We check in with GTM Research solar experts Adam James, Jade Jones, and Scott Moskowitz periodically to see what's on their solar-obsessed minds.

Here's the global demand update, with the most recent news and our analysis on Chile, China, India, and Russia.

Emerging Market Spotlight: Russia

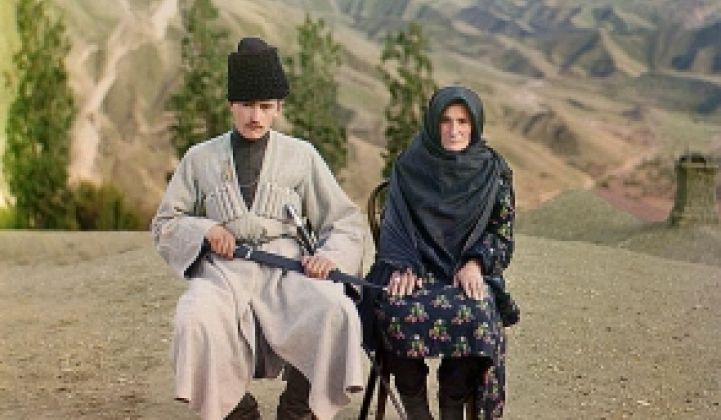

Brush up on your conversational skills in the northern Avar dialect of the Khunzakh language, because sunny Dagestan in the North Caucasus region, a federal subject of Russia, jump-started its market with the installation of a 1-megawatt system in late January. According to PV-Tech, the system was installed in two weeks' time by Hamburg-based EPC Enerparc using equipment from Mounting Systems, Trina Solar and REFUsol in Russia's largest solar installation to date.

Scott Moskowitz notes, "With the enactment of a new regulatory framework in 2013, a recently completed 1-megawatt project, reasonable insolation in southern regions, high loads, and government-connected corporations with healthy balance sheets, there's significant upside to long-term Russian PV forecasts."

Moskowitz adds, "Enterprises are beginning to make investments into the market and are building long-term pipelines. With some of the lowest electricity rates in the world, the market will be limited to utility projects and off-grid solutions."

Russia wants to build module factories in Altai, Bashkortostan, Orenburg, Samara and Omsk, according to reports. Moskowitz notes that "barriers to development include high domestic content requirements and limited local manufacturing capability."

Chile: Latin America's Biggest Market With Latin America's Lowest Module Prices

Chile is now Latin America's biggest market -- and it's also home to some of the globe's lowest module prices.

Chile has installed 173 megawatts of PV this year, with EPC firm Solarpack connecting 23.2 megawatts in Q2, according to PV-Tech, which is in line with GTM Research's Latin America Playbook forecasts. GTM expects another 77 megawatts to become active before the end of the year, making Chile the biggest regional market in Latin America in 2014. SunEdison and Solarpack are the current EPC market leaders, with SunPower expected to join the ranks by December.

Last quarter was "a testament to the real pipeline now emerging in Chile,” said GTM Research analyst Adam James. “The market has strong fundamentals, and we are seeing that companies like SunEdison can leverage a variety of business models to execute deals on those fundamentals. Both the PPA and merchant markets in Chile have exciting near-term potential, and several companies have secured financing and have projects moving forward."

Jinko is supplying 100 megawatts of panels to Enel, and Trina is shipping 36 megawatts into the region, according to James.

This chart from GTM Research’s latest report on PV pricing shows that in Q1 2014, regional price levels for Chinese-produced modules varied from 80 cents per watt in Japan to 55 cents in Chile, a mean spread of 31 percent.

Source: Global PV Price Outlook: Q2 2014

India: Unrealistically Ambitious

In a recent global review, Moskowitz noted the trouble brewing in India's National Solar Mission program.

This week, he notes that "India is moving forward with its long-term targets and will put up another 1,000 megawatts for bidding at the end of 2014."

But James cautions, "Given past experience, and the challenges with the domestic content requirements of the current phase of the National Solar Mission, we anticipate delays to the timeline or changes to the NSM bidding process."

China Downstream Demand to Increase

China will continue to be the world's largest solar market in 2014, with demand driven by massive utility-scale build-out.

"We expect demand to increase from Q2 through Q4 after a weak Q1. The slow start to the year can be attributed to seasonal factors and markets recalibrating to the new incentive regime," said James. "We anticipate an upwards revision to the 6-gigawatt feed-in tariff allocation for utility projects, driven by strong demand and the direct involvement of the Chinese Development Bank in downstream financing."

James adds, "Trina has completed and announced new projects and expects strong demand from China through 2014. Jinko has secured significant financing from the CDB and is connecting projects."

Although both Yingli and United PV have sought funds from Western capital markets to finance downstream projects in China, James says, "We disagree that this signals a hands-off approach to the industry on the part of Beijing. While the strength of balance sheets may be an issue, we believe there is a bigger point: This recourse to capital markets indicates that despite support from Beijing, capital is needed from outside sources to keep pace with strong Chinese demand."

Learn more about how Chinese demand impacts global pricing in the PV Global Pricing Outlook.

Solar agent Adam James travels to secret international solar locales this week, and if we're lucky, he'll report back to us between baccarat games and yacht parties.