Update 11:30AM November 8: Despite record highs in quarterly revenue and margin -- the price of Enphase shares have dropped to historic lows. The stock is currently down 20 percent and trading at $2.65 per share.

***

Enphase (Nasdaq: ENPH), the Petaluma-based solar microinverter firm, announced solid third-quarter financial results with a record revenue of $60.8 million, up 36 percent year-over-year -- at a record gross margin of 26.8 percent.

The firm sold 431,000 of its innovative microinverters in the third quarter, but lost $8.9 million. Losses in the second quarter were $11.4 million.

Enphase looks for Q4 to be between $52 million and $57 million and for gross margin to be 26.5 percent to 28.0 percent. Enphase also announced that it was accessing new and larger credit facilities.

MJ Shiao, GTM Research's inverter analyst, notes that Enphase continues to push costs down incrementally while keeping its ASP from falling as much as central inverter prices.

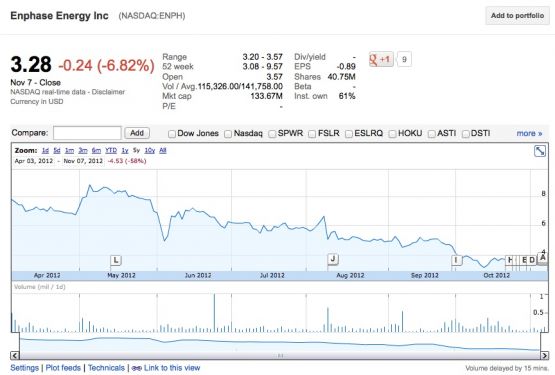

Enphase is growing its market and market share at a respectable clip. It's one of the few VC-funded cleantech companies to make it through the public window. But the stock market has not been kind to Enphase in 2012: its stock has been weighed down by uncertainty in the general solar market.

Enphase traded at $3.28 per share at market close November 7.

from Google Finance