ClearEdge Power of Hillsboro, Oregon, a manufacturer of proton exchange membrane (PEM) fuel cells, is acquiring fuel cell industry veteran UTC Power.

UTC Power is a maker of large-scale phosphoric acid fuel cells (PAFCs), although the firm also has experience with PEM, alkaline fuel cells (AFCs), solid oxide fuel cells (SOFCs), and molten carbonate fuel cells (MCFCs).

UTC Power has a long history, but it's a tiny piece of the $58 billion aerospace-technology conglomerate UTC (NYSE: UTX). Some sources report annual revenue of $40 million for the fuel cell unit, but UTC Power's revenue is not broken out separately. The firm "currently has approximately 380 employees and they are all part of this acquisition, which covers both the stationary and transportation businesses," according to a UTC spokesperson in an email today.

ClearEdge has raised just north of $100 million in VC funding since its inception in 2006 and has fewer employees and presumably less revenue than UTC. Details of the terms or structure of the acquisition were not disclosed. Neal Starling, ClearEdge Senior VP of Sales and Marketing, would not comment on the terms of the deal, but did say, "This acquisition will help solidify our position as a leading provider of cost-effective, clean, continuous, distributed power solutions."

Kohlberg Ventures is an investor in ClearEdge -- as well as Applied Ventures, the investment arm of Applied Materials, Big Basin Partners, and Southern California Gas Company.

The acquisition extends ClearEdge's power range, courtesy of the UTC 400-kilowatt fuel cell. The acquisition also creates in ClearEdge somewhat of a fuel cell industry powerhouse.

ClearEdge's core product is a modular PEM going after combined heat and power (CHP) applications at hotels, multi-tenant buildings and schools with power ranging from five to 200 kilowatts. ClearEdge claims its fuel cell can reduce CO2 emissions by up to 40 percent, along with producing "negligible" NOx and SOx. The fuel cell runs on natural gas, propane, or methane and can export excess heat for hot water, forced hot air, or hot-water cleaning. Other players in the small stationary fuel cell space include Ceramic Fuel Cells, Panasonic, and Ceres Power.

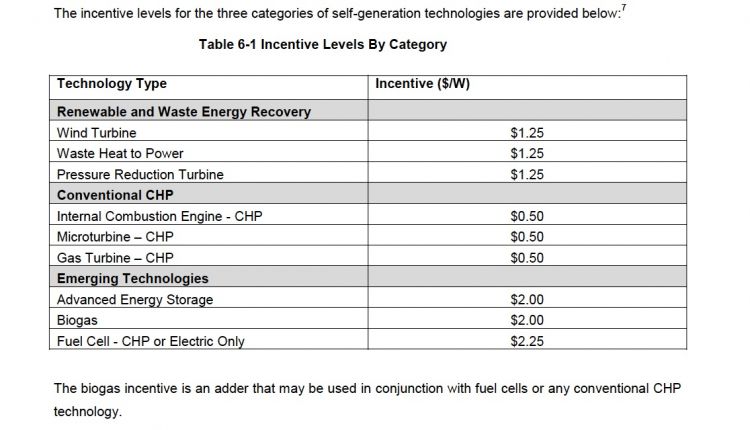

When last we checked, a 5-kilowatt ClearEdge unit had a $56,000 list price and an installation cost ranging from $10,000 to $20,000. There is a $15,000 investment tax credit. California has a Self Generation Incentive Program (SGIP) that can return $12,500, more if biogas is employed. There is the potential to exploit the SGIP for another 20 percent if the vendor is a California supplier (the approved list is currently limited to Bloom, FlexEnergy, Calgen, and Stem). New York, New Jersey, and Connecticut also have aggressive state incentive programs.

According to an earlier interview, in a 20-year light commercial application, factoring in the cost of the unit plus the gas, maintenance, replacement parts, taxes, and installation, power ends up at $0.091 per kilowatt-hour with the CleanEdge fuel cell. Starling verified this number today.

ClearEdge might be able to outperform batteries and other fuel cells, but the problem is that the real competition is the grid and diesel gen-sets. And few if any fuel cell vendors have proven that they can go head-to-head with those incumbent technologies on a per-kilowatt-hour basis. Fuel cells can be distributed and do have less emissions. Natural gas is cheap. But for fuel cells dependent on the natural gas grid, there's the downside of volatile prices and the sometimes less-than-green processes used to extract natural gas.

Fuel cells have benefited from state and federal subsidies, or in the case of Bloom -- Delaware ratepayer bill subsidies. The justification for renewable energy subsidies is often debated in these pages. But in the case of fuel cells, even after incentives, the fuel cell is expensive compared to the grid or to a diesel gen-set.

What happens to ClearEdge, UTC and the fuel cell industry when those subsidies subside?

California SGIP Schedule by Technology: