The attraction of geothermal energy is that it is a baseload, emissions-free, renewable energy source -- and the challenge is that finding it and producing it puts capital at risk.

Between March 2012 and February 2013, seven U.S. geothermal projects came on-line. In 2012, U.S.-installed geothermal capacity grew by 147.05 megawatts, a 5 percent growth rate. Though up to twice as many plants could become operational in 2013, compared to the wind industry’s 13 gigawatts in 2012, and the solar industry’s 3 gigawatts, those still are not impressive numbers. The Geothermal Energy Association (GEA) U.S. and International Geothermal Energy Finance Forum in New York City took up the question of what’s holding the industry back.

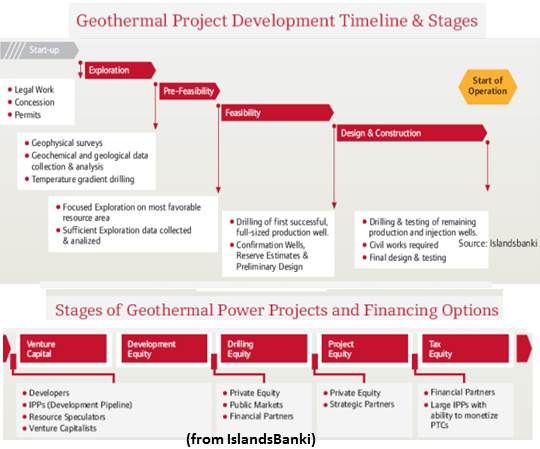

Average development time for a geothermal project, beginning with exploration and exploratory wells, is 7.5 years, explained GEA Executive Director Karl Gawell. Commercial financing only comes when the resource is proved and power plant construction begins up to three years into the project cycle.

“Almost half the cost can be proving the resource,” Gawell said. “If all of that is off the balance sheet, it is going to be hard to get the project done. And during the financial crisis, what we’ve heard is that the level of risk lenders are willing to take is pretty close to zero.”

“As you get further along, and you have more resource proven,” agreed Marathon Capital VP Sid Sinha, “you can go to the bank and construction finance lenders and get financing. When you go operational, you can do some of that financing with long-term capital.”

What will positively impact development, Gawell said, is getting lenders to understand the risk. One potential investor said he was attracted to geothermal when he saw its long-term, steady payout. “But he had to get past the risk,” Gawell said. “As a community, we have not involved lenders at that level.”

“As opposed to solar and wind, geothermal is 24/7,” Sinha said. “It runs at 95 percent capacity factor, it is baseload power that utilities like and, from an investment standpoint, it gives pension funds and other investors a way to diversify.”

When Senate Energy Committee Chair Senator Ron Wyden (D-OR) recently called geothermal a forgotten resource, said MidAmerican Energy lobbyist Jon Weisgall, he meant that geothermal has not been able to benefit from federal tax benefits like solar and wind. Geothermal got access to the production tax credit (PTC) in 2005. But wind, as a more nimble resource, has been able to take greater advantage of the PTC.

The industry needs to work more closely with government to find some kind of method -- a tax program, a loan guarantee program or something else -- to de-risk some of the upfront costs.

"The utility side of MidAmerican," Weisgall added, "can pencil out the cost of a wind or solar project more readily than we can a geothermal project and we have been able to begin and finish wind projects in a much shorter time than geothermal projects."

“In a conventional geothermal project development,” he continued, “you can drill an exploratory well, you can drill a production well, you can drill two or three of those, you can find yourself out $15 million or $20 million and have nothing to show for it.”