These are volatile, exciting and frustrating times in solar.

Shayle Kann, senior VP at GTM, kicked off last week's Solar Summit by confronting the realities of the solar industry today. But he also gave some compelling arguments for optimism in this maturing marketplace.

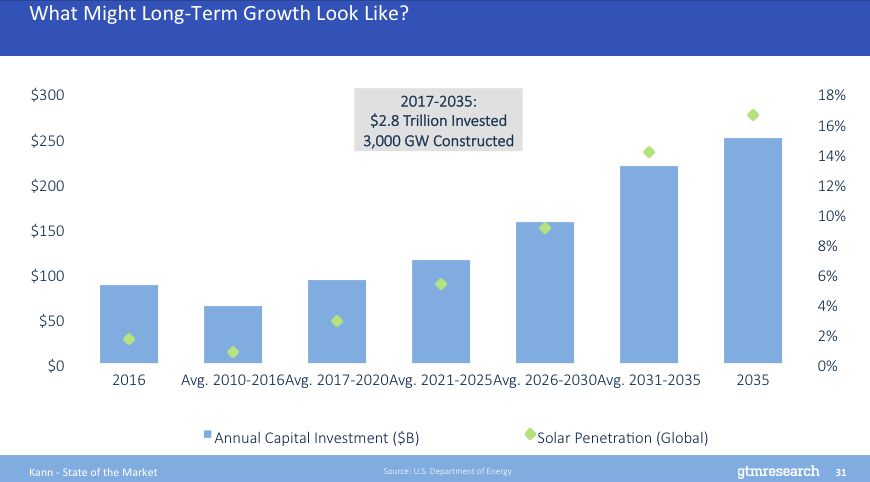

In Part 1, Kann looked back in solar history and focused on the market today. Here in Part 2, he forecasts the ways this market can, in the long term, reach thousands of gigawatts installed and trillions of dollars invested.

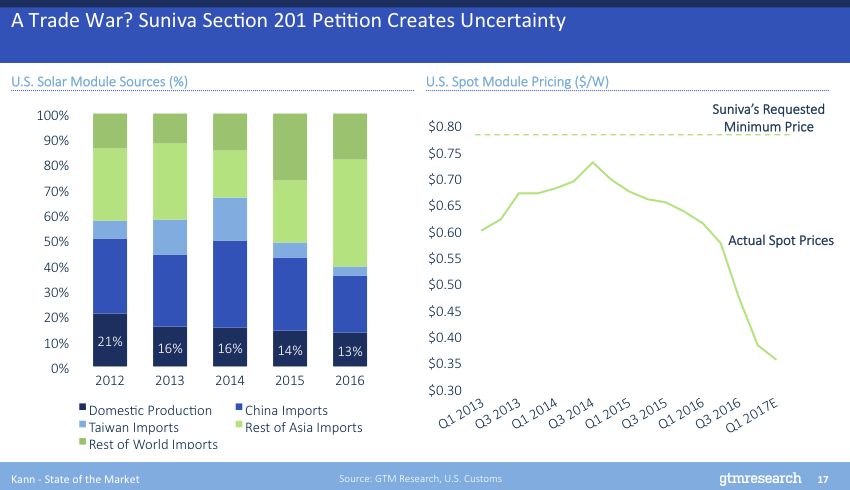

But first: A trade war?

The entire industry is very worried about Suniva's trade petition that could dramatically increase the price of imported cells and modules. Kann gave some reasons to be nervous.

"We estimate that about 13 percent of the solar modules that were installed in the U.S. last year were manufactured in the U.S. That means that about 87 percent of the market could potentially be subject to whatever remedies are imposed, if indeed they are imposed. So, it could have a big impact on module supply in the U.S. And indeed, it could have a big impact on pricing. And Suniva is requesting a 78-cent-per-watt minimum price in addition to a 40 cent-per-watt tariff. So imagine that pricing just goes straight to that minimum, the bare minimum price. That would be pricing levels we have not seen in the U.S. since 2012. That obviously could have a big impact on the economics of solar in the U.S."

"It's entirely possible that the numbers could be different or that nothing could happen. So let's set that aside and assume that solar does continue to get cheaper and cheaper, and that it becomes the least-cost resource for kilowatt-hours in much of this country and much of the world," he said.

