Saudi Arabia is once again the biggest producer of oil in the world, surpassing Russia to regain its title. Saudi Arabia also happens to be one of the most repressive and undemocratic regimes in the world. The Economist magazine ranked Saudi Arabia 161st out of 167 countries in its most recent Democracy Index.

The Saudis have massive economic and demographic problems to deal with, including a pending peak and rapid decline in oil exports. You heard right: Saudi Arabia, the world’s largest producer of oil, is facing a peak in its oil exports and a rapid decline thereafter.

There are solutions, however, to these very large problems, which I’ll discuss further below.

Saudi Arabia’s national oil company, Saudi Aramco, pumped about 11.5 million barrels per day for the last year, up from about 9.5 million in early 2009. The Saudis are pumping more oil now than they have in decades, along with the rest of OPEC, which is at a 23-year high for combined oil production.

Russia held the top spot for oil production for a couple of years, but Saudi Arabia has come roaring back since 2010. The U.S. is a distant third place with about 6 million barrels per day.

Net oil exports, are, however, a very different picture. The U.S. is famously the world’s biggest importer of oil. While our production of oil has taken an unusual upward tick in the last couple of years, spurred by record high prices, and our consumption of oil has declined even further due to increased energy efficiency, conservation and a still-struggling economy, we still import about half of the oil we consume: a massive 9 million barrels of oil per day.

Saudi Arabia exports about 8 million barrels per day ('mbpd' from now on), with Russia not too far behind at about 7 mbpd.

So far, this is all fairly familiar data. However, what is not well known is the degree to which Saudi Arabia’s massive oil exports are threatened by its demographics and a probable decline in its aging supergiant oil fields.

A new report from the U.K.’s Chatham House (PDF) examines this problem in detail. They conclude that Saudi Arabia’s oil exports will peak around 2020 and, under current policies, decline to zero by 2038. You read that right: decline to zero. This decline will occur due to the dramatic growth in consumption by Saudi Arabia’s rapidly growing population and increases in per capita energy consumption. Saudi domestic consumption of oil is growing at about 7 percent per year, which leads to a doubling of consumption in just ten years.

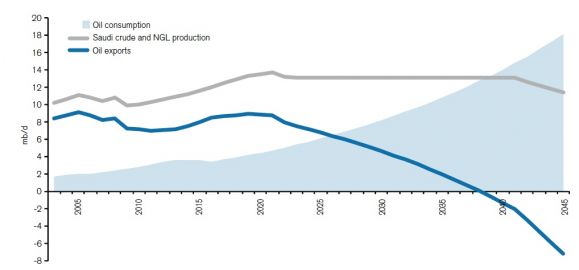

Figure 1. Saudi Arabia’s oil balance under “business as usual” projections

(Source: Chatham House)

Now, 2038 is a long time away, under normal circumstances. But oil politics operates in decadal timespans, not normal timespans. 2038 is, in oil terms, not that far away, so if Chatham House’s projections are accurate, we’ve got a major problem on our hands.

What will the world do if fully 10 percent of global oil production, and 20 percent of global net oil exports, is consumed by the Saudis rather than exported?

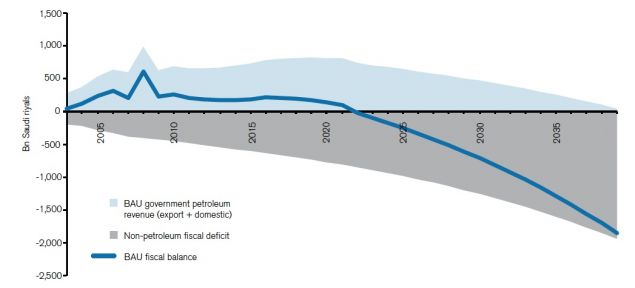

Saudi Arabia’s governmental revenue will come under extreme pressure if net oil exports decline. The Saudis rely on oil revenue for fully 80 percent of their budget. Many things will have to give if oil exports do dry up. Net oil exports declined fairly dramatically from 2005 to 2010, as Figure 1 shows, but have risen back in the last couple of years. Chatham projects net exports will rise to about 9 mbpd by 2020, and then start a precipitous decline as the Saudis’ demographic time bomb explodes.

Figure 2. Saudi Arabia’s fiscal deficit projections under “business as usual”

(Source: Chatham House)

The global oil exports problem

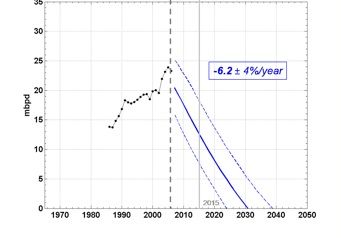

Saudi Arabia’s problem is not, of course, unique to Saudi Arabia. It is a global problem that afflicts many countries. Jeffrey Brown and Samuel Foucher have developed an “Export Land Model” to predict how the global net oil export situation will unfold in coming years. They found that the top five exporters of oil (Saudi Arabia, Russia, Iran, United Arab Emirates and Norway) decline from about 24 mbpd in 2008 to about 7.5 in 2020 and go to almost zero by 2030. Global net oil exports are about 40 mbpd, so these producers account for more than half of the global export market.

