More evidence of downstream solar industry consolidation and vertical integration came this week with Coronal Group's acquisition of utility-scale solar project developer HelioSage Energy.

Coronal Group, already in an existing partnership with Panasonic Eco Solutions, owns and operates a 100-megawatt portfolio of solar power plants in North America. The HelioSage acquisition adds a 320-megawatt (AC) contracted pipeline of projects to the Coronal stable, along with 22 employees being added to the Coronal project team. Marathon Capital was the financial advisor to HelioSage.

HelioSage's business is in utility-scale solar project origination and development. The Coronal-Panasonic group focuses on engineering, procurement and construction, project finance and asset management. The combined companies can now take a project from origination to O&M.

As an interesting side note, according to a release, "HelioSage also served as the exclusive solar consultant and transaction advisor for one of the nation's largest-investor owned utilities from 2012-2014, participating in the origination, due diligence, and acquisition of 230+ megawatts on their behalf."

"This is a really smart acquisition," according to GTM Research Solar Analyst Cory Honeyman. "HelioSage's pipeline fast-forwards Coronal's efforts to be a top-tier originator of utility-scale solar assets, in addition to its longstanding work in project acquisition."

HelioSage is the 12th-largest project developer in utility-scale solar, according to GTM Research's U.S. Utility PV Market Tracker. This announcement follows recent utility-scale developer deals such as Canadian Solar's acquisition of Recurrent Energy and SunEdison's acquisition of First Wind.

Honeyman notes, "HelioSage is one of a handful of developers to date that has successfully built out a pipeline of projects greater than 100 megawatts leveraging non-RPS-driven procurement opportunities, such as federal PURPA rules and voluntary procurement opportunities like Georgia Power's Advanced Solar Initiative."

All of the acquired solar power plants are due to be completed in 2016 -- before the 30 percent federal Investment Tax Credit is slated to be ratcheted down to 10 percent. The projects in the HelioSage pipeline range from 13 megawatts to 65 megawatts and are contracted with utilities such as Gulf Power, Idaho Power and Rocky Mountain Power.

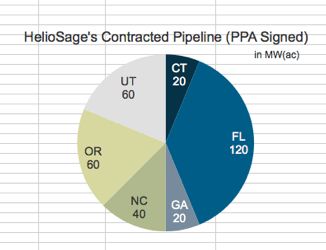

HelioSage is active in the following states, according to GTM Research's U.S. Utility PV Market Tracker.

Figure: HelioSage PPA Pipeline

Source: GTM Research's U.S. Utility PV Market Tracker

We spoke with Jonathan Jaffrey, CEO of Coronal Group, yesterday. He said, "If there is a reduction in the ITC, then being able to control the project from development to asset management will give that platform a leg up in the market." He spoke of reducing "multiple margins" and "points of friction."

The CEO notes that Panasonic's involvement "is not a product play" -- despite the fact that Panasonic owns Sanyo, which makes one of the world's most efficient solar panels. He added, "While we don't use their technology (because it's not for utility applications), they still understand the module and quality level of panels."

"HelioSage helped us expand our greenfield capability," he said, adding, "We think highly of what [HelioSage has] done. Now there's more financial horsepower with Coronal and Panasonic."

HelioSage claims to have more than 1.5 gigawatts of projects in development.

With the scheduled drop-off of the federal ITC approaching, expect to see some more acquisitions in this sector as financiers with capital seek to take advantage of project developers' pipelines before 2017.