In April we reported that flow battery aspirant EnerVault was "seeking new owners" and going through "a company restructure." Those terms are signals of a company going through hard times.

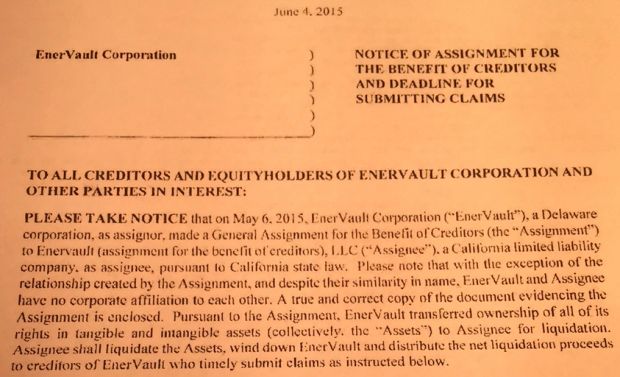

Earlier this month, persons close to the deal sent GTM a copy of the "Notice of Assignment for the Benefit of Creditors" document indicating the liquidation of the storage company's assets.

Flow batteries convert chemical energy into electricity by pumping electrolytes through a stack of electrochemical cells. The technology offers longer-duration energy storage than do sealed batteries and comes in a variety of chemistries. EnerVault's flow battery used iron-chromium electrolytes. As Senior Editor Stephen Lacey reported, the firm claimed its chemistry was safer and less acidic than vanadium and less expensive than other chemistries being developed.

Despite that claim, vanadium seems to be the predominant chemistry in the crowded flow-battery field, which includes RedFlow, Sumitomo, ZBB Energy, Prudent Energy, Gildemeister, UniEnergy, Primus Power, Imergy, EnStorage and ITN.

Last week Jeff St. John reported on the single largest order yet received for flow batteries when SunEdison ordered 1,000 redox flow units from Imergy. The batteries are to be delivered over the next three years for deployment in India, where they will store solar-generated electricity for off-grid consumers and businesses.

Imre Gyuk, DOE Energy Storage program manager, told GTM at last month's Energy Storage Association meeting in Dallas that he sees the industry in a "gradual move toward energy systems. We have shown that frequency regulation can be cost-effective, but what is really needed is peak shaving, load management, etc. That suggests flow batteries."

I keep hearing that the energy storage market is now like the solar market was six to eight years ago. I would agree -- in that we are due in for a wave of promises on new technologies that never materialize as dozens of companies fail in a venture capital/public relations/energy analyst hangover. So, yes -- I believe storage will be like the solar industry in that respect.

I would also suggest that lithium-ion batteries will parallel the role of silicon in the solar market as the dominant technology in volume, performance and price -- with a few notable exceptions. Perhaps flow batteries might be that exception in the energy storage market.

Founded in 2008, EnerVault had gained more than $24.5 million in funding from investors including 3M, Total, Mitsui Global Investment, Oceanshore Ventures, and TEL Venture Capital. A now presumably orphaned DOE demonstration project in Turlock, California was designed to provide 250 kilowatts of power for four hours to Pacific Gas & Electric; it was funded with $4.7 million in stimulus assistance.

A storage tank is installed at EnerVault's final deployment in Turlock, California. Image credit: EnerVault