First Solar, a vertically integrated thin-film solar EPC, had an analyst day on Wednesday that was full of industry-impacting announcements:

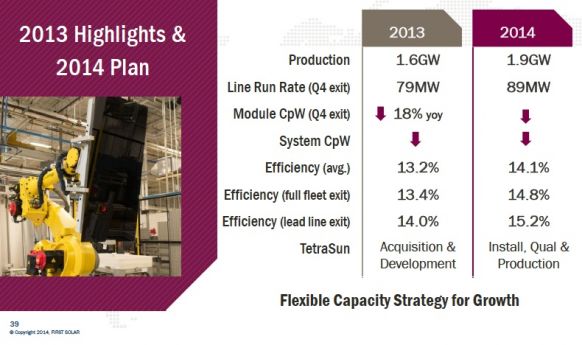

- First Solar has updated its module efficiency with a guidance that confronts average Chinese c-Si performance head-on by 2016

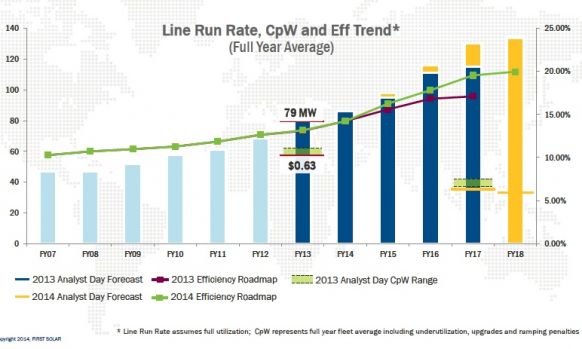

- It is speaking of a "split" manufacturing line that decouples front-end and back-end processes -- a markedly new approach for the firm.

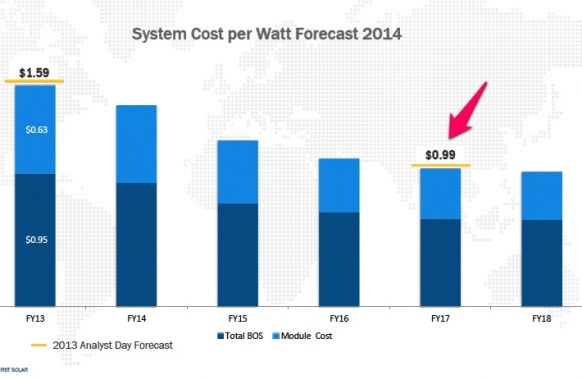

- The firm's new systems cost forecast is below $1.00 per watt by 2017.

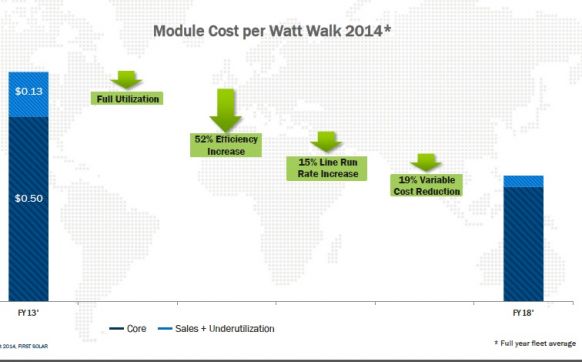

- The new module cost forecast is less than 40 cents per watt by 2018.

- More than 4 gigawatts of deployable capacity will be in place by 2017.

- First Solar bumped up the CdTe module efficiency record to 17 percent, from the April 2013 mark of 16.1 percent.

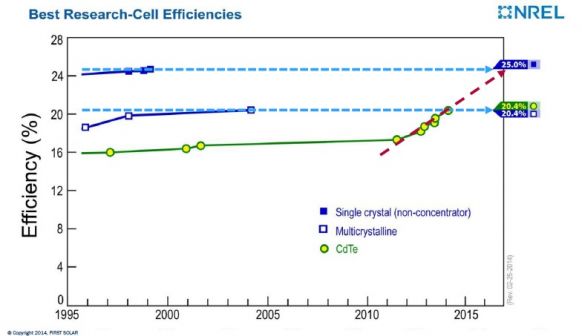

First Solar is extracting heretofore unanticipated performance and cost metrics from the cadmium-telluride materials system. Raffi Garabedian, First Solar's CTO, and his team, along with a little help from the acquired General Electric CdTe IP, is taking CdTe performance up the NREL efficiency slope line at breakneck speed. (Garabedian will be speaking at the GTM Solar Summit in Phoenix next month. Learn more here.)

The company's stock price is up 20.5 percent to $69.40 per share.

