GE Energy Financial Services, venture firm CMEA Capital, Statoil Hydro of Norway, and Khosla Ventures just put up a $15.1 million second round of funding for permanent magnet generator (PMG) specialist Danotek Motion Technology, reaffirming that the PMG is the future of the wind turbine power train.

It is a heavyweight list of backers. All have strong renewables portfolios.

CMEA Capital, said partner Rachel Sheinbein, has been looking for wind investments, but Danotek is the first opportunity substantial enough to win funding. “We see that there is innovation needed in wind,” she explained, mentioning the potential for advances in blades and wind measurements and analytics as well as drivetrain technology -- “which is what Danotek addresses.”

PMG technology will become “the dominant wind turbine drivetrain technology,” Sheinbein said. “All the major manufacturers have some program, either internally or with a supplier.”

CMEA Capital put the 2010 wind generator market at three billion dollars, of which PMG technology accounted for seven percent, according to Sheinbein. The 2015 generator market is forecast to be five billion dollars, with PMG technology capturing just over 40 percent.

“What we design, develop and manufacture,” said Don Naab, Danotek’s President and CEO, is the generator and the converter.” It is, Naab said, “the heart of the turbine.”

Housed inside the nacelle, the bus-sized rectangle at the top of the tower to which the blades and rotor are affixed, the generator-converter mechanism translates the mechanical energy of the wind on the blades to electrical energy and “pumps electricity out to the grid.”

Danotek, Naab said, currently has a PMG high-speed (1000 RPM) mechanism in a 670-kilowatt Clipper turbine and a 2-megawatt DeWind turbine, as well as a medium-speed (350-to-400 RPM) mechanism in use.

In development is a low speed (134 RPM) mechanism with direct-drive capability. “The low speed and direct drive system can go either way and will be scalable from about five megawatts to eight megawatts,” Naab said. “It is 18 months to two years off.”

The lower the speed of the generator-converter mechanism, the bigger it is. PMGs make for big machines but they are also more efficient and reliable. “A standard double-fed induction generator [DFIG] may be 80 percent to 92 percent efficient,” Naab said. “A permanent magnet generator is typically 96 percent to 98.5 percent efficient.”

PMGs increase reliability over DFIGs because they have fewer moving parts. “That creates less maintenance needs up-tower,” Naab said. “And we’ve designed what bearings we use to be replaceable up-tower. Our competition isn’t there yet.”

Wind industry powerhouses Siemens and Goldwind use direct drives, which incorporate PMGs in their most advanced systems. Their PMGs are much larger than Danotek’s current high- and medium-speed technology.

Whether the expense of dealing with a direct-drive system along with PMG technology is warranted depends on the application. “An onshore, higher megawatt unit may be better served with a medium-speed instead of a direct drive,” Naab said, because it is accessible for regular maintenance. “Where you find more direct drives is offshore,” he explained. Having fewer moving parts is an expense worth incurring when maintenance and repair entails setting to sea and dealing with five- to ten-megawatt machines.

The direct drive platform Danotek is working toward will be “very scalable,” Naab said. “We don’t try to offer a standard. We offer something we can scale off to.” This gives Danotek’s turbine manufacturer-partners the opportunity to co-design and customize.

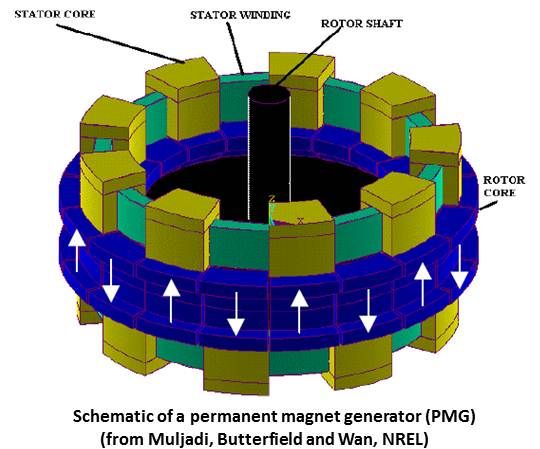

“What stays constant is how we derive the design of the rotor and stator,” Naab said. ‘We have a special recipe on our rotor-stator interface that gives us a uniqueness [relative] to our competition.”

The Switch, a Finnish company recently acquired by Massachusetts-based AMSC, is “a formidable competitor,” Naab said, but may have experienced a setback when China OEM [original equipment manufacturer] Sinovel, one of AMSC’s biggest customers, delayed some orders. There are industry rumors suggesting Sinovel may be planning its own PMG technology.

“We need to make sure,” Naab said, summarizing his take on the competition, “we have the appropriate differentiators from The Switch or Converteam or Ingeteam or Winergy.”

The renewed investment from round one investors comes, Naab added, because the company has "been able, in a relatively short time, to gain market acceptance with some OEMs and create a backlog of orders that validated the technology route we were on because it fit their roadmap.”

He mentioned in particular strong relationships with Clipper and DeWind. “We’re fitting right into where wind is going,” Naab said.

“The industry is moving toward more efficient and reliable drivetrains, and Danotek is going to lead the way,” CMEA Capital’s Sheinbein said.

The $15.1 million, Naab said, will carry Danotek well into 2012. It will be “a close call” whether more funding or revenues carry the company further forward because, he said, “the marketplace is funny right now.” Consultant forecasts, Naab explained, are worse than expectations he has formed from customer predictions. “I rely more on clients. They are going to be able to drive the markets because they build their own wind farms.”

In Naab's view, “The real key for a startup is, do you have a special sauce that can add value to the turbine and does the manufacturing community recognize it? And we’ve been able to find that with our rotor-stator interface.”