Organic solar-cell builder Heliatek just raised $90 million in equity, debt and subsidies in a funding round reminiscent of the enormous solar hardware VC investments made in the last decade.

Can an entirely new organic solar-cell (OSC) material be successfully commercialized in an unforgiving solar market dominated by cheap crystalline silicon and First Solar? Heliatek of Dresden, Germany thinks so -- and so do its investors.

Heliatek's funding raise was led by innogy, a European energy firm. New investors include Engie, BNP Paribas and CEE Group along with existing investors AQTON, BASF, eCAPITAL, HTGF, TUDAG and Wellington Partners. (AQTON SE is a strategic investment firm owned by Stefan Quandt, a billionaire investor with an unusual past.) The European Investment Bank added a $22 million loan to Heliatek.

That means Heliatek has raised more than $140 million since its founding in 2006 as a spinoff of the Universities of Dresden and Ulm. The startup claims a world-record 13.2 percent cell efficiency, although that figure is from a multi-junction cell with three absorber layers. NREL's record-keepers have Heliatek at about 10 percent for a single-layer device. Heliatek is focusing on using its OSC technology in windows, facades, building and construction materials, and automotive equipment.

GTM spoke with Heliatek CEO Thibaud Le Seguillon last week. He emphasized that his company is not a solar module company, but rather a roll-to-roll solar film company selling to large steel, glass, aluminum, concrete and automotive companies that will incorporate the film into their products and sales channels.

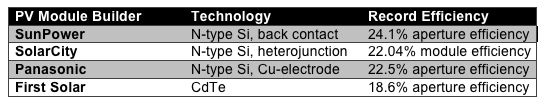

He called the Heliatek product "a shortcut to innovation" for these OEMs. CEO Le Seguillon discounted the importance of efficiency when the power production of OSCs in low light and at high temperature is considered. Nevertheless, here's what vendors in the domain of higher-efficiency technologies are capable of producing.

The CEO said that Heliatek's current fab is producing cells with an efficiency of 8.2 percent; the next fab will be at 10 percent, and "one year later, we'll be at 12 percent."

BIPV ascendant?

Heliatek is focused on the promised-land market of building-integrated photovoltaics (BIPV). This includes windows and facades, as well as concrete and other building materials.

As we've reported, BIPV is a difficult market to break into. Commercializing an integrated solar roofing product or facade is not just an engineering problem. It means driving a completely new type of product through the very conservative roofing and building channel -- and that's a daunting marketing challenge. Traditional solar modules on racks may be less than aesthetically perfect, but they have a distribution channel and a solid track record of technical expertise.

Recent announcements from Tesla, Solaria, SolPad and MiaSolé seem to point to a small resurgence in innovation in the BIPV space. SolPad integrates storage into its slick solar module package. Hanergy-owned MiaSolé launched its new “flexible, thin, ultra-light, high-efficiency, shatterproof modules.” Solaria entered into an agreement with NSG Group, owner of the Pilkington glass brand, to build semi-transparent BIPV. And sometime next month, Tesla will be revealing its new rooftop BIPV product.

Third-generation solar technology: OSCs

Organic solar cells are sometimes referred to as third-generation solar technology, coming after crystalline silicon and thin-film solar. OSCs can be divided into two categories: polymer-based (large molecules) and oligomer-based (small molecules). OSCs are lightweight, nontoxic, and semi-transparent. They hold the promise of low-cost manufacturing, but their efficiencies tend to be very low -- until now, at least -- and their long-term reliability has been called into question.

Heliatek uses vacuum deposition of very homogenous layers of small-molecule oligomers at low temperatures. The process doesn't use solvents (as printing-based processes do), and that serves to separate the firm from competitors, according to Heliatek's CEO. In a previous interview, Le Seguillon suggested that the firm's technology can be thought of as an organic light-emitting diode (OLED) in reverse. Heliatek itself is developing the organic materials it uses, and the firm claims to use just 1 gram of organic material per square meter in its roll-to-roll process.

Organic solar cell competitors

Currently, global deployment of OSCs is negligible. Global production capacity amounts to just a few megawatts.

Years ago, OSC aspirant Konarka raised a great deal of money and went bankrupt without ever making it to commercial production. OSC aspirants Dyesol and Oxford Photovoltaics have more recently focused on perovskite materials.

Other organic and dye-sensitized solar cell (DSSC) developers include Solarmer, Plextronics (bankrupt and sold to Solvay), Infinity PV, EPFL, Mitsubishi, Peccell, and G24i. Eight19 Limited raised $7 million from the Carbon Trust and Rhodia to develop plastic organic solar cells. Ireland's SolarPrint spent millions of dollars of investor money on a DSSC process before going bankrupt in 2014. Intel has also done some research into OSCs.

But the difficult task of commercializing economical and reliable organic solar cells remains. Heliatek seems to have gotten closer to that goal than any other firm to date.

Heliatek's CEO claimed that the company's product will last 20 years, as the firm continues to perform accelerated aging testing. Its plans are to enter mass production in 2018.