Etrion recently announced the delay of construction for the 8.8-megawatt Aguas Blancas solar park in Chile. The project was being developed in Antofagasta to supply power to an iodine mine owned by Atacama Minerals, under a fifteen-year power purchase agreement. As iodine prices have dropped, the mine has suspended operations.

Most of the offtakers for solar power in the northern part of the country are in a similar situation. Softer commodity prices, or even the threat of softer commodity prices, can cast a shadow over mining companies’ ability to sign long-term power purchase agreements.

So is this Etrion announcement a harbinger of things to come, or just a one-time fluke in a country with solid fundamentals for solar development and a huge potential market upside?

Mining and solar make an attractive match

Chile’s northern grid has three things every solar developer loves: rapidly growing demand, high marginal power prices, and some of the highest insolation levels in the world -- between 7 kilowatt-hours and 9 kilowatt-hours per square meter per day.

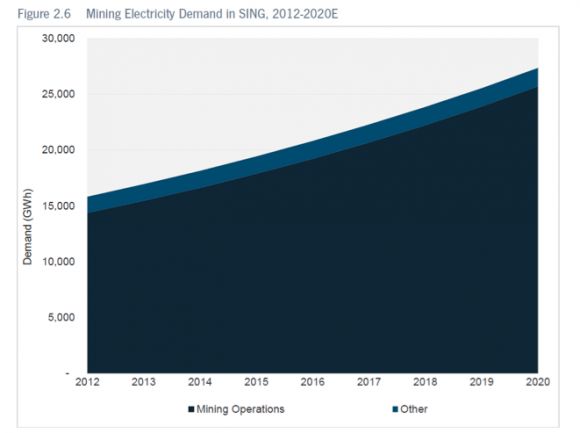

The vast majority of this rising demand will come from mining operations. This region produces most of the world’s copper and iodine, and it's a top producer of silver and gold, as well as producing a lot of iron, steel, and coal. Mining is essential to the health of the Chilean economy, with copper alone accounting for three-fifths of the nation’s exports and one-fifth of its GDP. As these mines grow and expand their operations, demand is on the rise.

Source: CNE and GTM Research

Mining companies are a key customer base for solar developers. Solar power purchase agreements are a way for mining companies to address rising demand and avoid paying high marginal prices on the spot market. On-site solar projects also ensure that the mines can continue operations without relying on the grid, a goal created in 2008 after rolling blackouts caused emergency shutdowns in South African mines. Solar developers can harness high insolation levels, increase output from their projects, and offer competitive pricing for their PPAs.

Etrion: A cautionary tale, or just bad luck?

Etrion’s solar woes can actually be traced back to the Fukushima disaster in 2011.

Japan is the number-two producer of global iodine after Chile, and the nuclear disaster caused a huge shortfall in supply. Prior to that point, Chile had been constraining production to keep prices high, but expected the new Algorta iodine mine to ramp up production in the wake of Fukushima. However, a variety of unexpected factors prevented that from happening, which in turn caused iodine prices to skyrocket to $97.5 per kilogram in June 2011.

With prices high, Chilean mines started operating at full capacity and considering expansion, including the Aguas Blancas iodine mine. In typical boom-bust fashion, increased production dropped prices to the $50-$60 per kilogram range in September 2013, and the outlook for 2014 is lower iodine prices. So Aguas Blancas is reducing operations, and definitely not expanding for the time being.

What is the lesson from all this?

Despite all the benefits from locking in solar power purchase agreements, mining companies are subject to the whims of commodity markets. The fluctuations in prices for gold, silver, copper, iodine, iron, steel and coal will all influence demand for solar power in the region. Mining companies are understandably hesitant to sign long-term take-or-pay power purchase agreements when they may have to suspend operations until prices rise again.

Yes, it’s complicated, but solar isn’t doomed

This isn’t a death knell for solar development in the country. However, it does imply that the offtaker market in Chile is more complicated than it appears on its face, and developers must find a way to address these circumstances in how they structure their contracts.

The benefit of power purchase agreements for solar developers is that they give long-term visibility into a project's cash flow that can be used to finance construction and operations. PPAs are often ten, fifteen or twenty years in duration. These contracts also have a fixed price, sometimes with an escalator built in over time.

In Chile, developers may have to design creative contracts that have shorter lengths, strike prices, no price floors, multiple offtakers, and so on. If these kinds of contracts can work anywhere, it’s Chile; the financing of merchant projects from SunEdison and SunPower show that the financial community considers pure spot market sales a viable way to generate returns.

Developers may be able to be more flexible in structuring PPAs if they know that financing is still possible with the spot market “backstop” for these contracts.

***

For more on the Chilean market, see GTM Research's Latin America PV Playbook.