How do you value the long-term benefits of grid-scale energy storage? That’s a hard question to answer, and not just because most of the next-generation storage technologies out there -- big batteries, compressed air systems, flywheels, or air conditioners, industrial motors, water pumps and other controllable loads that can “store” energy by doing their work at different times of the day -- are so new.

Indeed, the technical issues of connecting energy storage assets to the grid aren’t nearly as tricky as the economic and regulatory issues that stand in the way of energy storage optimizing its value once it’s connected. That includes making enough money to pay for itself and keep its owners and investors happy, of course. But it also includes the value to the grid, in terms of shaving peak loads, reducing instabilities from wind and solar power, and other such tasks.

Modeling that interaction is a pretty daunting technical task itself, and one well suited to the researchers at the utility-industry-backed Electric Power Research Institute. Indeed, EPRI has been working for years on these issues, with key stakeholders like the California Public Utilities Commission, which just launched its own groundbreaking proposal to add 1.3 gigawatts of energy storage to the state by 2020.

Last week, EPRI announced that it had taken its next step with the CPUC, by providing it an interesting piece of software called the Energy Storage Valuation Tool, or ESVT. Think of the ESVT as an energy storage modeling app, one that takes data and turns it into a measurement of value that can be fine-tuned by users like utilities, grid operators and energy storage technology makers and project operators.

“The CPUC wanted to look at a lot of different cases that their stakeholders had identified, but they didn’t have a tool they could [use] to analyze a large number of cases in California," Ben Kaun, senior project engineer at EPRI, said in a Friday interview. "We agreed to do that.” That led to the launch of the tool for users beyond the CPUC, which now includes a handful of utilities including Duke Energy and Sacramento (Calif.) Municipal Utility District, he said. (UPDATE: As the EPRI product abstract web page notes, the software doesn't come cheap, at $10,000 a pop, but it is available to buyers beyond its core utility membership, including the 30+ energy storage program funders that already receive access to it.)

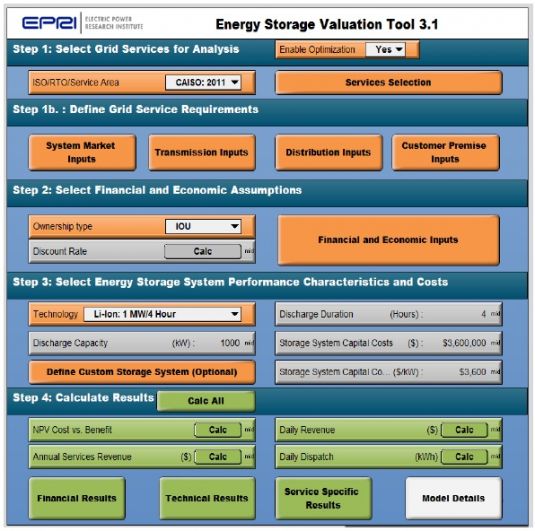

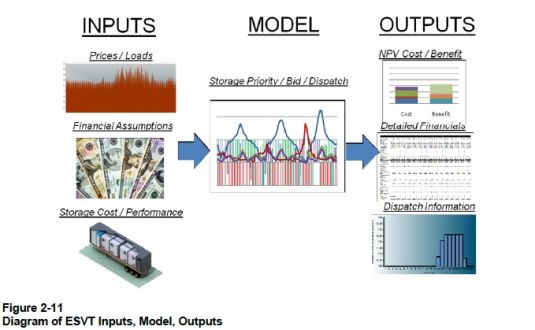

Here's the user interface for the ESVT, with the various links to guide users through the steps of establishing virtual energy storage projects in different parts of the country, complete with mapping and grid modeling to guide decision-making on a case-by-case basis or a system-wide scale. It then crunches all that incoming data to build models it can run through various scenarios to yield “direct quantifiable benefits, versus direct quantifiable costs, over the lifetime of the system,” Kaun said.

EPRI’s been doing energy storage research for years now, and its reports on the subject are great sources of data, both on dollars-per-kilowatt and kilowatt-hour costs for various different storage technologies, as well as the potential returns for the multiple functions they can provide, from millisecond-quick response grid balancing to long-term load shifting.

Its new research tool is built on that wealth of existing data and analysis, but it’s also built to encompass market structures or use cases that might not exist in the real world today, Kaun noted. For grid operators and utilities, it’s a good way to test the real-world potential of various technologies and business models to fit into existing market mechanisms, as well as to help model new programs or markets, which is what CPUC intends to do for California’s big three investor-owned utilities by next year.

