Green vs. Green

The solar industry has a public relations problem. Despite broad public support for renewable energy and growing utility interest in purchasing solar-generated power, few seem aware of the economic benefits that solar provides. To some extent, political posturing and vacillating regulatory goals have obfuscated the economic value of solar power. However, we believe that the solar industry has focused too much on the environmentally “green” benefits of solar power and too little on the economic “green” benefits. By educating consumers about solar’s role within electricity markets and emphasizing solar economics relative to conventional power -- specifically natural gas -- the solar industry can attain some pricing power and be a non-trivial part of the energy market.

Baseload vs. Peak

The first step is to understand the role that solar power plays in energy markets and the relationship of solar to natural gas. Why natural gas instead of hydro, nuclear, coal, or wind? The answer lies in the growing disparity between baseload power supply and peak power demand. Along with increasing demand for power in general, the gap between baseload supply and peak power demand is widening. Baseload sources such as coal, nuclear, and hydro generate at the same capacity throughout the day and cannot expand to meet mid-day peak power demand. Instead, natural gas turbines, because they can be dispatched quickly, are relied upon to accommodate the spikes in peak power demand.

Beyond simply serving peak power demand, natural gas increasingly is being recruited to serve baseload demand. While utilities are closing down more and more coal and nuclear plants -- the principal sources of baseload power -- the number of gas-fired plants is growing at an accelerating pace. This means that an ever-expanding percentage of our energy supply consists of natural gas, which, as we discuss below, is more expensive and volatile than traditional baseload sources. Therefore, average power prices will increase and become even more subject to the price fluctuations inherent to natural gas.

This is where solar comes in. Because solar generates the most during periods of peak power demand, it can help grid operators alleviate these demand spikes without being completely beholden to volatile gas-fired power. Moreover, unlike gas-fired power, solar’s costs are fixed from day one, which can protect utilities and consumers against climbing power prices.

Oil and Gas Prices: The Real Rationale Behind Solar Power

The second step is to understand solar economics relative to oil and gas pricing. There is a common misperception that solar power is always more expensive than conventional power. This is false. For one thing, utilities are purchasing increasing amounts of solar power -- a fact that cannot be explained away by regulatory requirements or environmental concerns. The plain reason is the economic benefit of solar power. Just ask consumers in Hawaii or Puerto Rico, where solar power is less expensive than the oil-based power that otherwise is available.

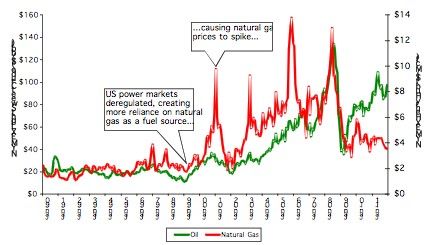

Skeptics may argue that comparing offshore electricity prices to onshore electricity prices is misleading. However, such critiques fail to grasp the complexities of energy markets. For one thing, a disconnect currently exists between the price of oil and natural gas -- with oil at $100/barrel, natural gas should be at $16.67/Mcf, not its current level of ~$4/Mcf (on an energy-equivalent basis, 6 Mcf of natural gas = 1 barrel of oil). Who wouldn't want to buy oil at $24/barrel when it currently costs $100/barrel? It is hard to believe that this gross disparity between oil and gas prices will hold over the long term. Granted, there are transportation constraints impairing the short-term marketability of U.S. natural gas, but, over time, market efficiencies will prevail, leading to convergence between oil and gas prices (see chart below). When that happens, onshore U.S. power prices will increase.

Yet, even in the currently cheap natural gas pricing environment, we are starting to see examples of solar-generated electricity that is less expensive than gas-fired electricity. For instance, prevailing solar PPA prices in California consistently are below the Market Price Referent, which is predicated on ~$4/Mcf natural gas. We also are starting to see the same pricing dynamics in predominantly gas-fired states like Texas. With all of this in mind, solar is a screaming bargain!

U.S. Natural Gas Markets and Miracle Technology

Today's prevailing theory, championed most often by oil and gas companies, is that the U.S. suddenly has become endowed with massive natural gas reserves thanks to new shale drilling "technology.” Unsurprisingly, natural gas producers want us to believe that we must become more dependent on this “now-plentiful” resource, a resource that miraculously has been unlocked by the brightest technological minds. But this ain’t our first rodeo, and we are dubious of supply-side secular changes in the industry. Previous natural gas cycles have ridden on the back of different newfangled plays or “technology breakthroughs” that were supposed to change the way that natural gas is produced. Remember Coal Bed Methane, Shallow Gulf of Mexico, Deepwater Gulf of Mexico, or Canadian Natural Gas, to name a few?

