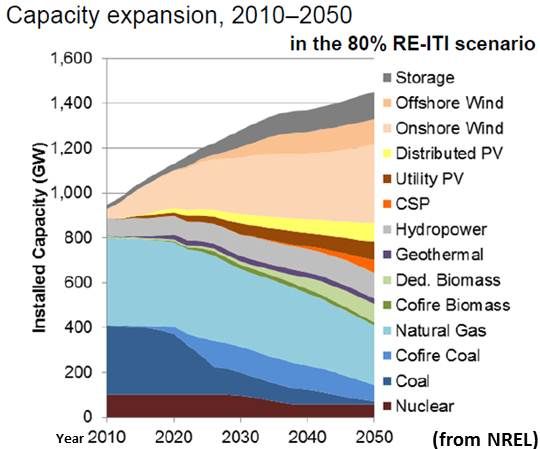

Increasing levels of solar and wind in the power production system need to be firmed by natural gas.

The Renewables Electricity Futures Study, a new comprehensive report from the National Renewable Energy Laboratory, concluded that “variable generation levels of up to nearly 50% of annual electricity can be accommodated when a broad portfolio of supply- and demand-side flexibility resources is available at a level substantially higher than in today’s electricity system” and that broad portfolio should include “sufficient capacity on the system for planning reserves” and “demand-side interruptible load, conventional generators (particularly natural gas generators), and storage.”

What is unknown is how current, unprecedentedly low natural gas prices will affect the growth of solar and wind.

Erik J.A. Swenson, a partner in the Washington law firm of Fulbright & Jaworski, presented on U.S. natural gas policy at the recent American Wind Energy Association (AWEA) annual conference and argued that making the export of liquid natural gas (LNG) easier will drive the market price up and grow solar and wind.

In full disclosure, Swenson acknowledged that Fulbright represents clients that want to export LNG.

“Wind and solar combined with natural gas present a good combination of greenness and cost,” Swenson said. “Wind and solar are intermittent sources of generation and gas is the natural firmer.”

New natural gas plants have “a relatively low capital cost” compared to nuclear and coal, he said, and “can be designed to throttle up and down better, depending on where they are needed to fit into the market.” Where state renewable energy standards require increasing penetrations of solar and wind, “there is going to be a lot of demand for gas-fired generation to firm it up.”

That is why, he said, “gas shouldn’t feel threatened by solar or wind.”

But, he added, “gas prices have traditionally been volatile.” Which is why wind and solar needn’t feel threatened by natural gas.

“If you couple gas with wind and solar, you can reduce the volatility.” Wind and solar are variable, but “it is pretty predictable over time as to what the capacity factor from a wind or a solar plant will be." And, he added, “generating costs are near zero, [because] there are no fuel costs.”

The bottom line is that “if you mix the volatility of the gas per kilowatt-hour output with the dead flat wind and solar output, you end up with a flatter, less volatile combination.”

The effective partnership depends, however, on a moderate natural gas price, what Swenson called the "Goldilocks price."

“If gas is expensive, electricity as a whole becomes less affordable, and consumers are going to be less receptive to wind and solar because they will see it is an added expense. On the other hand, if gas is cheap, it makes wind and solar look expensive. And, with cheap gas, you can afford to shut down coal plants and that takes pressure off the need to take other steps to deal with greenhouse gases.”

The NYMEX natural gas price has been below $3 per MMBTU this entire year. Swenson’s decades of experience with natural gas and his gleanings from a variety of other sources lead him to accept a conclusion he cited from a September 2010 Exeter Associates/Center for Resource Solutions report: “The base assumption of $9.50/MBtu for natural gas resulted in the displacement of natural gas-fired generation, leaving less-flexible coal plants to accommodate the variability of the wind and solar resources.”

This resulted in less wind and solar and more coal. But “when the price of natural gas was set at $3.50/MBtu instead of $9.50/MBtu,” according to the report, “wind and solar generation primarily displaced coal generation.”

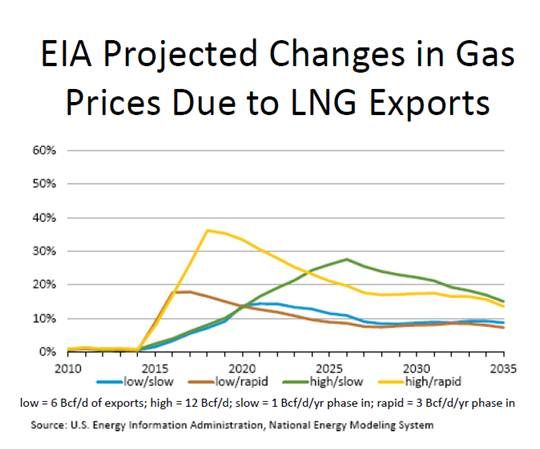

Swenson believes the key to moving today’s extremely low natural gas price to that $3.50 range is an adjustment to U.S. policy that would facilitate the export of natural gas, primarily in the form of LNG. “By adjusting the amount of gas exports, you can find yourself with gas priced in a way that helps encourage solar and wind generation.”

The U.S. Department of Energy Office of Fossil Fuels is currently considering freeing up strictures to natural gas exporting delineated in the Natural Gas Act of 1938. There is contention over the costs and benefits to the U.S. in doing so.

A Brookings Institution study suggested there is a modest net benefit overall from allowing gas to be exported: “The benefits that come from improved trade relations, the income from selling the gas, and the new jobs, and so forth,” Swenson said, “are greater than any detriment that comes from increasing the price of power or gas.”

The Japanese nuclear disaster has put upward pressure on the international price of natural gas and recently accessible shale gas resources make U.S. supplies seem abundant, Swenson said, and, as a result, “there are a lot of folks in the U.S. interested in exporting natural gas.”

Allowing them to do so may have drawbacks. But, as Swenson pointed out, it may make possible hitting the 'Goldilocks' price range around the just-right price of “$3.50 per MMBTU [and] benefit other policy goals such as the development of solar and wind."