Tomorrow, the U.S. Department of Commerce will announce its preliminary determination on the issue of whether Chinese solar manufacturers dumped crystalline silicon photovoltaic cells and modules into the U.S. market. But it’s important to understand that, irrespective of the alleged dumping, China’s top-tier solar manufacturers do have a legitimate cost advantage over U.S.-based solar manufacturers. China’s solar manufacturers are winning for good reason: they’re more competitive than their American counterparts.

Before I get into why that is, I want to stress two points: First, Chinese manufacturers could have developed this advantage on the back of illegal subsidies from the Chinese government (though Commerce found evidence of only small subsidies). Second, the fact that China’s manufacturers have a legitimate cost advantage does not necessarily mean they haven’t dumped product into the global market.

So who cares, then? Well, it’s important to separate fact from fiction in trade cases like this. It is very easy to point a finger at China as the bad guy, but that doesn’t help anyone. It has the potential to damage the U.S.-China trade relationship (and remember, it has been in part because of low-cost solar cells and modules from China that U.S. solar installations have boomed in the past years). Blaming China also takes the spotlight off of U.S. manufacturers and U.S. policymakers -- and what they can and should be doing to keep American solar manufacturers competitive in this global economy.

NREL study grossly misrepresented

Most of the arguments against the cost competitiveness of China’s top-tier solar manufacturers have relied on a presentation by Alan Goodrich at the National Renewable Energy Laboratory (NREL). The oft-espoused line is this: the NREL study proves that Chinese manufacturers have a 5 percent cost disadvantage compared to U.S. manufacturers when the cost of shipping from China to the U.S. is included. But that was, in fact, not the conclusion of the study at all.

Anyone who actually saw Goodrich’s presentation, not just the PDF slide deck, knows that Goodrich was not comparing a solar module assembled in China from solar cells made in China to a solar module assembled in the U.S. from solar cells made in the U.S. Instead, he was comparing the cost of a solar module assembled in China from solar cells made in China to the cost of solar module assembled in the U.S. from solar cells made in China. He was making the case for a manufacturer like Suntech to make its cells in China then ship them near to the U.S. location of the end customer and assemble the cells into modules there. (Which is, incidentally, exactly what Suntech does.) Watch the video and see for yourself.

China’s cost advantage: 18 percent to 30 percent

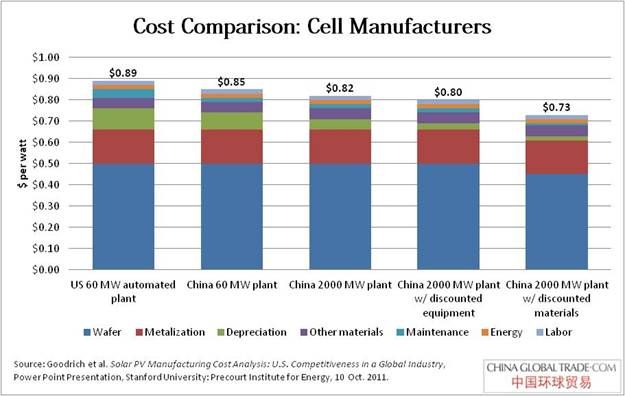

Goodrich did compare the cost of a China-made solar cell to the cost of a U.S.-made solar cell. And he found that the Chinese cell manufacturer has a core cost advantage of 18 percent to 20 percent over the U.S. manufacturer. That advantage comes largely from scale and vertical integration; Goodrich compares a 60-megawatt plant in the U.S. to a 2,000-megawatt plant in China. That scale and integration gives China’s manufacturers a 10 percent discount on all materials (“due to supplier leverage and captive production strategies”) and a 50 percent discount on equipment from Chinese equipment vendors. Labor costs are certainly much lower in China, but labor only makes up about 5 percent to 10 percent of the cost of a module, and U.S.-based manufacturers make up for higher labor costs with more highly automated plants.

An 18 percent to 20 percent cost advantage is in line with what I’ve heard from a number of other analysts and industry experts. Greentech Media’s own Shyam Mehta told me in an interview that the cost differential between U.S. and Chinese manufacturers is about 25 percent to 30 percent in 2012. Rob Wanless, Director of Business Development at SOLON Corporation, said that the cost of solar panels from Chinese manufacturers is about $1 per watt, and $1.20-1.30 per watt from U.S. manufacturers. One executive at a Chinese module manufacturer similarly suggested that China has about a cost advantage of about $0.20 per watt on modules and about $0.10 per watt on cells.

Keeping this debate to the actual facts is critically important, in no small part because the stakes of this trade case are so high. Perhaps even more important, misrepresenting the facts takes the heat off of U.S. manufacturers and policymakers. Spending their time blaming China for the U.S. solar industry’s woes allows policymakers to deflect discussions about what they need to be doing to help U.S. manufacturers stay competitive. We all know that the solar industry is but one example -- if the U.S. can’t figure out a way to compete here, the long-term prospects for American manufacturing are dim indeed.

Learn more about the source of China’s cost advantage and other facts behind the U.S.-China solar trade case (and listen to interviews with Gordon Brinser and Jigar Shah) at www.chinaglobaltrade.com.

***

Molly Castelazo is the director of ChinaGlobalTrade.com, where she coordinates the development of content packages on key China trade-related issues to fulfill the organization’s mission of promoting fact, challenging misinformation, and infusing balance into the dialogue. Molly holds dual degrees in economics and political science. She began her career in the research department at the Federal Reserve Bank in St. Louis.