Venture is broken. Cleantech is broken. Cleantech venture -- surely not a sector to invest in, right?

The Kauffman Foundation recently publicized a widely circulated report highlighting poor venture returns over the past fifteen years. Others point to dismal returns in cleantech (also check out Rob Day’s historical summary of cleantech VC to get a perspective on the current state of the field). Logically, these two sets of data should be enough to reinforce current conventional wisdom about cleantech venture, and scare away any potential newcomers from the field, while perhaps continuing to weed out some of the legacy players as well.

Could it possibly pay to play in one of the toughest sectors in the industry? Absolutely. How? Through seed stage and strategic opportunistic investing. However, to fully explain why those strategies are winners, I must first walk through the empirical data supporting the first two premises.

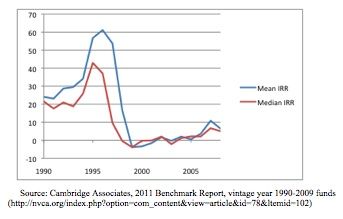

The Kauffman Foundation was not the first to recognize some of the deep-seated issues in the venture capital industry. Most everyone agrees that venture returns across the board are down, not just Kauffman’s funds. The most recent Cambridge Associates benchmark statistics illustrate poor returns for all venture since the peak in the late '90s.

Source: Cambridge Associates, 2011 Benchmark Report, vintage year 1990-2009 funds

The graph above looks even better than just a year before, such as the one found in the Kauffman report, as a number of recently vintaged funds seem to have increased their IRR in the past year. Still, it’s not a pretty picture.

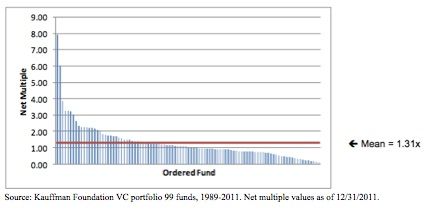

Kauffman’s portfolio performance certainly supports its conclusions and follows the general market trends. Of the 99 different funds in the firm's portfolio, 50 percent failed to return investor capital. The average return across all the venture investments was a paltry 1.31x, and only sixteen funds were able to achieve a return of 2x or better. Perhaps they simply invested in the wrong VCs and didn’t get into the top echelon funds, as Dan Primack notes, but that seems to be the least, rather than the most, logical explanation. With a nod to Occam’s razor, it seems most accurate to accept the strong data and its implications for the current state of venture capital. The statistics once again deliver a powerful message, as seen in the following chart.

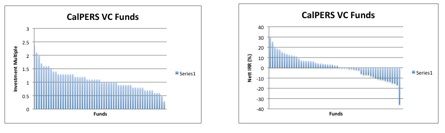

Aside from Kauffman, CalPERS Private Equity Program presents one of the only transparent views to public venture data. I used their numbers from the latest Quarterly Performance Review (3Q11) to specifically target the results from its investments in 56 different venture funds, going back to vintage year 1992. Those funds have cumulatively averaged a 1.09x return on investment (1.05x median) with a 1.28 percent average IRR (2.4 percent median). These numbers speak for themselves, however softly; venture has not been kind to public employees in California. Out of all 56 funds, 19 failed to return investor money (34 percent) and 26 failed to achieve returns over 1x (46 percent). Only three funds managed to garner venture returns of over 2x and two of those funds had a vintage year before 1996, while the other came in 2001. In fact, funds with a vintage year post-2002 averaged a return to investors of .85x (.90 median) with a net IRR of -5.21 percent (-4.1 percent median). The charts below illustrate the relevant data available from CalPERS.

Unfortunately, the news for cleantech isn’t any better. Difficult exit markets and notoriously capital-intensive plays continue to plague venture funds investing in cleantech. World leaders preach “sustainable growth” as pools of capital seek the sweet spot where profits meet increased environmental responsibility (the “double bottom line”), but venture continues to seek its footing in this space. Notable recent failures (ahem, Solyndra) have brought a harsh spotlight to the struggling industry and the challenges facing large, capital-heavy cleantech companies. A recent survey of venture investor confidence found that U.S. investors held the least confidence in cleantech compared to any other country by a significant margin, despite above-average confidence in domestic venture in general.

Matt Nordan of Venrock produced one of the best analyses of cleantech venture capital in his four-part series, The State of Cleantech Venture Capital 2011. His thorough discussion of the industry includes excellent original research and should not be missed. Nordan covers fundraising, exits, VC performance, and cleantech company paths. After almost 20 pages of in-depth analysis, he concludes that while there may be a lack of Seed/Series A money going forward, cleantech VC is doing about the same as venture overall.

Nordan argues that cleantech VCs are not doing worse than venture on the whole, based purely on the number of IPOs in the sector, a shorter average time to exit, and competitive valuations. I agree with his last point: cleantech funds are doing about the same as other venture funds in terms of value-to-paid-in-capital. However, his point just reaffirms the fact that both are broken.

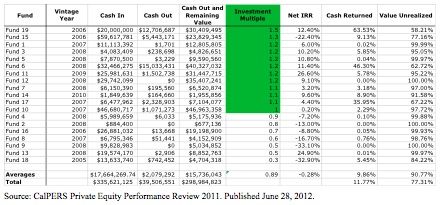

Generally, the cleantech funds for which good information exists (i.e., those with CalPERS data) are simply too young for industry observers to have a true handle on. They should still be experiencing the J-curve; even so, the funds are performing pretty horribly to date. Using the chart below, note that only 13 out of 19 funds are returning investors money using unrealized returns. Perhaps there are still live bullets in the chamber for most of these VCs. Yet only one has returned at least half the fund to the date of this CalPERS publication, and that includes firms that have been around since 2005 and 2006. This data illustrates that cleantech venture is having a hard time getting meaningful exits.

