First Solar had mixed news during its third-quarter earnings call. The solar manufacturer and project developer missed its revenue target but beat its margin target. The company lowered its revenue guidance but raised its gross margin guidance. Some of First Solar's misses can be attributed to the accounting methods used for recognizing revenue on its enormous solar energy projects.

Financial highlights

-

Net sales: $889 million, up $345 million from Q2 2014; analysts expected revenue of $1.049 billion.

-

First Solar logged a profit of $88.4 million in Q3 compared to $195 million a year ago.

-

Cash and marketable securities were $1.1 billion, net cash was $0.9 billion. These figures give First Solar one of the strongest balance sheets in the solar industry.

-

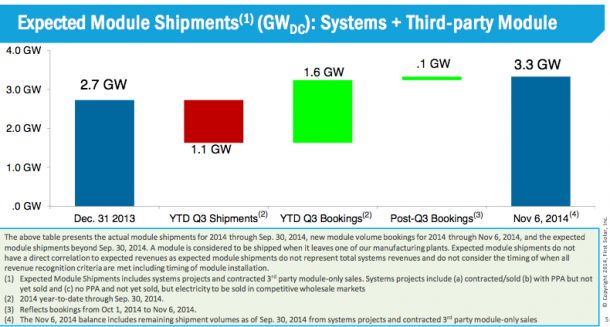

The company had 521 megawatts (DC) of new bookings and year-to-date bookings of 1.7 gigawatts (DC).

Earnings calls in the solar business involve net present value, GAAP gross margin, and timing of revenue recognition. It's an accountant's paradise with barely a crumb for the engineers. But vertically integrated First Solar offered a bit of a glimpse into the efficiency growth of its cadmium-telluride solar panels.

Efficiency gains in cadmium-telluride PV panels continue

In 2011, First Solar's module conversion efficiency was 11.6 percent.

Today, First Solar noted that its full fleet average conversion efficiency for the third quarter was 14.2 percent. Next quarter, First Solar expects its full fleet to average 14.4 percent conversion efficiency, somewhat below its analyst day prediction. The lead line at First Solar was averaging 14.6 percent last month.

During the conference call, First Solar's CEO noted that "recent pre-production runs of significant volume incorporating our latest device improvements have resulted in conversion efficiencies of up to 15.9 percent." These improvements are not scheduled to be deployed across the fleet until 2015.

The thin-film solar module builder and developer noted that its module manufacturing cost continues to fall with a "fleet average cost per watt excluding utilization below $0.40 per watt. Note this includes freight, warranty and EOL cost as well." The company continues to be a cost leader -- competitive with the silicon competition and aiming for a cost per watt of less than $0.37 by 2017.

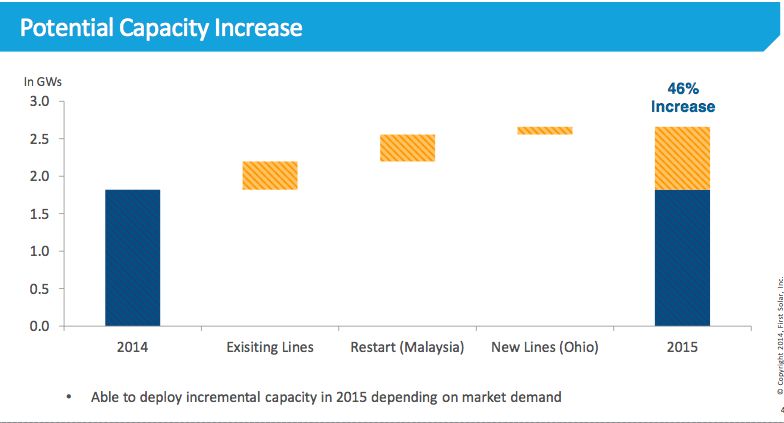

Capacity additions

First Solar will increase its production capacity by 46 percent to meet new demand driven by international projects and the imminent expiry of the 30 percent Investment Tax Credit. The firm has restarted mothballed lines at its Malaysian facility, adding more than 360 megawatts of capacity in 2015. More lines totaling 100 megawatts will be added at First Solar's Perrysburg, Ohio factory next year as well.

YieldCo pressure

It seemed as if every analyst on the earnings call asked the First Solar executive team about the company's YieldCo plans.

