As the energy storage market develops and shakes out, it's worth keeping an eye on Greensmith. The startup is a software developer and system integrator that has attracted investment, personnel and a growing roster of turnkey energy storage projects.

Last week, Greensmith CEO John Jung told Greentech Media that batteries from Aquion (based on an aqueous sodium-ion chemistry), ViZn (zinc redox flow batteries) and two established lithium-ion battery suppliers have been added to the eight battery types already deployed in its systems. Greensmith has been threatening to deploy four additional battery types since earlier this year.

Companies like the 30-employee Greensmith are winning energy storage projects not because they are building better batteries but because they are writing software that integrates batteries with inverters and allows energy storage to work with the grid at scale. Greensmith works with a variety of battery chemistries from different vendors, as well as multiple inverters and power electronics partners.

New battery technologies and projects

Amongst other technologies, Greensmith is using Aquion Energy's sodium-ion battery. The Pittsburgh, Penn.-based Aquion says its technology can deliver round-trip energy efficiency of 85 percent; a ten-year, 5,000-plus-cycle lifespan; energy storage capacity optimized to charge and discharge for multi-hour applications; and perhaps most notably, a price point of $250 per kilowatt-hour. In April, Aquion closed a $55 million Series D venture capital investment, bringing total investments and grants to more than $100 million. New investors Bill Gates, Yung’s Enterprise, Nick and Joby Pritzker (through their family’s firm Tao Invest), Bright Capital, and Gentry Venture Partners joined previous investors Kleiner Perkins Caufield & Byers, Foundation Capital, and Advanced Technology Ventures in the round. Aquion is already producing its 1.5-kilowatt-hour S10 Battery Stack units, as well as an 18-kilowatt-hour system that combines twelve of its S10 units.

Greensmith is also using ViZn Energy Systems' zinc redox flow battery energy storage technology. ViZn aims to produce a 80-kilowatt/160-kilowatt-hour system housed in a 20-foot shipping container, as well as larger systems. Other flow battery firms include American Vanadium, EnerVault, Primus Power, Imergy and ZBB Energy.

The CEO of the firm told GTM that Greensmith is developing a hybrid system using both the Aquion and ViZn storage chemistries.

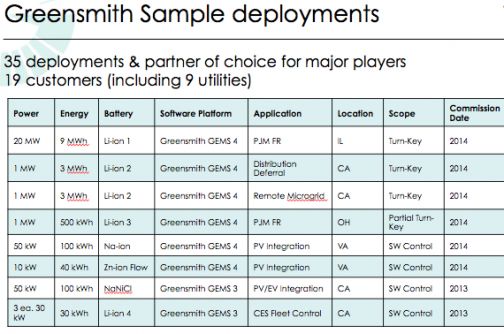

Since its 2006 founding, Greensmith has deployed 30 battery energy systems for eighteen different customers, nine of them utilities, and is aiming to have 23 megawatts of systems under management by year’s end. These include several megawatts of lithium-ion substation batteries for San Diego Gas & Electric, and work with Sacramento Municipal Utility District (SMUD) to get its grid battery project working smoothly. Here's a list from the firm of some of its 2013 and 2014 projects:

While many of its projects are utility-owned and operated as capital assets (that is, paid for by rate increases), Greensmith is also doing big commercial projects bidding into energy markets. That includes a 20-megawatt, 9-megawatt-hour project in Illinois that’s providing frequency regulation for mid-Atlantic grid operator PJM for an unnamed partner. Greensmith is also providing its software to New York-based Green Charge Networks, and is linking solar PV and electric vehicle charging in Hawaii.

The DOE global energy project database website cites an EPRI collaborative R&D project to assess the performance and reliability of a number of Li-ion battery chemistries; SDG&E installed a 50-kilowatt, 82-kilowatt-hour Greensmith lithium-iron-phosphate distributed energy storage system at the utility’s test facility. The project will investigate PV-battery integration capabilities and will test various modes of operation, including constant power charge/discharge, peak shaving and PV smoothing.

New personnel

In April of this year, Greensmith named Andrew Tang, formerly of AutoGrid, as SVP of business development. Last month, Leesa Lee joined the firm as senior VP of product management and marketing. Lee came to Greensmith from the senior director of marketing role at distributed energy storage vendor Stem. Prior to Stem, Lee was senior director of product management at Enphase, a solar microinverter firm. Greensmith also added Jim Murphy as CFO. Murphy was most recently COO and CFO at DDC Advocacy, a full-service advocacy communications firm, providing SaaS-based software and services to the Fortune 500.

New funding

According to an SEC filing, Greensmith raised $4 million of a $9 million round in May. Representatives of Luminor Ventures, Pruitt Ventures and Cap Gemini SA sit on Greensmith's board of directors.

