What do leaders from the largest U.S. municipal utility and one of the industry’s more disruptive technology upstarts have to say about the market transformation at the grid edge and what it means for utility evolution?

GTM recently had the opportunity to sit down face-to-face with CEOs Doyle Beneby of CPS Energy and Naimish Patel of Gridco Systems to find out.

San Antonio-based CPS Energy is the country’s largest municipal utility in terms of total asset base, ownership of generation assets in megawatts and total end customers, serving roughly 1 million combined electric and gas endpoints. CPS also has healthy amounts of utility-scale and residential PV (compared to other utilities in Texas) and is currently deploying Home Area Networks (HANs) with a goal to reach upward of 200,000 homes in the San Antonio area.

Patel, founder and CEO of Woburn, Massachusetts-based Gridco Systems, has raised approximately $30 million to design, build and deploy its system to support next-generation grid infrastructure. The company's "emPower" solution consists of its IPR (In-Line Power Regulator), DGC (Distributed Grid Controller) and GMAP (Grid Management and Analytics Platform).

A number of top-tier utilities in North America and Europe are using the platform’s ability to control voltages along individual distribution lines with devices that use no moving parts, need no regular maintenance, and keep running for decades, according to the company. (Gridco Systems, along with nineteen more of the industry’s most innovative companies, was recently named to Greentech Media’s Grid Edge 20 list.)

Patel and many other market visionaries will be speaking at Grid Edge Live in San Diego, California on June 24-25.

Part I: Technologies Driving the Modernized Grid

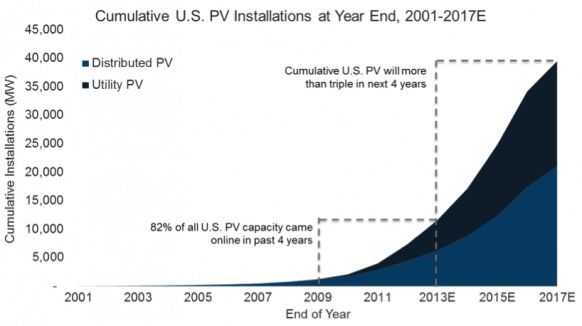

The first part of the discussion touches on how electric grid infrastructure will change in the coming five to ten years in the face of increased distributed PV (GTM Research forecasts more than 300 percent growth in the U.S. over the next four years) and the strain it is placing on existing distribution infrastructure.

Source: GTM Research

Patel named three trends that are driving the industry (and ultimately provided the rationale for founding Gridco):

- The increasing adoption of renewable, time-varying sources of power introduces reliability challenges to the grid

- There are an increasing number of capacity constraints associated with transmission and baseload generation. Distribution utilities are being called upon by transmission authorities to provide deeper levels of peak capacity curtailment. But the reliance on traditional demand response providers to provide such deep levels of curtailment is becoming more difficult, as it fundamentally relies on customer behavioral change.

- The increasing frequency of large-scale outages as a result of storms is forcing the need for much more efficient and quicker adaptation and recovery.

Given these trends, Patel claims that a new class of infrastructure is needed going forward as utilities face the challenge of balancing supply and demand in a reliable and scalable way. This all comes with a new set of requirements focused on fine-grained delivery and management of power to end customers, a set of requirements that the existing class of tools will be increasingly challenged in providing, according to Patel.

On the utility side, Beneby outlined several key themes that are priorities at CPS Energy:

- Increasing customer participation in energy management services by putting more tools in the hands of customers to centrally and remotely manage their usage

- Finding new ways to bundle demand response in a way that helps the system’s responsiveness, whether as a result of needing to shed demand to stabilize the system or if it’s needed for voltage regulation. To this end, deploying distributed, intelligent devices in aggregate will be more responsive than central generating stations.

- Focused efforts on increasing customer participation in outage management and helping to reduce O&M costs, via "decentralized customer participation"

- Deploying intelligent systems that act as "traffic cops" to ensure that the distribution system remains stable

When asked about some of the most pressing issues facing the grid and what needs to be done to address those issues, Patel offered, “The idea of capacity management along with maintaining reliability is a particularly important one -- one that’s going to become more difficult to provide because what once was able to rely on predictable supply, or at least supply under a utility’s own control, is increasingly moving into a world where not only demand is going to become increasingly variable but an increasing percentage of supply will not be under direct control of the utility either. The balancing equation becomes more difficult. Given that it’s the fundamental role of the utility to deliver reliable, safe and efficient power, what must be true is that utilities provide for that control and own the ability to provide for that.”

