At first glance, South Africa appears to be on the brink of an explosion in solar installations. While 2012 installations amounted to only 40 megawatts, a combination of high levels of solar irradiation, high electricity costs, and a government push toward more renewable energy generation is likely to quickly expand solar power generation. While the largest chunk will come through the established government Renewable Energy Independent Power Producer Program (REIPPP), developments outside of the procurement program may be opening up the addressable market for solar PV, where solar is being looked at as an alternative to the high price of retail electricity.

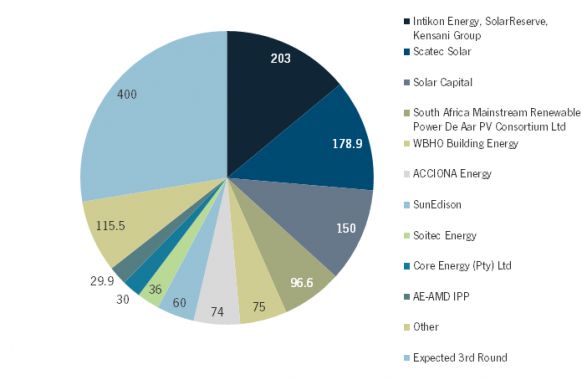

The REIPPP is the government’s only tender for renewable energy. It is responsible for the majority of existing solar installations. The REIPPP has successfully closed on two rounds of bidding, with a total of R28 billion ($2.83 billion) in investment and 1,043 megawatts of capacity allocated. The REIPPP is set to close its third round of bidding on August 19 and is expected to allocate 400 megawatts of capacity to solar PV projects. Numerous developers are submitting bids for the third round, and it will likely be a very competitive round.

The REIPPP is estimated to see five total rounds of bidding, and it is expected that all of the remaining capacity under the REIPPP will be allocated in round three. It will be up to the National Energy Regulator of South Africa (NERSA) to allocate further capacity to the program, and there has been no indication about how big future rounds may be. Industry stakeholders are confident that NERSA will allocate further capacity to the program to contribute to South Africa’s stated goal of 8,400 megawatts of renewable generation by 2030.

Figure 1: Current Allocation of REIPPP PV Capacity by Project Developer (MW)

Source: South Africa Department of Energy, GTM Research

Many in the solar industry view these developments as indicators that the REIPPP has sufficient support and follow-through from the South Africa Department of Energy to continue to rollout successful projects.

With all of the hype, one can’t help but wonder if South Africa’s solar market potential will come to fruition. The global solar industry has been plagued by boom-or-bust cycles, and it remains to be seen if South Africa will be the next market to see significant development followed by stagnation. GTM Research sees two issues with the procurement program that could stymie growth in future iterations of the REIPPP:

- Historical Delays: The rollout of the procurement program has suffered stoppages since its establishment in 2012 and continues to see delays. Bidding window one experienced delays between the financial closure of the project and its construction stage. Construction began for most round one projects in early 2013. Round three has also seen a belated rollout so far -- the original date for the close of the submission round was July 2012 and is now set for August 2013. While some developers have seen the delays as a form of relief allowing them to catch up on their pipeline and secure additional partnerships, the change in the submission round dates may have negatively impacted small local developers and stakeholders who have had to carry their costs, bonds, and/or guarantees over this longer period of time.

- Local Content Requirements (LCRs): To complicate the issue, the Local Content Requirement threshold has increased to 45 percent for bidding window three. The Department of Energy (DOE) also implemented a black identity shareholders requirement, which mandates that a firm or project have documented black South Africans as shareholders. The LCRs may make it increasingly challenging to attract outside developers. Smaller companies may not be able to obtain the requisite shareholders to implement a project, and it may be equally difficult for international firms to acquire the shareholders.

It is worth noting that in previous rounds of the REIPPP, securing project financing was a big question mark. However, five local banks -- Investec, Standard Bank, Netbank, ABSA, and RNB -- have stepped up to provide the vast majority of the debt/equity financing within the procurement program. The successful closure of financing has boosted developer and manufacturer confidence, evidenced by new sales, service and manufacturing offices throughout the country. ABSA allocated a total of $375 million for 421.4 megawatts of PV projects in the first procurement round of the REIPPP. More recently, Investec announced on July 24 that it will be investing $813 million in the third round of bidding for the REIPPP. Questions remain, however, about whether purse strings will remain loose for projects outside of the REIPPP.

