According to a filing on Friday, GCL-Poly, a Chinese firm that produces solar polysilicon and wafers, as well as develops solar farms, bought SunEdison's once billion-dollar business for $150 million. UBS was a financial advisor to GCL in the deal.

GCL lists the "target assets" as "solar materials businesses including relevant platform, people, intellectual property processes and advanced manufacturing technology...to (i) enhance its research and development on electronic grade granular polysilicon on FBR technology; (ii) increase its production capacity of electronic grade granular polysilicon; (iii) substantially improve pulling efficiency and quality of its single crystalline ingots production with SunEdison’s proprietary technology; (iv) reduce the production costs of single crystalline ingots and electronic grade granular polysilicon with SunEdison’s advanced manufacturing technology; and (v) maintain the cost advantage and competitiveness the Group currently has in producing solar materials by securing the relevant patents."

According to the document, the sellers are listed as SunEdison, SunEdison Products Singapore, MEMC Pasadena and Solaicx.

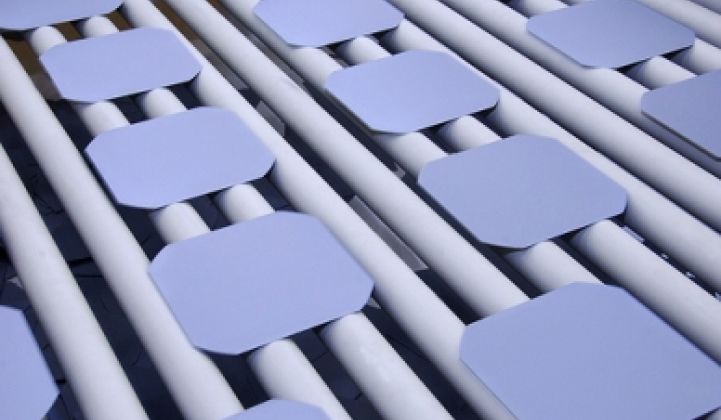

MEMC acquired Solaicx for $66 million in cash, plus the potential for $37.6 million more, back in 2010. Solaicx developed continuous crystal growth manufacturing processes to produce high-efficiency monocrystalline silicon wafers. Solaicx's Continuous Czochralski ingoting process was suited for MEMC's Fluidized Bed Reactor.

Benjamin Attia, GTM Research solar market analyst, notes, "GCL-Poly has a solar materials arm, and SUNE's CCZ and FBR processes are cutting-edge, promising stuff -- and totally proprietary."

GCL-Poly had strong shipments and revenue in the first half of 2016

GCL is also looking to bid for SunEdison’s controlling stake in TerraForm Power. According to Bloomberg, "TerraForm Power has a market valuation of about $1.6 billion, making it SunEdison’s most valuable standalone asset." Hedge fund manager D.E. Shaw is also considering a bid, as is hedge fund Appaloosa Management, along with asset manager Brookfield Asset Management. "SunEdison is also considering selling its shares in TerraForm Global, which has a market capitalization of $630 million," according to Bloomberg News.

SunEdison filed for reorganization under Chapter 11 of the U.S. Bankruptcy Code in the Bankruptcy Court for the Southern District of New York in April. The SunEdison YieldCos, TerraForm Power and TerraForm Global, were not involved in the filing. The company also secured commitments for $300 million in new debtor-in-possession financing from a group of first- and second-lien lenders to keep the company afloat during the restructuring.

For a short period of time, SunEdison was the largest renewables developer in the world

According to GTM Research's U.S. PV Leaderboard, SunEdison had been a consistent top-five player in the non-residential market, which includes both private- and public-sector projects. SunEdison was originating portfolio deals with Fortune 500 customers, as well as acquiring projects from local developers to provide PPA financing -- eventually flipping the projects into its YieldCo, TerraForm.