Given the wave of changes occurring at the grid edge, including the growth of distributed PV, new load types such as EVs, the growth of Home Energy Management Systems (HEMS), and other factors, Beneby offered the following insights as to how these trends will shape the way utilities manage distribution grid planning over the next five to ten years.

- Utilities will likely have to rethink their entire capital-planning horizon. With that, they are going to need help in developing algorithms that tell them which areas of their service territory can best optimize the different types of technologies.

- With the introduction of EVs, delivery infrastructure could be stressed, thus requiring new thought processes around transformers, conductor size, fuse size, etc. All of these things will have to be monitored and in some cases upgraded.

- Conversely, in different areas with accelerated solar adoption, facilities could be underutilized, yielding the inverse and potentially causing stranded investment.

As a result, CPS is considering where to adopt, or incentivize in some cases, different technologies. “We’re going to have to go out and have tailor-made marketing, perhaps, for adoption of technologies in places that are most advantageous to the grid so we can manage the stranded investment issue,” according to Beneby.

All of these issues have led to significant growth of information technology (IT) being deployed by utilities worldwide, in a variety of applications.

Patel feels that the monetization of these investments in IT can only be fully realized once they are complemented with operational technology (OT); that is, technology that can enable utilities to respond to the information rendered by the IT systems and do so in an adaptive way -- to actually make changes or enact change on the grid in response to those triggers.

“Over the next several decades, what you are going to see is a complementary set of investments, necessary to monetize utility IT investments, in OT change agents,” according to Patel.

Alongside all of this are the algorithms to manage those OT assets. Patel sees a future where there will be an increasingly versatile set of power electronics-based devices that can manage, regulate and alter the flow of power.

The fundamental question then becomes how these technologies can be used for the purposes of supply/demand balance, capacity management and reliability.

“It will be algorithmic-rich, and the algorithms are at the intersection of power systems and scalable computation,” says Patel. “This all refers back to the nexus of control. Much like the internet is composed of a set of change agents (routers, etc.), I think that over time you will see a similar evolution in the grid infrastructure.”

Part II: Utilities Transitioning Into an Age of Energy Decentralization

Other major technology industries have gone through phases of moving from centralized architectures to highly distributed ones (computing and telecommunications are two examples). These shifts have led to significant opportunities for service providers and technology vendors alike.

According to our research at GTM, that transition is already underway in the electric utility industry and will affect everything from technology adoption to business model optimization.

GTM: What types of challenges and/or opportunities will arise as this shift to decentralization takes place?

Beneby: It’s coming. It has been our view all along that this transformative disruption is occurring and we want to be a part of it. We want to not only jump on the train, but to lead, as opposed to denying its existence or its inevitability. When it gets here, the first issue we’ll have to face is stranded investment. This is a very capital-intense industry. Unlike other industries that may have become decentralized, you probably didn’t start from the same starting point of legacy capital investment that has to be recouped.

Although some of it may be solved by commissions or governing bodies, some of it is going to have to be solved by the utilities in finding a way to make that work. It can be a positive catalyst. How do you avoid leaving that capital investment on the table when you have to pay investors and bondholders a return while certain assets are not being utilized and not earning as much revenue?

The other part is a social compact. Not all classes or categories of customers are ready for a distributed world. Some of them are heavily dependent upon the utility for the obligation-to-serve aspect of what we do. Figuring that out will be critical because they cannot be left behind. When we look at distributed solar adoption rates, they are congregated around certain higher-economic-level ZIP codes. We’re looking at that and trying to figure out what programs we can offer lower-income customers. The second part is trying to figure out how to bring along all customers. If we don’t figure that out, it will become a red line issue.

Patel: Broadening the class of service that Doyle is mentioning is a critical piece of the equation. Fundamentally, we saw that transition in the telecom industry. The deregulation that gave rise to CLECs [Competitive Local Exchange Carriers] was fundamentally a result of the increased level of demand diversification by the customer. Because of some of the new technologies learning curves so steep as PV, we’re seeing the beginnings of that now in the utility space, which is to say not every customer is the same.

