepore recently pointed out in the New Yorker, many of the case studies used to illustrate how radical change can shake up industries don’t always have clear winners and losers. She describes the case of the disk-drive industry:

As striking as the disruption in the disk-drive industry seemed in the 1980s, more striking, from the vantage of history, are the continuities. [Harvard Business School professor Clayton M.] Christensen argues that incumbents in the disk-drive industry were regularly destroyed by newcomers. But today, after much consolidation, the divisions that dominate the industry are divisions that led the market in the 1980s. (In some instances, what shifted was their ownership: IBM sold its hard-disk division to Hitachi, which later sold its division to Western Digital.) In the longer term, victory in the disk-drive industry appears to have gone to the manufacturers that were good at incremental improvements, whether or not they were the first to market the disruptive new format. Companies that were quick to release a new product but not skilled at tinkering have tended to flame out.

Lepore outlines numerous other examples in equipment manufacturing, steel production and retail where winners were not always destroyed by disruptive technologies, as typically thought.

“The theory of disruption is meant to be predictive,” lamented Lepore, who believes that truly disruptive change can only be seen in hindsight.

Of course, many people would strongly disagree with Lepore. There are plenty of other modern examples where radical change has been easy to see as it unfolds – online retailing, digital photography and internet publishing being some of the most obvious ones.

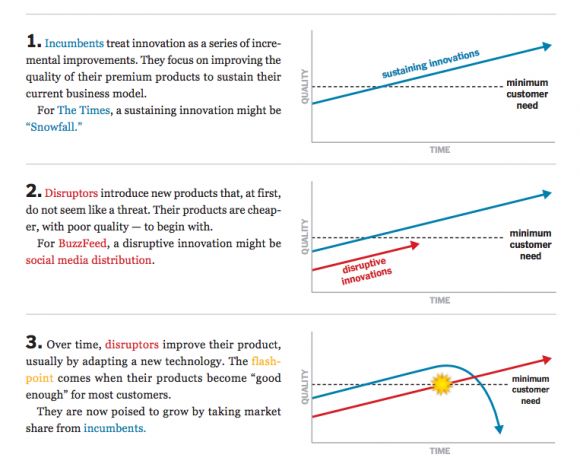

In its recent internal strategy report on innovation in the newsroom, The New York Times’ offers its own definition of disruption, which it calls “predictable” -- contradicting Lepore's take:

Disruption is a predictable pattern across many industries in which fledgling companies use new technology to offer cheaper and inferior alternatives to products sold by established players (think Toyota taking on Detroit decades ago). Today, a pack of news startups are hoping to “disrupt” our industry by attacking the strongest incumbent -- The New York Times. How does disruption work? Should we be defending our position, or disrupting ourselves? And can’t we just dismiss the BuzzFeeds of the world, with their listicles and cat videos?

Although the utility industry is completely different from the newspaper industry, the Times editors offer some relevant insight into how the paper should proactively react to "the BuzzFeeds of the world," rather than simply dismissing the competition:

Because we are journalists, we tend to look at our competitors through the lens of content rather than strategy. But BuzzFeed, Huffington Post and USAToday are not succeeding simply because of lists, quizzes, celebrity photos and sports coverage. They are succeeding because of their sophisticated social, search and community-building tools and strategies, and often in spite of their content.

“At The New York Times, far too often for writers and editors, the story is done when you hit 'publish,'” said Paul Berry, who helped found The Huffington Post. “At Huffington Post, the article begins its life when you hit publish.”

This is one lesson utilities can learn from other industries currently dealing with rapid change. Like the new generation of digital media companies, distributed energy companies are not succeeding because they necessarily have a “better” product than the centralized grid. They are often succeeding because they have a compelling story to tell about consumer empowerment, environmental benefits and cutting-edge technology adoption. For the more sophisticated companies, installing a single solar system is only the beginning of a long-term relationship where customers will buy ever-more customized services.

The New York Times strategy report includes a simple graphic illustrating this trend, which is fairly consistent with changes occurring in the electricity sector. (Although the “poor quality” description is inaccurate for maturing technologies like solar PV, it is certainly true that they often don’t account for all the customer’s onsite needs. Many utilities that provide grid backup services would likely agree with the characterization.)

David Crane echoed this take on disruption in March, when he penned a letter to investors lamenting how power companies were failing to emulate tech giants like Amazon, Apple, Facebook and Google. He worried that electricity providers weren’t thinking beyond simple electricity delivery:

What do these four very successful, but very distinct, companies have in common? They all provide products or services, directly to the consumer, which are deemed essential to the enrichment of the consumer's life experience, day in and day out. What causes these four companies to rise well above others that have similar offerings? The "Big Four" offer their own product or service in a manner that is more comprehensive, seamless, intuitive and, in the case of Apple, visually elegant, than their respective competitors. They enable, they connect, they relate, they empower.

There is no Amazon, Apple, Facebook or Google in the American energy industry today.

It is very easy, however, to pick and choose disruptive models to fit with the conclusion one wants to make. In her piece, the New Yorker’s Jill Lepore quoted Josh Linkner, another writer who focuses heavily on innovation: “Predicting the future based on the past is like betting on a football team simply because it won the Super Bowl a decade ago."

For some, the coming of the “utility death spiral” is inevitable. In such a scenario, utilities that don’t actively invest in distributed generation and find new ways to engage their customers will wither away and die. This is not just the opinion of environmentalists and advocates; the investment bank UBS warned last month that large-scale power stations -- the backbone of traditional utilities -- could be “on a path to extinction.”

But modeling the end result of disruption in the utility sector is extremely difficult. It is a highly regulated industry that adheres to the rules set by regulators and legislators. Although distributed generation is on a path to becoming competitive in some markets without subsidies, it still depends heavily on incentives and favorable market rules. Those rules -- which are steadily changing in favor of a distributed grid -- still create boundaries around what’s possible.

No one can predict what ongoing disruption will bring for utilities based on other industries. There are transferrable models and ways of thinking about change, but no prescriptive outcomes. In that respect, the New Yorker's Lepore is correct about disruption not being "a law of nature."

But Lepore is wrong in assuming that disruption can be only be identified after the fact. No matter where they stand on the issue, almost everyone in the power sector agrees that a radical transformation is underway that will impact the financial stability of traditional power companies. As the Edison Electric Institute explained in last year's disruptive innovation report, how utility executives choose to frame that change will determine their fate:

While the pace of disruption cannot be predicted, the mere fact that we are seeing the beginning of customer disruption and that there is a large universe of companies pursuing this opportunity highlight the importance of proactive and timely planning to address these challenges early on so that uneconomic disruption does not proceed further. Ultimately, all stakeholders must embrace change in technology and business models in order to maintain a viable utility industry.