Don't get us wrong, the oil and gas industry will continue to drive the energy complex; we just doubt that it is that easy to increase supply at consistently low costs over a long time period. Factor in the rapid decline rates of shale wells and the consolidation of domestic natural gas producers, and we see just-in-time inventory management of an inelastic resource by an oligopoly. Stated differently, if the few natural gas producers that remain (or, at least, those that control swing shale volumes) want to increase prices, they will simply stop drilling, causing more than 70 percent of their product to disappear from the market in a year. Therefore, if shale gas currently contributes 20 percent of the total U.S. natural gas supply, we could lose 14 percent of our total natural gas supply in one year. Because the price that everyone pays for natural gas and electricity is set by the last buyer, unless we trim 14 percent of our consumption, even a marginal supply shortfall will cause natural gas and power prices to spike.

Lastly, changes to the regulatory environment have significantly impacted natural gas prices. Natural gas always has been a geographically constrained resource, but before 1999, when markets deregulated, prices were consistently below $2/Mcf. As a result of deregulation, power prices no longer can be determined by utility commissions alone. Instead, since deregulation, natural gas and power prices have increased in amount and volatility. While it will never be perfect, we think that fuel/feedstock switching and liquefied natural gas inevitably will allow for natural gas to trade in closer parity to its substitutes, correcting the short-term disconnect between natural gas and oil. Ultimately, natural gas prices respond to marketing (trading) dynamics, not just supply dynamics, and solar will become more attractive.

The Value of Certainty

While myriad uncertainties surround the future of natural gas pricing, what is certain is the cost of solar power over the next 20 to 25 years, at least. Not only is the price of solar competitive, but long-term power purchase contracts, coupled with the predictability of solar radiation, make it a uniquely stable source of power (see our September 23, 2010 article). We believe that the incredible price stability of solar can benefit consumers greatly. For instance, municipal budgets that are funded by local utilities will be in dire straits when natural gas prices spike. The plain fact is that U.S. power markets have changed dramatically since deregulation, and fixed-priced solar generating assets are the only protection against otherwise volatile gas-fired peak power prices.

Remember that owners of assets, such as natural gas or solar, make more money with higher prices. Likewise, any trader or power marketer makes the most money in volatile markets. These are simple market facts and these parties are acting as any investor should -- it's just not necessarily in the best interest of municipal stability. Therefore, we want to warn consumers that, by the time gas-fired electricity is routinely more expensive than solar power, it will be too late to buy solar at today’s low prices -- market efficiencies and rational investors will prevail.

In addition, beyond simply providing a hedge against natural gas price volatility, fixed-price solar electricity enables consumers -- whether residential, commercial and industrial, or municipal -- to plan and budget with increased certainty. Current city budgets, including critical line items such as fire, police, and teacher salaries, are constantly threatened by the specter of rising and volatile electricity prices. We believe that solar power is an elegant way to ensure that those budgets are met.

Lastly, solar-generating systems last longer than 25 years, with minimal maintenance -- all solar panels carry an 80-percent-plus output warranty for 25 years. Because of this, current investment in solar-generating assets will benefit consumers for several decades to come. What are the chances that natural gas prices will remain low and disconnected for the next 20 to 25 years? Even if you believe that the chances are remote, it is a big gamble not to hedge at least a portion of your budget with a long-lived asset like solar.

Solar Makes Economic Sense

While we agree that there are environmental and social benefits related to solar, the tangible economic benefits of solar power must not be ignored. For solar to be a non-trivial part of the energy market, the industry must understand conventional energy economics. The fact is that solar can be less expensive than conventional power and solar can provide unmatched long-term price stability. By emphasizing energy economics, the solar industry will gain some pricing power and stand on its own “green” merits.

Historical Natural Gas and Oil Prices

($/Mcf and $/barrel)

Sources: Bloomberg, Natural Gas Week

***

Tuan Pham is President of PowerFin Partners, a manager of institutional funds for solar projects in North America. Its principals have meaningful experience in energy capital markets, legal and regulatory matters, and renewable engineering.