The social path that was justifiably set to incentivize investment must necessarily change because not all customers are going to be the same. Their demands will be different. The revenue models for utilities, whether IOUs, munis or co-ops, are going to change.

In particular, one piece of that is rate design. Rate design is going to be an interesting challenge to tackle, so that you’re not leaving anyone behind but you’re also incentivizing others to ask for and demand what they would like, and incentivizing the utilities to invest to supply that demand. There are cases where it’s difficult to maintain a constant reliability metric across service territories. There are places in the Northeast where this [issue comes into play]. That asymmetry, in and of itself, is also a cause for the need to look at tiered services. That’s an absolutely essential piece to the sustainability of the industry.

Beneby: A lot of these tiered services are going to have to be menu-driven. If you add another layer to the concept of tiered services, there may be scenarios where you choose the amount of reliability that you want. And we have to be able to have the gateways, if you will, to be able to do that.

That may free up some bandwidth, but it could become that fine in the next ten to fifteen years where you may pay a premium for being restored in a certain amount of time -- under an hour, for example.

One of the other challenges is security and protection of customer data. We have to find a way to make this transition [so that] customers are never worried about data security.

Patel: Data suggests that a large percentage of cyber attacks in the Unied States are against energy infrastructure. If that’s going to be the case going forward, one necessarily must move to a decentralized architecture for resiliency.

I think there is a sentiment in the industry [on the part of] a number of utilities that the upcoming changes are necessarily going to give rise to revenue reductions and therefore impact to their investors, particularly IOUs. I don’t think that will be the case, because this tiered service idea has the ability to enable utilities to operate on multiple points along the demand curve, as opposed to [operating at] one point on the demand curve today. Going forward, there will be some customers that will be lower sources of revenue for the utility, but there will also be other sets of customers that will be higher revenue-per-unit sources for the utility. The utilities that take a proactive approach will be the ones to benefit first.

The idea that revenue must reduce is an intrinsically incorrect assumption.

Beneby: Moving forward, perhaps in a few years, imagining a solar farm for example, where the subsidies roll off, cash flows change and we have an opportunity to own -- we’ve got to have people that understand this model.

The second piece of it is, as we move toward a distributed architecture, we have to have the people that understand it architecturally. A lot of the skills we’re going to have to import, but troubleshooting and the like, we’re going to have to understand, because the value for us, as utilities, is that we still have the first shot at retaining that bond with customers.

Part of the advantage to us is that the things we’re talking about are things that not many customers think about. They have a pretty paternalistic relationship with their electric utility.

There could be ways that change happens dramatically in the manner we’ve talked about, but we can retain a level of branding with our customers and provide services to them that allow us to continue in a world where it makes business sense.

GTM: What are some of the fundamental differences in future utility business models when considering the differences between IOUs, munis and co-ops?

Beneby: There is a significant difference. The IOUs have a more acute concern about stranded investment. Typically, they are in decentralized, competitive markets. We are not, here in Texas, yet. It’s ironic because we are working on solutions even though the threat is not as clear and present as it is to other IOUs.

Second, it’s a different deal to have to feed investors as opposed to a community. We have to be competitive. We have to make a return. Our shareholders are de facto the city, because there’s a general fund transfer from some of our gross revenues, but that’s much different than your typical investor in the private investment world.

Don’t miss the fact that in this model, a big, monolithic multi-billion-dollar asset base utility is working with a company like Gridco. You’re seeing some of the future right here. This is unique and provides a way that will enable utilities to survive.

It’s also going to help the marketplace because we’re going to be able to bring to the table a lot of customers and a lot of applications that companies like Gridco and others can have access to.

I think that most big utilities ought to be thinking this way. We can help bring low-cost capital to the table and ways to scale up that perhaps small companies can’t. You’re looking at the future here. Early adopters are going to have an advantage.

PART III: Technology Game-Changers and Advanced Energy Service Offerings

GTM: What are some of the key technologies that will have the greatest impact on the industry going forward?