“There is a lot of confusion about storage in the industry,” Kaun said. “It’s been hard to understand both its impact and its values. We’re working on coming up with a clear path” to standardizing that effort, he said.

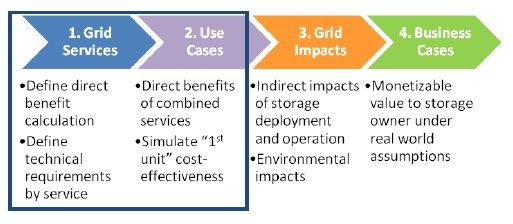

Step one is clearly defining all the services that can be provided by energy storage -- a long list -- and step two is building a model to represent individual use cases’ impacts on the grid and energy costs and benefits at large, he said. The third and fourth steps are deriving indirect economic and environmental impacts of energy storage deployments, and calculating the financial value to storage owners in real-world situations, respectively.

“At this analysis, we stopped at step two,” Kaun noted. “We went broad, we didn’t go deep -- but I think it’s deeper than we’ve gone before, and it’s fully transparent,” with the ESVT software built to allow users to add multiple new data inputs, as well as delve into all the different algorithms that go into crunching that incoming data. “There’s no black-box code here,” he said.

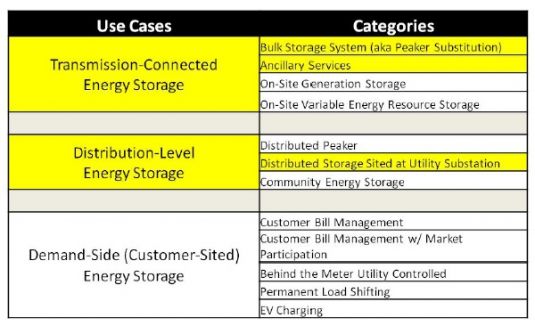

EPRI’s tool also takes into account the fact that energy storage can pay for itself in multiple ways at once, Kaun said. Take the “distribution energy storage” use case, which envisions lots of batteries installed at the distribution grid level. First, those batteries can help defer investment in bigger transformers or more power lines that might otherwise need to be made -- a use case that’s already been proven out by real-world storage projects in Texas, Hawaii and West Virginia, by the way.

Next, all those aggregated batteries can provide capacity to the system, in the same way that natural-gas-fired combustion or combined-cycle power plants, or solar and wind power farms, do today, he said. That’s usually measured in kilowatts and megawatts, and represents the ability to meet the grid’s projected needs over a long-term basis. Finally, once it’s deployed and up and running, the distribution energy storage can provide spinning reserves, frequency regulation, and other services commonly performed by “peaker” gas-fired power plants, or perhaps demand response, today.

Of course, there are limits to all the things a single energy storage system can do at once. In the aforementioned model, for example, all those batteries have been first and foremost pledged to the purpose of investment deferral, which generally means discharging at times when demand is at its peak, which defines just how hefty the system needs to be.

Even so, if properly managed, energy storage systems like these “could perhaps do double-duty,” Kaun said. For example, the system could be discharging when needed to keep the system stable, while also meeting the grid’s frequency regulation requirements at the time by minutely “fluttering up and down” that level of discharge from second to second, he said.

What about the critical measure of storage capacity? EPRI’s report released along with its ESVT tool notes that today’s energy markets and grid operations processes have a particularly hard time dealing with limited-duration energy storage, as measured in how many hours or minutes a system can deliver a set amount of megawatts or kilowatts. “Limited duration doesn’t necessarily mean limited value,” the report notes, “but it requires new planning and operational approaches to be considered to properly value energy storage.”

At the same time, some of the most potentially lucrative uses for storage, such as frequency regulation, also happen to require relatively short “bursts” of power. AES Energy Storage, the storage-focused subsidiary of U.S. energy company AES, announced this week that it’s building a 40-megawatt lithium-ion battery storage system in Dayton, Ohio to play into mid-Atlantic grid operator PJM’s frequency regulation market, and bankrupt flywheel company Beacon Power’s 20-megawatt plant in New York is still providing services to NYISO under new ownership.

For purposes like these, storage capacity isn't as critical a factor, compared to response time and ramp rate, Kaun noted. On these measures, batteries can indeed outperform peaker plants in many instances, even if they're only able to do so for short periods of time.