GTM Research projects a $1 billion U.S. market for battery-backed solar PV systems by 2018. But that growth won’t come evenly -- and which of the 40-plus contenders in solar storage will succeed remains an open question.

GTM Research’s new report, The Future of Solar-Plus-Storage in the U.S., lays out some key success factors for companies seeking to capture a share of this new market, which is set to grow fiftyfold to 318 cumulative megawatts installed by 2018. In dollar terms, solar-storage investment will grow from $48 million in 2014 to about $1 billion in 2018 -- and in terms of penetration, nearly one in ten commercial and industrial solar installations will come with batteries by then, according to the report.

Most of the growth will be in California, the current leader in solar PV and grid batteries, and other states with grid storage incentives or utility-driven procurements underway, like New York and Hawaii. These are also key target markets for the four of the country’s top ten residential solar installers now offering energy storage, notably SolarCity and NRG Energy -- but the commercial and industrial (C&I) sector offers much more promise of steady payback. The following chart shows state-by-state breakdowns for C&I solar-storage installations over the next four years.

These states share key characteristics, such as relatively high electricity rates and a growing share of power coming from customer-owned rooftop PV, that are driving solar-storage system paybacks. That’s why report author Ravi Manghani, GTM Research Senior Energy Storage Analyst, chose PG&E, Southern California Edison, New York’s Consolidated Edison and Hawaii Electric as the utilities used to run an analysis of typical returns on investment in different combinations of commercial businesses -- hotels, hospitals and grocery stores, to be specific -- as well as typical homes.

In terms of internal rate of return (IRR) measurements, “three selected commercial customer types (hospital, large hotel and supermarket) range from 16 percent to 23 percent, with an average IRR of 20 percent for deployments in 2014, demonstrating that the economics are already attractive,” Manghani noted.

Two key factors make this possible. The first is the falling price of lithium-ion batteries, and the second is the value of demand charge management. That’s the business of using batteries to prevent buildings from exceeding certain set limits on power use at any one time, as measured in kilowatts, in order to reduce rates and avoid penalties that can add up to half the cost of a commercial customer’s electric bill in states like New York and California.

That’s the same business that behind-the-meter storage players like Stem, Green Charge Networks and Coda are targeting today -- and it doesn’t need solar panels to pay for itself. Adding solar PV does help the building reduce energy use, however. “For a typical commercial end customer, solar-plus-storage systems can provide electricity bill savings of 20 percent to 30 percent, depending on system size,” Manghani noted. “More than half of those savings typically stem from demand-charge reductions.”

That also means that smaller systems, sized just right to reduce demand charges without adding unnecessary costs, are a better return on investment. “Since demand charges are based on the highest 15-min. to 30-min. intervals, solar-plus-storage systems don’t need to have multi-hour duration,” Manghani said.

Homeowners don’t pay demand charges, and while a few states are discussing rate reforms that could create them for residential utility customers, that payback stream isn’t available today. Most of today’s residential solar-storage systems tout emergency backup power as an attribute, and GTM Research applies a rough value of $250 per year to that.

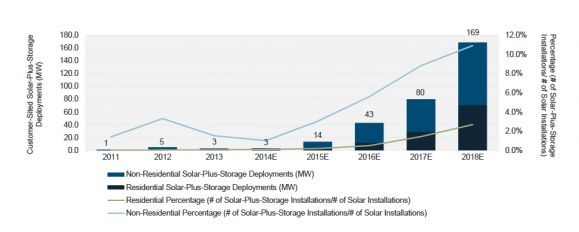

Beyond that, however, storage systems only have energy reductions to drive returns. That’s why the share of residential solar installations that include batteries will remain relatively low for the foreseeable future, rising from just about one-tenth of a percent today to about 3 percent by 2018, compared to more than 10 percent of C&I solar installs by that time, as shown in the following chart.

One of the report’s more interesting findings is that state incentives aren’t as critical as many in the industry make them out to be. That’s according to an analysis of solar-storage payback for a typical customer of California utility Pacific Gas & Electric, which showed the payback both with and without the state’s existing Self-Generation Incentive Program (SGIP), which provides up to half the cost of a typical 10- to 30-kilowatt commercial-scale system.

“Although incentives are an important value-adder, the economics for commercial customers can be acceptable even without them,” Manghani noted. “The returns for PG&E territory would be ~4 percent lower without the SGIP, but still within acceptable limits.”

Perhaps more important changes on the horizon are the potential state-by-state reforms to net energy metering (NEM), the mechanism by which solar customers in California, New York, Hawaii, Arizona, and most other states pay customers for their solar energy. Utility commissions in twenty-one states have discussed or are discussing NEM-related rate reforms, not all of which will have a direct impact on solar-plus-storage economics, according to Manghani. But there are some reforms that could have a positive impact on adding storage to solar.

Those include proposals to roll back net metering from retail to wholesale rates, adding fixed charges to residential customer bills, or introducing value-of-solar tariff structures that end up reducing the value that customers get for the kilowatt-hours of solar their home systems pump onto the grid. All of these measures could make storing solar energy more attractive, particularly if they include time-of-use tariffs with significant differences in peak vs. off-peak rates.

One of the ironies of the solar-storage partnership is that it can gain in some ways from economic shifts that aren’t that great for solar. As Manghani observed, “Customers tend to prefer solar-plus-storage in markets where the value of excess solar generation has been reduced below retail rates through lower feed-in tariffs (e.g., Germany) and export tariffs (e.g., Australia).”

Finally, storage systems that are part of a solar installation get to claim part of the federal solar Investment Tax Credit, which means that they’ll also be affected when the ITC expires at the end of 2016. Losing the credit will lower IRRs for projects by several percentage points and lead to slower growth in 2017, but the market should recover by 2018 as new state incentives and ever-falling battery prices help make up the difference.

***

More details on the the new GTM Research report The Future of Solar-Plus-Storage in the U.S. can be found here.