Shyam Mehta, GTM Research's Lead Upstream Analyst, Solar, writes, "First Solar's Analyst Day saw it reaffirm its intention of setting new benchmarks for the solar industry, be it in technology, costs, or megawatts of solar deployed, as it has repeatedly done in the past. Its updated module efficiency roadmap is particularly impressive and is the fulcrum upon which successful execution of its aggressive targets rests. While solar companies are in the habit of providing ambitious guidance, there is reason to be optimistic about First Solar's prospects given that the company has a consistent history of beating expectations. Since First Solar's ability to participate in the two largest markets in the world -- Japan and China -- is extremely limited and with the uncertain future of the U.S. utility solar market in a post-RPS, post-ITC world, the key challenge ahead for the company is in winning large volumes of utility-scale solar projects in currently small-volume markets such as the Middle East, Latin America and Southeast Asia."

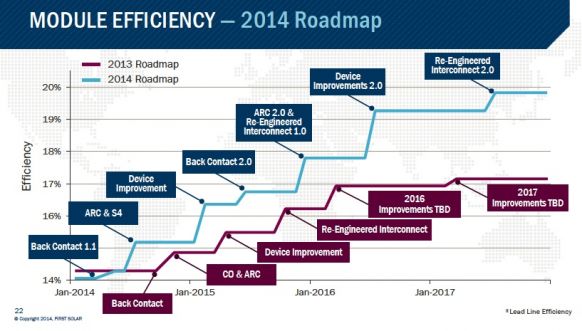

New efficiency roadmap

-

First Solar asserts that it can equal efficiencies of average c-Si modules by the end of 2015.

-

The company believes it can hit ~19.5 percent efficiency in 2017 (that's up from a previous target of 17.2 percent).

-

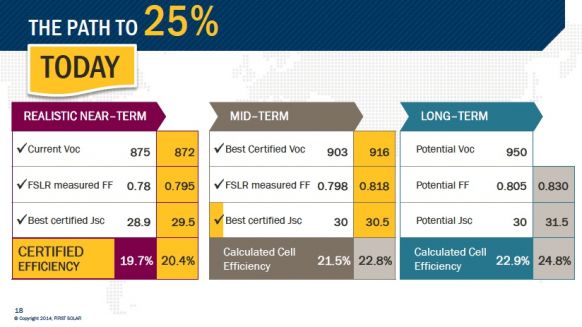

The firm also sees credible long-term paths to 23-percent-efficient and 25-percent-efficient CdTe cells.

New cost roadmap

First Solar remains the industry cost leader despite the fall in polysilicon prices and China's trade practices. First Solar asserts that it can get below $1.00 per watt in total system cost in 2017, a 35 percent reduction from 2013. This will be driven by balance-of-system and module efficiency gains, as well as trackers and incorporating GE’s inverter. If First Solar can hit the 37 cents per watt target by 2017, it can stay ahead of the c-Si competition.

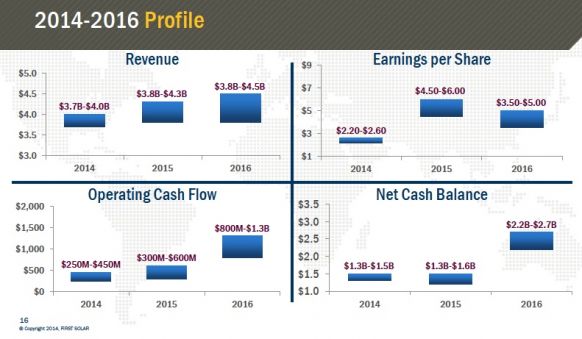

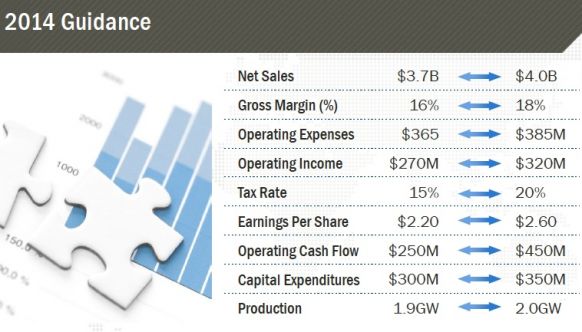

FBR Capital Markets and Baird note that guidance for 2014 was below estimates and consensus, but 2015 and 2016 surprised to the upside. Baird notes, "We think [First Solar's] balance sheet strength relative to its competition will play an increasingly important role in winning new business, particularly as the ability of its Chinese competitors to avoid bankruptcy remains in doubt."

First Solar provided 2014 guidance of $3.85 billion in sales at a 17 percent gross margin, while expecting 2015 revenues of $4.05 billion.