For all of its publicity, the REIPPP only represents a small portion of South Africa’s potential solar market. South Africa appears ripe for significant installations of solar systems outside of the central procurement program due to the supply-demand crunch. Yet very little has been written about this segment of the market because minimal development has occurred.

Utility-scale projects outside of the REIPPP are not particularly attractive to developers due to the cumbersome state regulations imposed on Eskom. Eskom is a state-owned utility and acts as the sole offtaker in South Africa. For an IPP or power generator to obtain a PPA from Eskom, the generator or IPP must carry all of the project costs on the balance sheet for an indeterminate amount of time as Eskom sorts through its regulations. Eskom can then offer a PPA. It is rare that an IPP or project proposal can meet all of the regulations. Eskom releases limited unsolicited tenders for similar reasons.

Self-consumption projects that do not have to apply for a PPA from Eskom are increasingly attractive to developers. Various drivers appear to be pushing development in that sector, including:

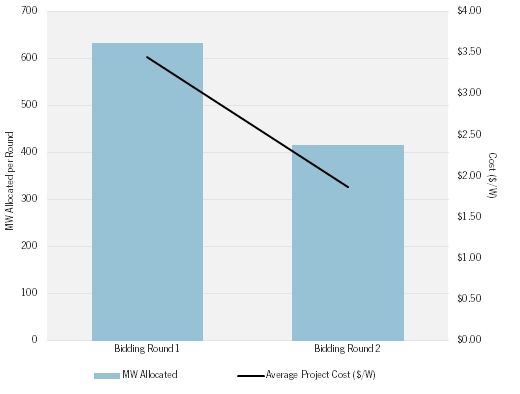

- Falling Cost of Solar PV: Increasing competition across the entire value chain, from module manufacturers to developers, is leading to falling costs of solar projects in South Africa, especially as struggling European companies seek greener pastures in "emerging" markets. Although local content requirements increased in the second procurement round, average project costs still fell by 17 percent. While some reductions have come from a maturing local industry, much of the cost-cutting is the result of increasing local competition from foreign developers and module manufacturers.

Figure 2: Average Pricing of PV Projects in Bidding Rounds 1 and 2 of REIPPP

Source: South Africa Department of Energy, GTM Research

- High Electricity Prices: NERSA recently approved Eskom’s 8 percent annual price increase. Eskom, however, was asking for a 16 percent price escalator, saying it needed the escalator to cover its increasing generation costs. As Eskom tries to make up its increasing costs of generation, retail electricity rates will continue to go up. With the price of solar PV electricity continuing to decrease, retail grid parity seems to be an inevitability.

- Energy Supply and Demand Mismatch: One of the underlying reasons for Eskom’s aggressive price increase schedule is the growing mismatch between energy generation and demand in South Africa. Eskom is running razor-thin energy reserves and needs to build more generation. The utility is in the process of renovating several coal-fired power plants to increase generation but is having trouble completing these projects on time. The Medupi power plant was scheduled to commence operations months ago, but labor disputes have prevented the plant from coming on-line. Eskom’s energy supply problem has been further exacerbated by a cold winter, and the utility has warned customers that additional load-shedding may be necessary.

With critical energy shortages extending through the summer of 2014, businesses in South Africa are looking to alleviate the supply-demand mismatch with renewable energy generation. Large industries, such as mining, have a vested interest in replacing their backup diesel generators with less expensive renewable energy capacity. For example, last November, SMA announced the completion of 1-megawatt PV-diesel hybrid project for mine operator Cronimet Chrome Mining.

Module suppliers and integrators have also indicated a growing interest in solar amongst a spectrum of large energy consumers to offset the expected retail rate increases. SolarWorld recently announced two projects totaling 1.5 megawatts. Other suppliers have indicated supply agreements in the single-digit-megawatt range destined for various self-consumption projects.

While the distributed generation market remains small, the growth of local offices and supply chains, driven by high retail electricity rates and the falling cost of PV, could spur a robust distributed generation market in the near future. Market education and financing outside of the central procurement program will be near-term barriers for the sustainable DG market. In the short run, the REIPPP will continue to dominate, but a combination of factors including volatile electricity supply, growing interest from large energy consumers and high solar irradiation should create a vigorous, attractive and sustainable distributed generation market in South Africa.