Cogenra Solar has been tapped by Johnson Controls Inc. (NYSE:JCI) as its preferred solar solution. Being selected by the multinational powerhouse in building efficiency solutions could move Congenra’s unique hybrid solar hot water-solar electricity concept to the big time.

JCI will use solar-heated water to drive its YORK absorption chillers. Chillers make use of water temperature differences to flow cool water through buildings ceilings, walls and floors, lowering ambient temperatures with reduced air conditioner use and thereby reducing electricity consumption.

“Our hot water goes into the YORK chiller at 200 degrees Fahrenheit and comes out at 160 degrees Fahrenheit,” explained Cogenra CEO Gilad Almogy. "Not cold, just less hot. That is one cycle. On the other side, there is the chiller water that comes in at 55 degrees Fahrenheit and out at 44 degrees Fahrenheit.”

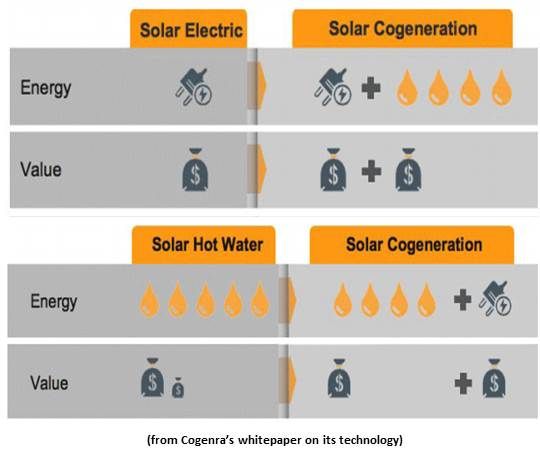

“There are other solar hot water collectors,” JCI Global Industrial Chillers Director Joe Brillhart said, “but they don’t capture the electricity at the same time. They, like Cogenra, are about 50 percent to 60 percent efficient on the hot water, depending on other factors. Cogenra matches that and gets another 15 percent from electricity. That is a combined 75 percent, and it becomes simple math after that.”

The electricity, Almogy said, “has nothing to do with the actual chiller operation; it has to do with the economics of the technology.”

The Khosla Ventures-backed Cogenra rooftop hardware is composed of a parabolic trough mirror, assembled from flat plate mirrors, that is mounted on a single-axis tracker and reflects the sun’s light and heat up to silicon PV panels that line the metallic water chamber. “They let the heat but not the electricity go through and the water conducts that heat away,” Almogy said. To date, Cogenra has sold solar hot water services to facilities like college dorms and the Facebook fitness center. “With Johnson Controls,” he said, “it can be if the customer needs cooling.”

According to Almogy, the value of the heat roughly doubles the value of the electricity. “You make one unit of electricity and four units of heat. The financial value of the heat, factoring in the efficiency of the absorption chiller and other things, more or less doubles the value of the system.”

The first thing Cogenra is, Almogy said, “is a low-cost concentrating PV system. We use silicon panels and flat mirrors. Both are low cost. We concentrate the sun [approximately] ten times, and as a result, we get low-cost PV.”

High-end CPV technologies like those employed by SolFocus, Amonix, and Solar Junction have floundered. They can get 500 times to 1,300 times concentrations and achieve much higher efficiencies, Almogy said, but at a much higher cost, because they use expensive optics, more expensive module materials, and double-axis trackers.

“Two years ago when silicon was very expensive, that seemed like a viable solution,” Almogy said. “But since the silicon price has dropped, this proposition is problematic.”

Cogenra installations “can be large, small, roof-mounted, or ground-mounted,” he said. “Our economics make sense when we can install for no more than the cost of PV. You get the rejected heat free as a byproduct. You put it into an absorption chiller and you get the extra cooling and that gives you a cost advantage.”

The high correlation between when the sun is shining and the cooling load makes this a potentially enormous opportunity, Almogy said. “In places like the Gulf states, 70 percent of their daytime electricity load is for air conditioning. In some places in the Southwest, it can be 50 percent. This is now one of the things Johnson Controls has in its tool set.”

Cogenra may only fit “a small portion of the existing absorption chiller market,” JCI’s Brillhart noted, but in sunny places like Arizona and California, “the larger opportunity will be to provide this new solution to our university, commercial and industrial customers.”

The opportunity could be much bigger beyond the U.S. market, Almogy added. “The biggest stress on the grid in many places is the need for more and more chilling. If you can provide chilling without adding stress to the grid, and in fact do the opposite -- reduce it -- growth could be explosive. In the U.S., something like 87 percent of homes have air conditioning. In India, 2 percent of homes have it.”

According to Almogy, Cogenra’s is the only hybrid product that incorporates IEC-certified PV modules and an SRCC-certified hot water system. Neither Brillhart nor Skyline Innovations Director of Market Development Mike Healy, Chair of the newly formed U.S. Solar Heating and Cooling Alliance, could name a comparable hybrid product.

“Johnson Controls didn’t add Cogenra without a lot of checking and testing,” Almogy said. “Cooling is mission-critical to the big buildings, big campuses, big data centers and big plants that Johnson Controls is trusted to keep working. The fact that Johnson Controls trusts us means a lot.”