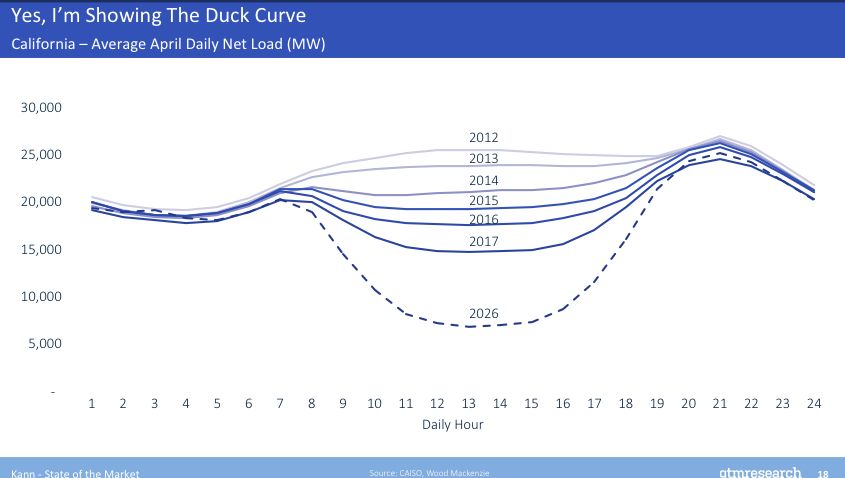

Why a duck?

The duck curve in California is becoming more pronounced, said Kann. It's a sign of things to come in other states as solar grows.

"Most of the time, you're used to seeing a theoretical version of the duck curve that the California ISO put out a few years ago. This is real data from an average April day -- and it's a real duck curve. And I think the reason we're talking about it is that it represents a coming set of challenges that we're going to have to figure out how to deal with as solar penetration increases as a result of solar becoming the most talked-about resource."

"It's worth noting that we talk about the duck curve a lot, and it is largely a California phenomenon, because California has the highest penetration of solar anywhere under the sun. A decent benchmark for when you have to start thinking about this kind of challenge is, roughly speaking, when solar gets to about 10 percent of electricity load. Then you start to see the duck curve phenomenon.

"Our forecast calls for solar penetration nationally of a little over 2 percent last year to about 5.5 percent -- so that's a dramatic increase in the year 2022. But it's going to be relatively concentrated among the major solar states, which means you still aren't going to have a ton of states that are facing a duck-curve challenge," he said.

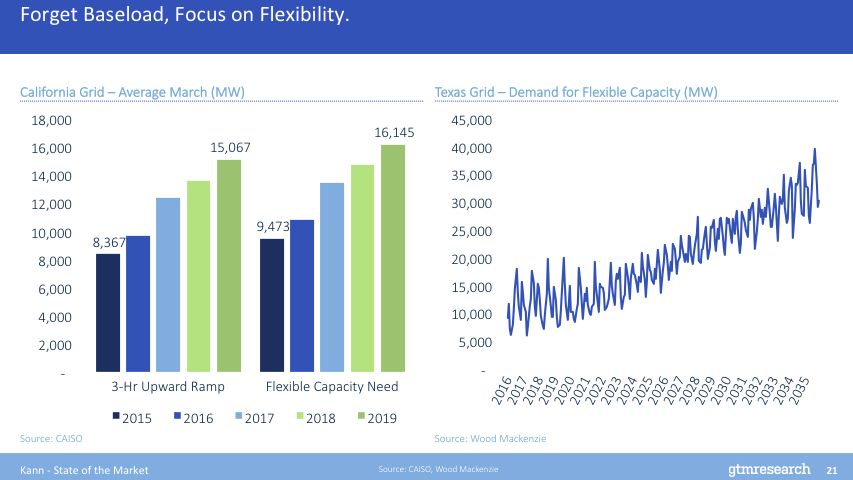

Flexibility is the key

With Energy Secretary Rick Perry targeting solar and other distributed resources as a potential threat to the grid, flexibility and reliability are becoming increasingly important.

Kann said, "'Flexibility' is a word that has started to proliferate in electricity circles, and I think it's going to become a buzzword for the next few years."

