Historically, vertically integrated solar cost leader First Solar has executed well on its growth plans and technical goals amid volatile global solar markets.

That's why First Solar's 2016 guidance and outlook for 2017 serve as a bellwether in these times of policy and regulatory uncertainty in the U.S. solar industry. (The firm has a reputation for setting conservative guidance, and the lumpy nature of a project-based business doesn't always make that easy.)

The company announced its full-year 2016 financial guidance.

- First Solar's 2015 guidance calls for 2.8 to 2.9 gigawatts of shipments, with only slight growth in the 2016 guidance to 2.9 to 3.0 gigawatts shipped.

- Net sales of $3.9 billion to $4.1 billion versus 2015 guidance of $3.5 billion to $3.6 billion

- Earnings per fully diluted share of $4.00 to $4.50

- Ending 2016 with net cash of $2.0 billion to $2.3 billion

The full financial guidance is as follows:

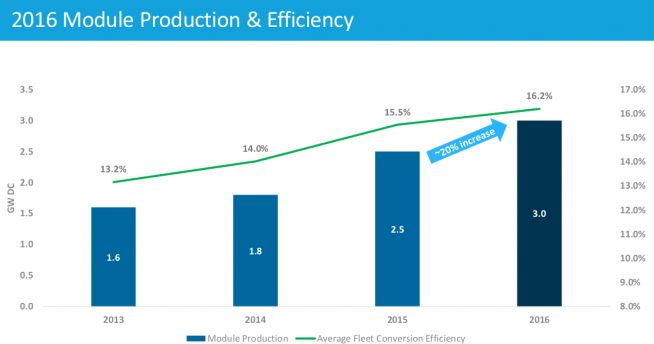

Production and efficiency

During the call, CEO Jim Hughes said, "In 2016, we expect module production of nearly 3 gigawatts, which represents an increase of almost 20 percent from the current year. The approximately 500-megawatt increase in module production as a result of higher conversion efficiency improved throughput and a full year’s output from two additional lines of capacity, which we began ramping earlier this year."

Hughes added, "We expect our full fleet to average around 16.2 percent conversion efficiency in 2016. [...] Our lead-line efficiency next year will remain at the current 16.4 percent conversion efficiency level through most of the year. As we exit 2016, our lead-line efficiency is expected to run slightly above 17 percent as we roll out our next round of efficiency roadmap improvements."

The Investment Tax Credit and solar in the U.S.

First Solar CFO Mark Widmar noted that "a key assumption underlying our financial guidance is that the 30 percent ITC could step down to 10 percent as scheduled under current law at the end of 2016. To the extent that there is a commenced construction modification or an extension of the 30 percent ITC, this could impact the guidance we are providing today. [...] Notwithstanding the 2016 impact, if a change occurs, it would have a net benefit over the period affected."

Hughes said, "I think the only guidance I can give you is that it continues to be an uncertain and wild ride with the political process in D.C. The reports that we are getting change day to day and hour to hour. There continues to be the possibility of no change and the stepdown [occurring] in 2016. There continues to be the possibility of a bill that would only provide commence construction, and there remains the possibility of a bigger...more comprehensive package that provides a phase-down extension of both the PTC and ITC, along with commence construction. Again, I am not good in handicapping Washington, and I am not going to try to. I do think that we will have an outcome somewhere [in the December 15 to 18] timeframe."

Hughes added, "We see lots of asset-acquisition opportunities, [more] than we have over the last several years. We will take a hard look at them. We have to believe that we can add some value and find a reason that it's going to be accretive and attractive to us; sometimes we do, and sometimes we don't. But there is an increasing volume of assets for us to [look at]."

As for 2017, Widmar said, "We continue to feel relatively positive; we continue to feel that we’re going to see more demand in the U.S. than we originally anticipated. It will clearly be down year-over-year."

Financial analysts weigh in

Oppenheimer equity research reports, "As FSLR continues to judiciously manage its business, we expect investors to be somewhat disappointed in 2016 guidance, which was in line with consensus. We note the company has a history of guiding conservatively and of accelerating project timelines. We would not be surprised to see it deliver results at the high end of guidance or above in 2016. For now, we adjust estimates in line with guidance and believe the story will evolve meaningfully as resolution on the U.S. investment tax credit (ITC) expiration becomes clear."

"We see FSLR regaining the mantle of solar’s cost leader and being able to extend that lead. We anticipate the company will be able to outbid peers on a price basis, in part aided by low-cost capital from its YieldCo CAFD, and still see expanding project margins, but are somewhat cautious on the mix shift becoming too heavily weighted to module sale."

Credit Suisse: "2016 margins below our expectations, tepid commentary on 2017 likely met with disappointment."

UBS reports, "While we remain more sanguine on prospects (particularly for a 5-year extension), solar stocks have begun to move meaningfully ahead of a potential deal. We note resi players, like SCTY, have been disproportionately impacted, only reiterating doubts on their outlooks without such an extension. We suspect a more likely commence construction deal would be most positive for FSLR and SPWR."

"Importantly, management remained constructive on the ’17+ outlook, emphasizing confidence in continued volume growth and initial contracting success, committing to maintain a 1:1 book-to-bill ratio in ’16 to emphasize the opportunity, also still within its 15%-20% range."

Baird commented, "FSLR provided 2016 guidance which had lower revenue and gross margin than our/consensus estimates, but higher EPS. Importantly, FLSR provided its strategic plan for 2016, which includes a continued ramp in module production and efficiency, a focus on achieving a book-to-bill of >1, and plans to expand in international markets."

Avondale writes, "FSLR is among the companies most levered to potential progress on the ITC this week."

EnerTuition at Seeking Alpha suggests, "Management appears to be concerned about 2017 demand, and given its conservative approach to adding capacity, is not willing to increase the production guidance until it can be certain about 2017 demand. Management appears to be planning for a scenario where the ITC 'commence construction' clause gets rewritten in Congress, potentially pushing some of the 2016 project completions into 2017. And finally, management appears to be sandbagging guidance so that it can come back and exceed guidance late in the year as it has done in the last couple of years."

***

Guidance call transcript from Seeking Alpha.