First Solar is the largest solar module firm by market capitalization, the largest thin-film solar firm, and one of the largest solar firms by capacity, shipments, and certainly by cumulative profits. The company is in the cross-hairs of every other solar firm and continues to set the bar in terms of solar panel value and corporate performance.

What first Solar does in the next few years is important.

Which is why more than 200 people showed up to attend a presentation by Alex Panchula, First Solar's Manager of Performance Analysis, presented by the Silicon Valley PV Society chapter of the IEEE.

Last week we looked at the market issues that are compelling First Solar to innovate "beyond the module."

This week, we'll look at some of those innovations and some of First Solar's deployments.

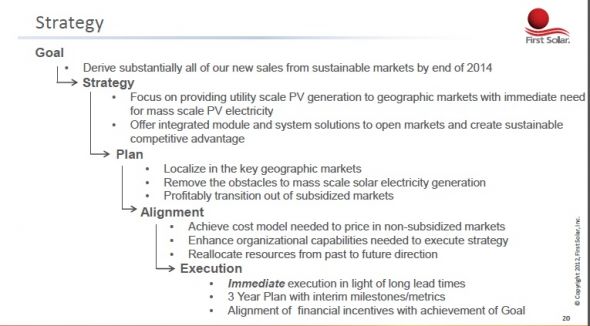

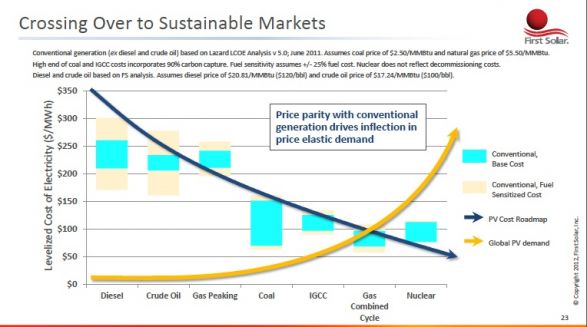

According to Panchula, First Solar must deploy 65 gigawatts over the next 10 years in order to thrive, rather than continuing to play whack-a-mole and chase subsidized markets. First Solar's goal is to get new sales from utility-scale power plants in sustainable markets by 2014. That means eliminating the dependency on subsidies and getting the price of solar down to levels where it is genuinely at grid parity at utility scale in developing nations.

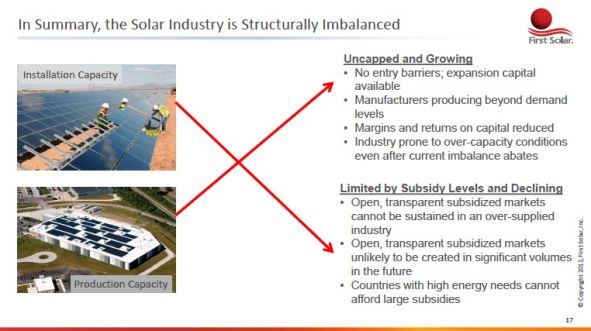

Panchula's presentation proclaims, "Our low-cost technology and captive U.S. project pipeline will help us remain profitable in a shrinking, structurally unbalanced industry."

The First Solar strategy is to go after "open markets" at utility scale. First Solar will not be addressing residential rooftops anytime soon.

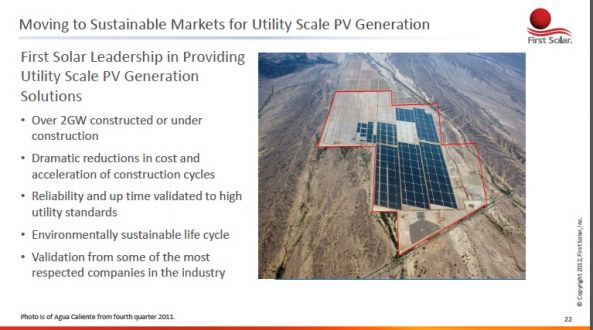

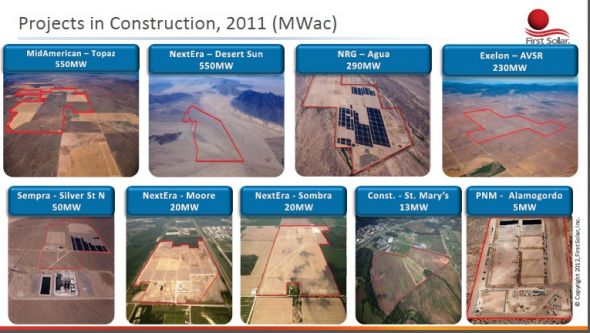

The slide below shows a photo of the Agua Caliente installation, a 290-megawatt (AC) project currently under construction. One of First Solar's cost reduction techniques is to build these massive projects quickly. At one point, Agua Caliente was being built at a rate of 5 megawatts per day. That's more than 50,000 panels per day and about 35 acres per day at peak construction.

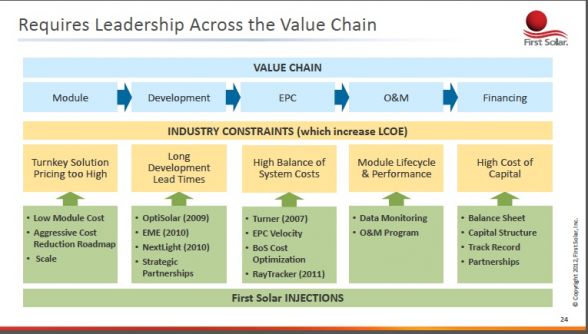

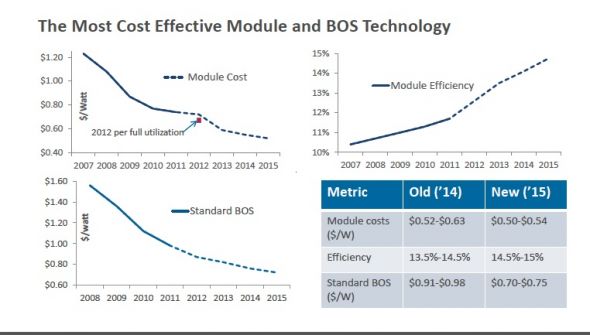

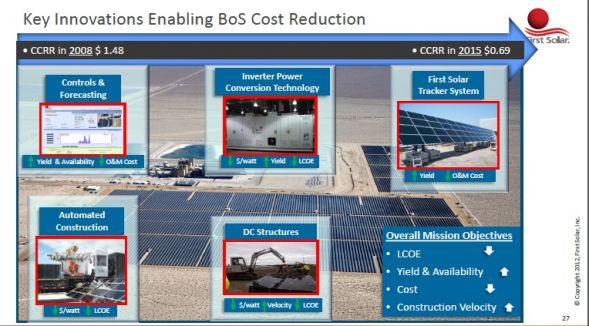

In "going beyond the module," First Solar looks to lower total solution costs in O&M, financing, balance of system, and cost of capital. Panchula remarked that the First Solar acquisition of RayTracker in 2011 was one of the moves to lower cost and optimize performance. Panchula spoke of more automated construction methods and lowering total BoS to $0.70 to $0.75 per watt, down from its current rate of $1.00 per watt.

Recent records for CdTe module efficiency of 14.5 percent and small cell efficiency of 17.3 percent show that CdTe performance still has some life left in it. Panchula is looking toward 14.5 percent to 15 percent module efficiency by 2015.

First Solar has more than 2 gigawatts of utility-scale solar power plants constructed or under construction.