Competitive solar over the next 10, 20, 30 years

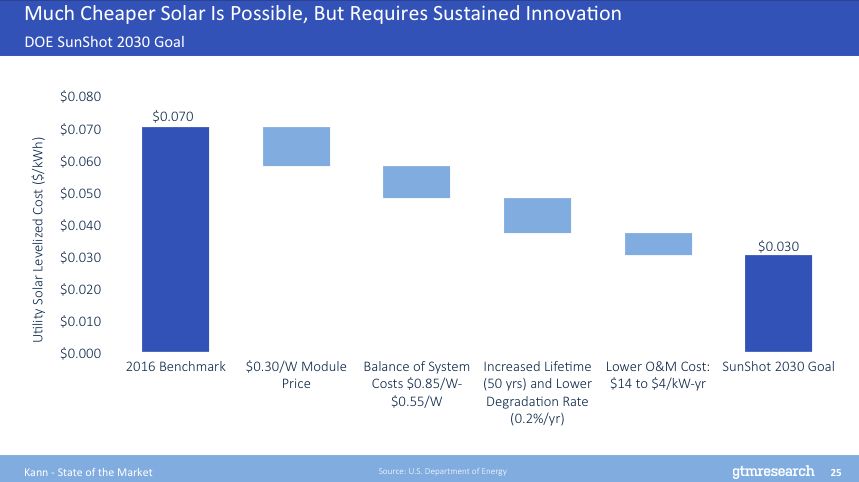

Kann pushed back against the notion that "once we hit grid parity, we're done." He argued that the more solar you put on the grid, the less value it's going to have on its own as it saturates the wholesale markets -- and that means that it has to continually get cheaper. So solar has to keep coming down in cost in order to counter the value deflation effect.

"How do you do that?" he asked.

According to the DOE, the way you get there is by reducing panel costs down to 30 cents a watt (without import tariffs), reducing balance-of-system costs by 30 cents a watt over that period, and by deploying 50-year lifetime solar content with 0.2 percent per year degradation.

But the duck-curve problem still has to be solved. Kann said this can be done with:

- Expanded grids: "This is one of the solutions that the Southwest has been looking at, the West in general -- the energy balance market. Basically, the wider your geographic array through which you are trading electricity, the better off you are. The more resources you have within your trading area, the better off you are. The more diversity of your resources, the easier it is to manage the peaks and valleys of your given resources, including solar and even wind."

- Traditional flexibility: "I think there's one bucket of solutions for the flexibility challenge that you might call traditional resource flexibility capacity. Natural gas is currently our most flexible natural resource that can ramp up and down really quickly." Other traditional flexible resources would include coal or carbon capture.

Kann spoke of the emerging suite of next-generation flexibility solutions such as energy storage, EVs, V2G and demand response.

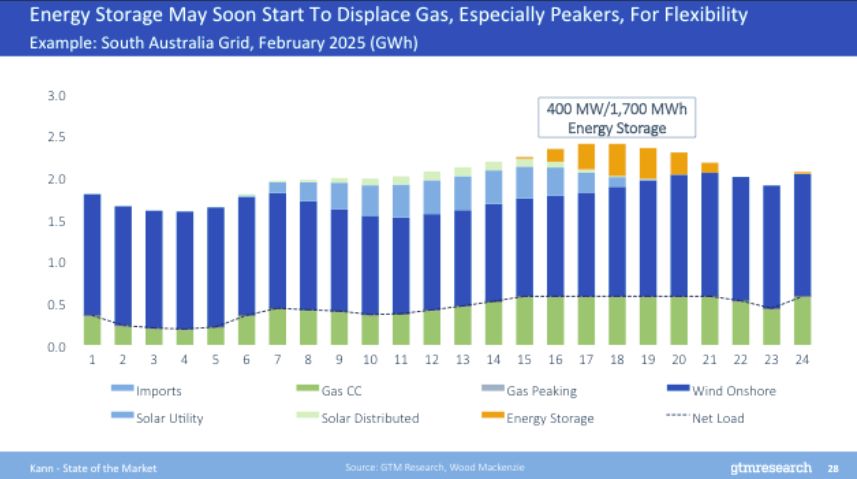

Storage Down Under

Kann used Australia as an example of how a bit of grid flexibility (in the form of energy storage) could go a long way.