New energy storage competitors

Like Greensmith, startups like Younicos, GELI and 1Energy are also looking to develop a software operating system for the energy storage ecosystem. Another system integrator, Solar Grid Storage, has five 250-kilowatt projects operating within the PJM Interconnection, according to the DOE's global energy storage database. Younicos works with multiple battery partners, including lithium-ion batteries from Samsung for its 1-megawatt battery park modules that link solar panels, electric vehicle chargers and frequency regulation service. It’s also deep into longer-term energy storage, using sodium-sulfur batteries in Berlin and on the island of Graciosa in the Azores, and deploying CellCube vanadium-redox flow batteries from Germany’s Gildemeister. Younicos bought Xtreme in April, picking up its 60-plus megawatts of working projects and gaining a foothold in the U.S. energy storage market in the process.

Rogers Weed, vice president of product management at Seattle-based 1Energy Systems, writes, "Even at this early stage, two things seem clear. First, until costs come further down, the business case for storage will be situation- and customer-specific, often involving multiple uses that arise unpredictably and change over time. Second, to realize their business potential, these systems need sophisticated control software that integrates well with existing grid systems."

Demand Energy and Stem have developed more specialized software for peak demand limiting and demand reduction. A number of companies are pursuing storage projects on the customer side of the meter, including Convergent Energy + Power, Arista Power and Demand Energy.

Green Charge Networks, a startup deploying energy storage equipment for commercial customers, raised $56 million from K Road DG to expand its no-money-down energy storage program. Founded in 2009, Green Charge’s GreenStation has been installed by 7-Eleven, Walgreens, Levi's Stadium, UPS, school campuses, and cities across California, including Redwood City and Lancaster. Green Charge owns and operates the energy storage assets deployed at customer sites, with zero capital or maintenance costs for the customers. The company claims that it is already profitable and has more than 25 customers. Although the company calls its program a "PPA," the fact is that it's a shared savings model that more closely resembles an ESCO arrangement.

What’s really driving the first wave of building battery systems are demand charges -- the portions of utility bills that building owners pay when their total electricity consumption hits or exceeds certain thresholds at any given moment in time. Because these “peaks” are hard to monitor or predict, they’re hard to prevent -- and in certain markets, like California or New York, they can add up to a significant portion of overall utility bills.

Stem, another batteries-for-buildings startup, has launched a $5 million fund with Clean Fleet Investors to boost installations of its own building energy storage systems. Former EV maker Coda also offers a no-money-down energy storage play, this one financed internally by Fortress Investment Group (FIG), the multi-billion-dollar investment firm that picked up Coda’s assets for $25 million in June.

In March, energy storage market leader AES launched its Advancion business line, which is integrating lithium-ion systems from LG Chem and other as-yet-undisclosed partners, in hopes of replacing gas-fired peaker plants for grid capacity services. It has also built its own Storage Operating System software to manage these multiple variables throughout the lifespan of a storage system.

AES isn't the only company proposing the use of lithium-ion batteries to meet this need. A123 Energy Solutions, the grid-scale arm of lithium-ion battery manufacturer A123 which was bought out of bankruptcy by China's Wanxiang and sold for $100 million to Japan's NEC in March, has launched a long-duration storage system that it has deployed in Spain and Japan so far.

Greensmith CEO Jung told GTM, "When we started in 2008, people were looking for a 'killer app' in the storage world." He adds, "But it's not the inverters or batteries, but how the software works to solve grid congestion problems." The company is battery-neutral, according to the CEO, because "batteries need to be selected according to the application. An 8-hour application will require a different battery than does a 15-minute frequency regulation application."

"Batteries must do more than just work -- they have to scale." He notes that most of the 23 megawatts deployed by the firm this year was lithium-ion. Jung added that "a lot of people are trying for large projects -- but we're delivering now."

He said that some inverter or battery firms are trying to forward-integrate to the system level, but customers realize that the supplier is "trying to sell more batteries and more inverters." He said that the integrator role "allows us to be unbiased and really care -- without going in with one hammer looking for a nail."

He also makes his point: "Last year, we competed against a large inverter and large battery company and we won that project. We then turned around and actually used the competitors' inverter and battery for the project."

The CEO notes, "While we've done EV charging and C&I applications, our pole position is at the grid scale. We are well positioned to scale from small C&I systems to grid scale -- managing fleets and aggregating distributed systems. We provide the software for fleet management and control."

"And our pipeline is going through the roof," said the CEO, adding, "Despite being a small company, we are beating the largest players in the world for these systems."

GTM Research predicts the U.S. market for distributed energy storage will grow at a 34 percent cumulative annual growth rate to reach 720 megawatts by 2020, driven largely by the demand charge business case, but also boosted by solar integration needs.