Dong Energy, a Danish oil and gas developer and distributor with a growing business in offshore wind, went public last week in Europe's largest IPO of 2016. Shares sold at above the midpoint of the guidance range, valuing the company at more than $15 billion.

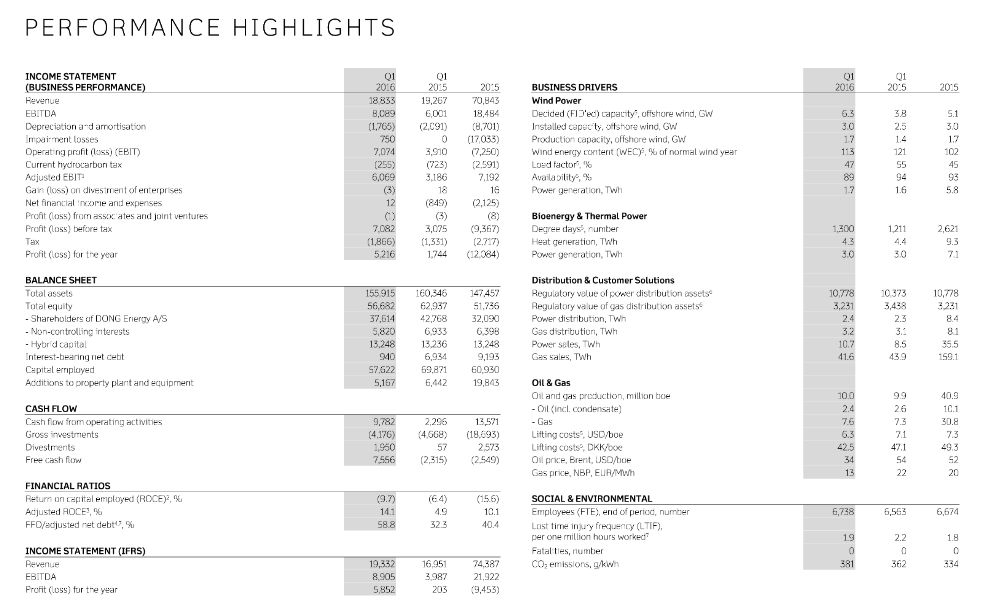

Dong had a profitable first quarter of 2016 but lost money on revenue of $10.7 billion in 2015. Its offshore wind business is growing, while its conventional power business has slowed.

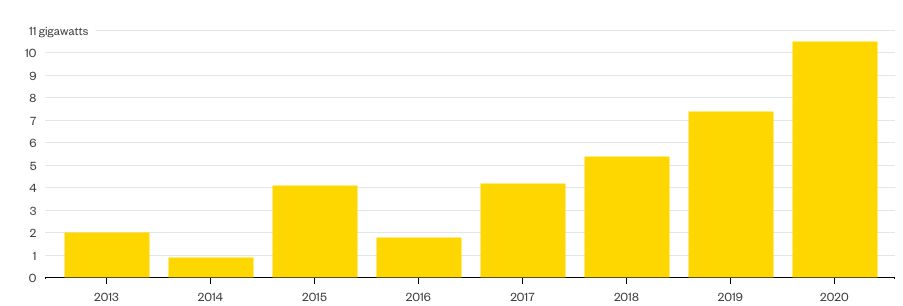

A National Renewable Energy Laboratory (NREL) report estimates the cumulative global offshore wind market at 11.8 gigawatts as of the end of 2015. Dong has built more than a quarter of these installations. (Compare that to the 27.5 cumulative gigawatts of solar photovoltaics operating capacity in the U.S. alone.)

FIGURE: Annual Offshore Wind Installation Forecast

Source: Bloomberg New Energy Finance

Dong is owned by the Danish government and Goldman Sachs; the Danish government still controls 50.4 percent of the firm following the IPO.

The terms of a Goldman investment in Dong "nearly led to a collapse of the Danish government in 2014, according to The New York Times. Goldman doubled its $1.2 billion investment in 2.5 years, "fueling criticism in Denmark that the previous government sold an 18 percent stake to the Goldman consortium too cheaply," according to Financial Times.

The company claims to produce "more than half of its electricity and heat from renewable resources."

Offshore wind is not cheap

Windpower Monthly notes, "At the median installed cost of $5,000/kW and a 9 m/s wind speed, generation costs are just under $192/MWh. Higher wind speeds are found farther offshore, but the installed and [operations and maintenance] costs are likely to be greater. With a 10 m/s wind speed, at the upper bound installed cost of $6,000/kW, generation cost is around $194/MWh. At the lower end of installed costs of $4,000/kW, costs really start to tumble -- falling from $200/MWh at 7.5 m/s to $150/MWh at 9 m/s."

But the European offshore wind industry claims, "With the right build-out and regulatory framework, the industry is confident that it can achieve cost levels below [$90]/MWh for projects reaching final investment decision in 2025, including the costs of connecting to the grid. This means offshore wind will be fully competitive with new conventional power generation within a decade."

NREL points out that "the majority of the land-based project cost (71 percent) is in the turbine itself, whereas the turbine makes up only 33 percent of the offshore reference project cost," and adds, "Offshore wind net capacity factor ranges from 30 percent to 55 percent."

One of Dong's projects, the 1.2-gigawatt Hornsea facility, will be the world’s largest offshore wind farm when completed.

A pioneer in offshore wind, Andrew Garrad, founder of consultancy Garrad Hassan, wrote in a 2014 report, “We have been there from the start and learned many lessons -- in design, project management, project certification, operations, maintenance and finance. But the single biggest lesson that we have learned is that cost reduction comes with volume and that volume comes with confidence. That confidence is being undermined by regulatory uncertainty, which is the biggest threat to our nascent industry today.”

FIGURE: Dong Energy Financial Performance, Q1 2016 (click to enlarge)

Source: Dong Energy quarterly report