The CEO responded, "Finally, turning to the often-asked question of YieldCos. The company has determined that we are not prepared to file a registration statement and pursue a listed yield vehicle at this time. However, we have also determined that the ownership and operation of whole or partial interest in select solar generating assets does have a role as a component part of our overall business model. We will continue to develop generation assets in the U.S. and select other markets, and at times we will retain either a whole or partial interest in such assets."

He added, "We do not feel that we are missing either gross margin opportunities or market share capture opportunities because we don’t have a YieldCo today. As we have consistently said, we’re self-developing projects, and those projects continue to be lucrative assets for us. We are keeping those projects on our balance sheet through the commercial operations date, and in certain circumstances we are retaining an interest in those projects where we think it makes sense."

Ben Kallo of Baird Equity Research expected a YieldCo decision, writing, "We believe FSLR is well positioned to launch a YieldCo given its strong balance sheet, which could allow it to acquire projects under development, expand its pipeline, and hold projects. That said, we believe FSLR could pursue a 'HoldCo' or other strategy to increase project economics, which we would also view as a positive." Kallo also notes, "While U.S. projects with favorable terms will help support margins in the near term, FSLR's project pipeline will be replenished at lower prices and margin profile will shift as it transitions to an EPC model. FSLR estimates it will have to price systems at a range of $1.40-$1.60 per watt in order to enter future unsubsidized markets, and it is targeting a long-term gross margin metric of 15 percent to 20 percent."

First Solar has claimed that it is bidding on PV projects with partners and is forming partnerships with other EPC providers.

SunPower, First Solar's closest peer, is charting a similar course on YieldCos.

The ITC and 2017

The CEO noted, "The potential...step-down of the Investment Tax Credit in the United States market at the end of 2016 continues to pull demand forward, and so we want to maximize our ability to capture some of that demand. In addition, a number of our international markets are performing very well, and we continue to see demand begin to emerge and manifest...in those markets." Hence, the capacity expansion.

But he added, "I will say that I think we do have a note of caution about the overall market position as we exit 2016 and move into 2017. The demand that we're pulling forward into 2016 broadly...we think will result in the slowdown in '17....but you can't ignore the fact that on a global basis, there are a number of markets that look like they could see a decline over the same time period that capacity is getting added, so we are cautiously watching to make sure we are not headed into another period of excess capacity. So we’re cognizant that an argument could be made that there is some risk of that."

Bookings through the end of September were 1.6 gigawatts compared to shipments of 1.1 gigawatts during that time period. The single biggest booking in Q3 was Chile's 141 megawatt (AC) Luz del Norte project.

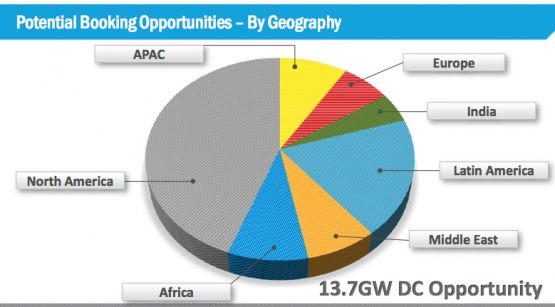

Market opportunities outside of North America have grown to 7.7 gigawatts, more than half of the total. This total has been raised recently, driven by opportunities in the U.S., Latin America and India.

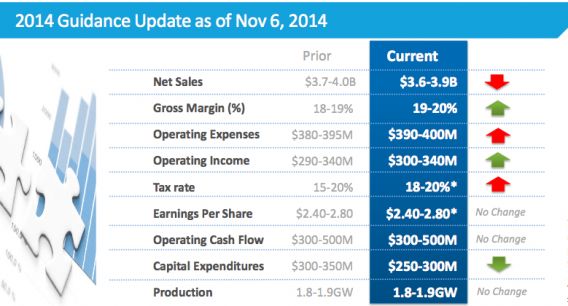

Guidance for 2014

Net sales guidance was lowered by $100 million to $3.6 billion to $3.9 billion. Gross margin was guided higher, "reflecting the improved pricing environment for self-developed projects and especially as it relates to our Solar Gen 2 project, which was sold in the fourth quarter."

Thanks to SeekingAlpha for the transcript of the call.