In April, residential solar financing startup Clean Power Finance (CPF) announced the $37 million piece of a $60 million equity round that included Edison International (NYSE:EI), Duke Energy, as well as several unnamed power sector investors.

GTM has learned that Clear Sky, NextEra Energy's Investment arm, is one of the unnamed investors, according to sources close to the company. We have also heard that Dominion is part of the syndicate.

Alex Weiss, Managing Director of ClearSky Power & Technology Fund I LLC, is on CPF's Board of Directors, so it's not a big stretch.

We have also learned that CPF has closed on an additional $20 million in equity capital from funds in the United Arab Emirates. CPF, ClearSky, and NextEra would not comment.

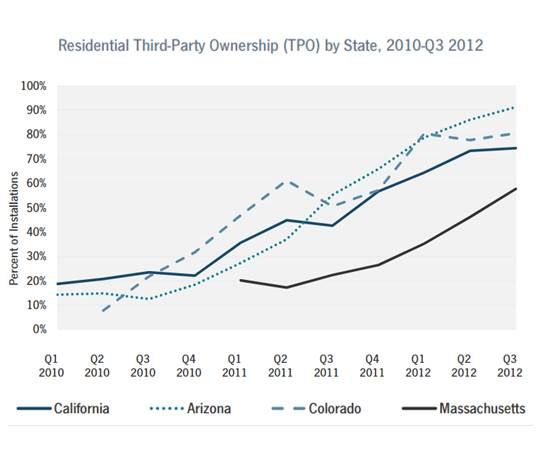

CPF's total VC investment is now more than $82 million from investors including Kleiner Perkins Caulfield & Byers, Google Ventures, Claremont Creek Ventures, Clean Pacific Ventures, Sand Hill Angels, and Hennessey Capital. That figure is equity and working capital (note that the startup manages hundreds of millions in project finance funds for corporations and institutions). CPF ranks among the top four in third-party ownership (TPO) financing of residential solar.

Conservative utilities and owners of generation and transmission entering the solar TPO market indicate how financially robust the TPO marketplace has become for investors. It could put utilities in a conflicted place regarding net metering, as owners of solar systems selling into the grid.

As CEO Nat Kreamer noted in a previous interview, “Utility holding companies are increasingly interested in solar, particularly residential solar. [...] The power company of the future will own both centralized generation and distributed generation (i.e., residential solar) assets.”

The investment community's acceptance of financed residential solar has opened the cash floodgates. Here's a partial list of recent funds:

- Vivint Solar of Provo, Utah secured $200 million in two new tax equity funds to finance solar power systems on residential rooftops. Vivint Solar is the solar integrator and PPA financier unit within Vivint. Vivint is notable for its sales network and low cost of customer acquisition. The company was acquired by Blackstone for $2 billion in September of last year. Vivint Solar was the second-largest U.S. residential solar installer in Q1 2013, according to the GTM Research's U.S. PV Leaderboard.

- SunPower's residential lease program has signed up a total of 18,400 customers and has about 147 megawatts booked to date with $528 million in net aggregate payments. SunPower just raised $150 million in new residential lease financing.

- Sungevity, the solar sales, financing, and software startup, won $125 million in new venture capital and project financing in January and landed another $15 million in funding, including investment from GE Ventures just last month. Previous investment has come from Brightpath Capital Partners, home improvement store Lowe's, Vision Ridge Partners, Firelake Capital, Craton Equity Partners and Eastern Sun Capital Partners.

- SolarCity (SCTY) joined with Honda Motors on a $65 million residential solar project fund for the benefit of Honda and Acura car buyers earlier this year. SolarCity also raised $500 million from Goldman Sachs in May.

- OneRoof has raised more than $80 million in operating capital and finance capital from Hanwha, Black Coral Capital, U.S. Bank, The Quercus Trust, Yellowtree Energy, and Spring Ventures.

- In June, Sunrun announced three new funds totaling $630 million. Investors include JPMorgan and U.S. Bank. While U.S. Bancorp (NYSE:USB) has been a big supporter of residential solar, this is the first entry for JPM Capital Corporation, a subsidiary of JPMorgan Chase & Co. (NYSE:JPM). Sunrun CEO Ed Fenster said, “It is the largest and most consistent provider of capital to renewables, but until now most of their investments have been in wind. This is a watershed moment.”

- SunEdison's acquired EchoFirst, a solar, hot water and conditioned air provider with a dedicated $50 million fund.

GTM Research sees the residential solar financing market in the U.S. growing from $1.3 billion in 2012 to $5.7 billion in 2016.