The Colorado solar industry won an important victory in a new agreement with Xcel Energy that will almost quadruple the amount of incentive-eligible residential solar.

The agreement, in principle, ups the amount of eligible residential solar from 9.6 megawatts to 33.6 megawatts and institutes a step-down plan in the incentive amount. The deal was reached April 29 and signed by Solar Energy Industries Association (SEIA) President Rhone Resch, Colorado SEIA Executive Director Edward Stern, and Karen Hyde, Regional VP of Xcel Energy (NYSE:XEL) subsidiary Public Service Company of Colorado (PSCo).

The 2013 compliance plan approved by the Colorado Public Utility Commission (CPUC) for Xcel's PSCo was “wholly insufficient” to sustain the state’s burgeoning residential solar industry, according to REC Solar Director of Governmental Affairs Ben Higgins.

Colorado built 13.8 megawatts of residential solar in 2011 and 18.3 megawatts in 2012, according to the GTM Research and SEIA U.S. Solar Market Insight 2012 report. But the CPUC-approved allotment for the PSCo Solar*Rewards small component (systems under 10 kilowatts) program for 2013 was 9.6 megawatts.

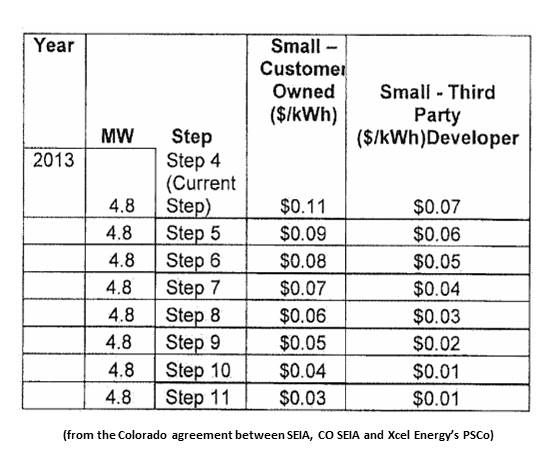

The Solar*Rewards production-based incentive (PBI) is $0.11 per kilowatt-hour for homeowner-purchased systems and $0.07 per kilowatt-hour for third-party-ownership (TPO) financed systems. TPO financing built 83.2 percent of all Colorado residential solar in 2012.

The compliance plan would have been a “solar cliff” for Colorado’s 250-plus solar businesses and solar workforce of more than 3,600, Higgins said. The 2013 allotment was exhausted last week, he added.

The agreement, which must still be approved by the CPUC, calls for the new incentive allotment to be applied in seven steps. Each step allows 4.8 megawatts to earn the Solar*Rewards rebate and calls for the rebate to be reduced by $0.01 per kilowatt-hour at each step.

The PBI for the last 4.8 megawatts, considered the eleventh step in the overall Solar*Rewards program, will be $0.03 per kilowatt-hour for homeowner-purchased systems and $0.01 per kilowatt-hour for TPO-financed systems.

Higgins noted that Colorado solar advocates insisted the agreement also include a provision requiring that capacity subscribed for but not built within twelve months be returned to the queue.

The gradual rebate step-down was modeled on the successful California Solar Initiative (CSI) program, Higgins said, and will provide the same kind of predictability, stability, and transparency for Colorado solar.

With the CSI, California built a cumulative installed residential solar capacity of 673.6 megawatts, over four times more than Arizona and New Jersey, the next most active states.

The declining incentive program will also allow market forces to have a role in setting the solar price point, Higgins said. And by reducing the incentive amount, he explained, it should keep the Solar*Rewards program intact through mid-2014, when a new PSCo compliance plan should be approved by the CPUC.

“We believe it is important to keep this program available to the market for the remainder of 2013, by moving forward capacity that was planned for next year,” said PSCo President/CEO David Eves. “It is also important to continue to reduce our program incentive levels and provide transparency.”