Even though Nordan provides data that cleantech startups average a faster exit than average, I am skeptical. The earliest fund in this group reports an investment multiple of 0.3x with 84.22 percent of its total unrealized value. After seven years of investing, they have seen almost no hard returns. The best fund in CalPERS still has over half its value unrealized and an investment multiple below two -- that math equals long time horizons to exits. Let’s say Nordan is correct and exit times in cleantech are shorter. Earlier exit runways for cleantech companies don’t necessarily represent a healthy ecosystem. Nervous cleantech VCs could be dumping lousy portfolio companies early to avoid zeros, whilst hoping for a big winner later to make the portfolio whole. Get what you can while you can get it.

I will use the public markets to get a better sense of current the exit environment, and again, it’s ugly. The public markets are beating up virtually all cleantech companies that have managed to come to market, with the exception of Tesla. Take a look at these cleantech indexes, which theoretically aggregate the best companies in the industry:

The Cleantech Group used this graph to illustrate how good its returns within cleantech have been in the past five years; the numbers are only down 10.5 percent over the past five years, compared to a loss of 0.9 percent for the S&P 500. The variation amongst the numbers of the different indexes suggests a decent spread of different cleantech companies, meaning the portfolios shown aren’t all based on a few losers -- the entire sector is flailing. Check out the performance of Nordan’s IPO list, a laundry list of southeast-pointing arrows.

Clearly, even those companies that successfully make it to public markets aren’t rewarded. Not surprisingly, cleantech firms continue to delay their presentations to potential public shareholders, despite the recent signs of post-Facebook life in IPOs.

So given all this, money should be flowing out of the sector because the numbers are a disaster for cleantech venture as a whole. The data provided by the Cleantech Group suggests that investors may be catching on to cleantech VC’s hostile landscape. While the 2011 Summary notes that the investment total in the sector went up to $8.99 billion in 2011 (a 13 percent increase from 2010), the number of deals dropped by 7 percent. Both 1Q12 and 2Q12 have seen a fall in total dollars from the previous year, and total deal count for the year is down compared to 2011. Generally, there are few strong trends in the past 18 months, but I think it’s fair to say that VCs' enthusiasm for cleantech is waning.

I believe that these numbers suggest two winning strategies in cleantech venture: old-school seed investing and strategic opportunistic investing.

Strategy One: Seed Investing

The dearth of funding available in the earlier rounds means that cleantech entrepreneurs must be having serious difficulty fundraising at the moment. The key insight from 1Q12 and 2Q12 cleantech data is that seed/Series A investments appear to be gaining less and less attention from venture investors; Series B or later rounds accounted for 61 percent of the deals in 2011 (85 percent of the total money). In 2012, they accounted for 56 percent and 59 percent of deals (88 percent and 90 percent of all money) in Q1 and Q2, respectively. This means that crafty VCs with some appetite for risk can get in early at generous valuations -- less cash for more equity.

- There is a plethora of opportunities with minimal technology adoption risk that still remain unfunded because the money simply isn’t there. Capital-efficient companies do exist in this sector and should be targeted at this stage. Investors willing to play this game will be able to find good deal flow and valuation leverage in the earliest funding stages. A fund able to make initial capital commitments with adequate follow-on funding will surely find a more enticing exit market in the coming years as new carbon-pricing schemes (look to Australia) and friendlier public markets give rise to increased profitability of cleantech solutions across the globe.

- The corollary to this insight is that smaller funds (<$250 million) will optimize investment returns compared to their larger competitors. Silicon Valley Bank released a report in 2010 confirming this observation. According to their data, the majority of funds (51 percent) larger than $250 million fail to return investor capital after fees, and almost all (93%) fail to return investor capital at a venture rate after fees. On the other hand, smaller funds only fail to return investor capital after fees 34 percent of the time and actually achieve a venture rate of return at the same rate -- 34 percent. Seed stage investing tends to be more attractive to smaller funds because they don’t have the capital to play in high-valuation, follow-on rounds for any type of meaningful equity. Thus they tend get in early in the game -- and according to the data, that’s the winning strategy.

Takeaway: Early-stage, capital-efficient cleantech companies, given sufficient capital to hit their growth curve, represent an opportunity for low valuation investing that can blossom into early exits at a high multiple.

Strategy Two: Strategic Opportunistic Investing

The other opportunity is less obvious, but perhaps more intriguing.

- Given the present state of cleantech venture capital, many funds currently sit with blown-up portfolios, saddled with capital-intensive companies full of promise that have yet to commercialize their technologies. The technological potential still exists, but fund managers may not want to pour more money into eventual losers.

- A fund with sufficient capital should be able to find mispriced assets in many of these portfolio companies and transform them into winners again, or simply give them a push toward the finish line. After the aforementioned issues in cleantech venture, there are vast opportunities to purchase these companies from other funds at a competitive price and, with new injections of capital, to turn them around. Funds facing horrible returns would be foolish not take a discount in order to secure some exits that may otherwise not exist. Such examples remain abundant, and for a firm with enough resources, represent a striking opportunity.

So is venture capital broken? Yes. Is cleantech even worse? Probably. What does this mean for cleantech investors? Bountiful opportunities with a new mindset.

***

Adam Medoff was Summer Associate with Clean Pacific Ventures, a seed-stage cleantech venture fund in San Francisco.