At the end of 2010, Clean Power Finance (CPF) CEO Nat Kreamer and a group of the biggest names in greentech venture capital, including Kleiner Perkins and Google, decided to take the company to the next level.

CPF was founded in 2007 as an online tool to connect solar buyers and sellers with financial products and help them design solar systems. By 2010, it had 800 solar businesses, including marquee names like Suntech, BP Solar and Real Good Solar, as customers. Forty percent of all residential and small- and medium-sized commercial solar sold used the CPF software platform.

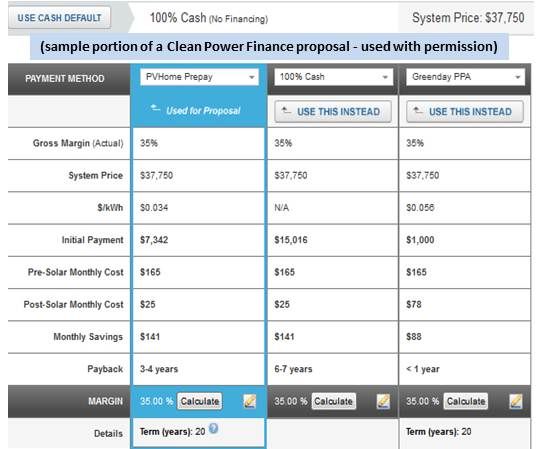

White-label financing in the software package offered solar business customers the ability to make available, under their own brands, the full range of financing options to solar system buyers, from leases and power purchase agreements to loans and tax credits.

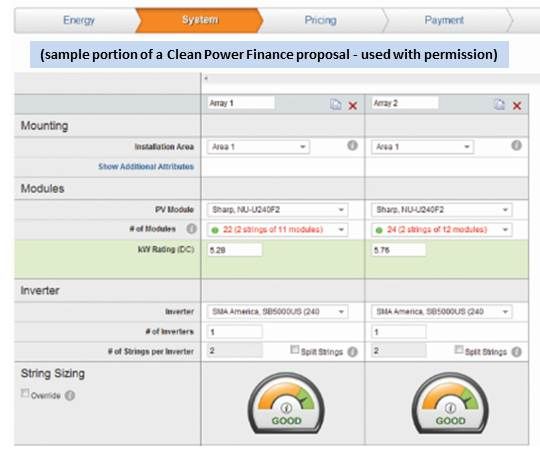

“The company worked for four years to develop the software,” Kreamer said, “and grow its customer base.” While perfecting its tool “to design, quote and propose solar,” the company was accruing an enormous database, from the price and amount customers pay for electricity to the cost and performance of their solar systems.

As a result, Kreamer said, “we really get solar, we really get software, and we really get finance.”

Equally importantly, Kreamer said, the CPF deal flow is voluminous.

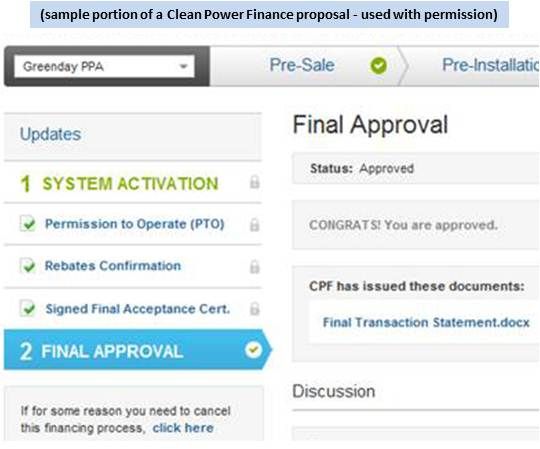

In December 2010, with backing from Kleiner Perkins Caufield & Byers and Google Ventures, as well as Claremont Creek Ventures, Sand Hill Angels, and Clean Pacific Ventures, Clean Power Finance added solar financing to its CPF 2.0 software tool.

“We remained in stealth mode through summer 2011,” Kreamer said, while perfecting the software and securing “third-party investors who wanted to 100-percent own residential solar systems and offer power purchase agreements and leases.”

With the tool, the money and a marketing team in place, “We started selling financing for solar systems in April 2011,” Kreamer said, and “by August 2011, we were financing more than a million dollars a day of residential power purchase agreements and leases.”

By comparison, Kreamer noted, SunRun, which he founded and which is one of the giants of solar finance, “took years to get to a million dollars per day.” CPF is a B2B play, while SunRun, Sungevity, and SolarCity reach out to the end customer. Other firms are reaching out to roofers.

CPF also went, between April and August, from having the 800 customers it won between 2007 and 2010, to 1,400 customers.

But CPF, Kreamer said, is just getting started. The software is used in 50 states, but the financing is only in use in California, Colorado, Massachusetts and New Jersey (though a project is also pending in Arizona). But there are 45 states left, which explains why Kreamer said CPF has no present plans to expand internationally.

On the recent China trade war and Solyndra controversies, Kreamer noted that CPF customers’ 2011 volume is up 40 percent over 2010. “That means the market is growing despite negative press.”

There are two key reasons for the success, Kreamer said. Because CPF’s model is B2B, the acquisition of customers costs less, resulting in more competitive financing terms. And because CPF has no ownership of the systems it finances, it can operate on a lower rate of return, again lowering the cost of capital to consumers and installers.

CPF was able to attract capital in the current economic climate for two reasons: because their voluminous deal flow promised to put investors’ money to work, and because, Kreamer said, “residential solar as an asset class is a really attractive investment.”

Financing solar, Kreamer said, “is refinancing someone’s electricity bill.” He added that “solar ends up being a great deal for consumers. They save a lot of money.” In addition, Kreamer said, “It turns out people pay their electricity bills and people who own homes do so even more consistently. So there is low likelihood of default, and investors like that.”

With the federal Investment Tax Credit (ITC) available to system purchasers through 2016, as much as 45 percent of an investor’s capital outlay comes back as a tax benefit in the first year of the loan. Kreamer said the overall return on investment in residential solar is “anywhere from the high single digits to the mid-teens.”

Proof that solar systems financed through CPF 2.0 provide the claimed 10 percent to 50 percent utility bill savings, Kreamer said, is that it has attracted so many new customers and so much money in such a short time.

The low-risk, high-reward value to investors of what is essentially a long-term asset, Kreamer said, is also substantiated by reports that default rates on solar financing (“20 basis points per year”) come in below default rates on AAA bonds ("0.33 points per year”).

Caltech’s Nate Lewis, one of the nation’s leading solar researchers, famously pointed out to The New York Times’ Tom Friedman that buying a cell phone in 1992 was worth almost any price because it offered something otherwise unavailable -- but buying solar panels to generate electricity does not have that kind of substantial added value.

Nat Kreamer said Clean Power Finance’s new financing model has the potential to “change the paradigm and make solar a lot more like cell phones.”

“Solar is sold, not bought,” Kreamer said. “But when you refinance someone’s electricity bill with solar, you’re giving them more money. Who doesn’t want that?” With solar, he added, “you get to save money and you get to do a really good thing. How many times do you get to do that?”