"South Australia has added a lot of wind to the grid. A fair amount of solar as well, but really a ton of wind, and earlier this year they had some really painful blackouts on the grid, in part because they had so much wind, but also, there was a storm that shut down some of the lines -- and for some people in South Australia, it was 13-day blackout.

"So that made news in Australia, but of course it hit the broader public eye when Elon Musk tweeted it out, which is how we know things are important. So Elon Musk tweets about it and said, 'We need storage to solve this problem,' and now all of a sudden, there's a bunch of energy storage hitting South Australia.

"What if you wanted to use energy storage to replace the gas peakers and the imports? What would that take? It's actually not all that much. Because you have over-generation of wind during the day, you charge your energy storage with the curtailed wind, feed that into the grid in the evening -- and all it would take to completely displace the peakers and the imports is about 400 megawatts of energy storage, 4-hour duration mostly. Just by way of context, 400 megawatts of energy storage is not that much. There's already 100 megawatts getting built in South Australia now. To imagine that you get to 400 megawatts by 2025 is not crazy at all.

"And so as a result, you have no imports at all, and there's no need for peak generators. This is one of the reasons why I don't think it's crazy to imagine that gas peakers or peakers in general are not going to be a major resource on the grid before too long. Energy storage, and to a lesser extent demand response, can replace that need in many cases," he said.

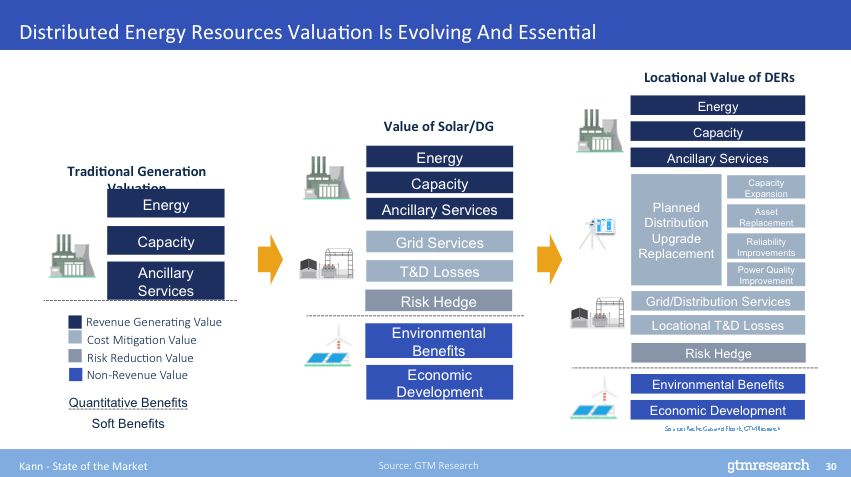

More carefully valuing distributed resources

Kann said, "Ultimately, you need to get to point where you're asking what the location of that resource is. This is where utilities can say, 'All right, I expect that I'm going to need to upgrade these substations at a cost of a million dollars. Can your portfolio of distributed resources defer the upgrade or make it so that the upgrade is not needed at all? Can we do it cheaper?'"

"This is the notion of non-wires alternatives for utilities. We've seen more of that this year already proposed to utilities in the U.S. than all previous years combined. This is starting to happen, but it does require more sophisticated methods of understanding how the grid should function in a role that is highly distributed," he added.

The prize: 3 terawatts of solar by 2035?

"There is still a fair bit of tumult amongst many solar companies, but I hope that we can all just step back and recognize what the prize is."

"Right now, we're at about 2 percent solar penetration globally; just imagine modeling this out, imagine solar getting to about 17 percent by 2035. That's not an unreasonable number, given the cost trajectory and opportunity and need for electricity generation globally. If that is true, we're going to go from a market that is...about $87 billion a year to about $250 billion a year. And over that period, we would install 3 terawatts, or 3,000 gigawatts, of solar energy -- that's about $2.8 trillion.

"The prize is enormous, and it's not crazy to imagine that this is how this market is going to play out," he concluded.