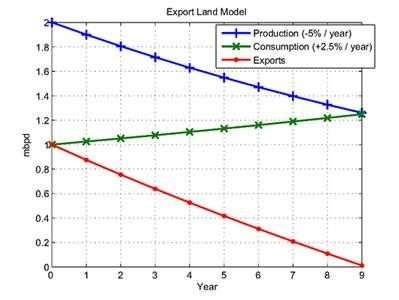

These net oil export projection declines are due to the demographic explosion that the Chatham House report focuses but also to declines in oil production in these countries. Chatham House chose not to discuss the role of declining oil production, choosing instead to believe Saudi projections of steady oil production, but this is a real and extremely serious corollary to the demographic explosion. It’s also the reason why Brown and Foucher project Saudi Arabia and other oil exporters going to zero faster than the Chatham House report. Figure 3 illustrates (with generic numbers) how these two trends work together to cause net oil exports to decline very quickly. Figure 4 shows the result of Brown and Foucher’s modeling for the top five producers.

Figure 3. Brown and Foucher’s Export Land Model

Figure 4. Brown and Foucher’s 2008 projections for the top five global exporters of oil

This data should provoke a “holy crap” moment in all readers. It’s a very big deal.

Currently, we’re far more worried about economic growth, or the lack thereof, presidential elections and why Europe can’t get its act together. These are all important issues. But the big daddy of issues is this one: global net oil exports.

I’ve written about these issues before, in the last go-round of record high oil prices in 2008. This time around, four years later, we’re seeing much the same phenomena unfolding. We’ve just been through yet another super price spike, which hurt Europe more than us because they hit new record highs for oil prices, whereas we in the U.S. didn’t see prices as high as we did in 2008.

Europe is now being pushed back into recession in part because of the new record high prices (every recession in the last 30 or more years has been preceded by an oil price spike). And we are now seeing oil prices decline again (oil is currently about $83 per barrel for U.S. WTI crude and just under a $100 for European Brent crude, down from the recent peaks of $112 and $127, respectively) rather quickly as European growth stalls, U.S. growth struggles and oil storage numbers reach recent highs here in the U.S.

A recent article extends the original Export Land Model, shedding additional light on this singularly important issue and providing strong support for Brown and Foucher’s initial projections.

The Saudi solar solution

There are solutions. I’ve written recently about the tremendous growth in renewable energy around the world and similarly positive trends in energy efficiency and conservation. The picture is far less rosy, however, when we look at transportation fuel as opposed to electricity. There are some similar positive themes in transportation energy, but there are also major problems in shifting away from petroleum as our key transportation fuel because we’re so dependent on oil for transportation. Simply put, this is a many-decades-long process at best.

What we really need is a World War II-level effort to rapidly and massively save energy in all sectors through improved energy efficiency and conservation, and to shift away from oil and coal in transportation and the generation of power.

The Saudis seem to be recognizing the severity of the problems they’re facing. They recently announced a massive renewable energy initiative, designed to bring 54 gigawatts of mostly solar and wind power on-line within 20 years. This will make up about one-third of total electricity consumption at that time, up from almost zero renewables on-line today. This growth will be achieved with a type of feed-in tariff, which guarantees eligible power producers a contract at a long-term fixed rate. Feed-in tariffs are responsible for the large majority of solar and wind capacity installed around the world today.

At the same time, the Saudis need to focus on energy efficiency and conservation. Saudis consume the most oil per capita of any major economy in the world. I have considerable faith that, as government revenues shrink from declining net oil exports, the Saudis will find economically compelling incentives and/or mandates to reduce domestic consumption of oil.

Conclusion

The problem of “peak oil exports” is the even more scary sibling to “peak oil.” Peak oil is, by itself, a massive problem, but peak oil exports highlight the problem even further, particularly for major oil importers like the U.S., Japan, China and Western Europe. The Saudis and other nations experiencing a demographic explosion will suffer greatly from reduced revenue from oil exports, but they will at least have the energy resources to maintain their economies. Countries that are net importers of oil will suffer in their own way, primarily from much higher prices for oil and possible shortages of oil as demand far outstrips supply.

As the world’s biggest importer of oil, by far, the problem of peak oil exports highlights the need for the U.S. to get off oil as quickly as possible.

The package of solutions to achieve this shift away from oil must include major and ongoing investments in energy efficiency and renewables. Energy efficiency is steadily improving with new technologies and higher fuel prices. Similarly, conservation (behavior change, as opposed to technological improvements that foster energy efficiency) will occur automatically with higher prices.

We also need to ensure that the exponential growth in renewable energy over the last decade continues. Luckily, the cost of renewables has plummeted in recent years, so this transformation away from fossil fuels can be done cost-effectively when it comes to electricity.

Transforming our transportation energy sector is far less easy, however. Conservation through carpooling, better mass transit and low-tech solutions like bikes and walking, will be major parts of the solution. Smaller vehicles, higher mileage vehicles, hybrid cars and electric cars must lead the way in terms of new technologies. Electrification of transportation, while still fairly expensive with today’s technology, is still the most promising long-term solution, because electric vehicles offer a readily available technology for entirely eliminating dependence on oil.

***

Tam Hunt is an attorney specializing in renewable energy law who owns the consulting firm Community Renewable Solutions LLC, based in Santa Barbara, California.