Patel: A new class of devices must be distributed in their deployment because of the challenges posed at the edge of the grid. They must be dynamic in nature in that they will have to adapt in short time frames to varying grid conditions, and they must be able to grow and scale the grid in modular fashion, relying on elements that can decouple or isolate one side of the grid from the other.

We’re also seeing things like smart inverters, which are indeed necessary pieces of the system, but unless the utilities have control over such assets, and have that control in a scalable way, it’s going to be very difficult to address the challenges being posed.

What we see is not only an opportunity to provide a class of infrastructure for the regulation of power, but also a class of infrastructure that in essence forms the nexus of that control in a distributed way, rather than a centralized way, for scalability reasons.

GTM: How important is distributed storage in aiding the transition that we’re discussing?

Beneby: It’s essential. There are several game-changers in this industry and storage is one of them. It’s not only critical from a customer perspective but critical for utilities as well. If we can have some of these storage mechanisms to inject into the grid during peak, it can create opportunities for customers to save and not be fully dependent upon the utility, charting their own path, but also helping the grid.

I hope that the first wave of the change will be electric vehicles. If we can spur adoption and create a regime where we have the infrastructure where people have an incentive to discharge during peak times, for example, it creates a scenario where we could potentially have several thousand mobile power stations.

On the retail side, it’s going to happen. It needs to happen. My view might be that the winning horse may be battery storage in electric vehicles.

Patel: If you fast-forward, storage has to be a component of the solution. There are already niche applications where it proves out economically -- peaker plant replacement, as an example. Over the next decade, the cost of storage will be such that the way to monetize it will be to share it across multiple applications or to use it in a way that’s very sparing in its capacity, so the efficiency of its use will be very important.

What that will then require is algorithms. How do you make the most efficient use of the storage via intelligent algorithms? Software control of storage will be critical to operationalizing it at scale.

GTM: What is the future requirement for back-office systems to enable efficient grid network design and modeling?

Patel: Before getting into that, it’s important to consider that such systems often require human resources to be educated on, operate and manage, which is a challenge.

With that said, the goal should be, as we move into this more dynamic environment, to achieve autonomous operation of the distribution feeder system.

GTM: New partnerships are forming around holistic consumer energy services and systems. Examples include Nest and Sunrun, SolarCity and Tesla. What are your thoughts about the growth of players like this in providing a more holistic consumer energy management service offering?

Patel: The general trend of customers being able to gain more insight into their usage and granularity into that insight no doubt seems to be afoot. What that will enable is for customers to not simply be passive consumers of power but rather important elements of the grid infrastructure itself.

I can imagine a future, where much like in the case of electric vehicles, there will be a need, where there is strong penetration, to explicitly schedule the charging of those devices, whether that’s induced by price signal or some other mechanism.

You can even imagine that, at a finer granularity, all of your home appliances understand their energy consumption needs and can interact in a dynamic way with the grid infrastructure in forecasting their needs and/or dropping out and saying, “I’ll wait for another five minutes to consume power because there may be a capacity constraint upstream.”

All of these things feed into the system as a whole as new controllable elements. They’re new resources that once were not viewed as resources in that sense.

GTM: Any specific thoughts on microgrids?

Patel: I think that microgrids are another example of a customer-owned grid, fundamentally. It’s just another example of where decentralization of control over the power is going to occur.

Although they are currently viewed as customer-owned, they can very equally be owned by the utility. It is part of the service delivery of power. It will have natural benefits in terms of reliability and outages. It remains to be seen how the economic and ownership structures around microgrids will evolve.

Beneby: The deployment of all of these technologies, for the foreseeable future, will still be required to allow a vast majority of customers to employ them passively. It’s likely that a small percentage of customers are going to be mentally engaged with all of this.

There may be an initial point where they work with utilities to program one time, but then it’s got to be, leave it alone. The majority of people don’t have time or interest. They need to hit a button and have it be taken care of. We believe that there are generally four tiers of customers:

- For some it’s going to be islanding themselves for purposes of privacy and resiliency.

- A younger demographic that like things new and shiny and want to be able to control their appliances, manage things remotely and do it from a smartphone.

- There will be some that want to do good. All of this becomes meaningful because it offsets carbon somewhere and it impacts communities in a positive way.

- Lastly, and for us most importantly, people want to save money. They want a lower bill, or else all of this means nothing.

In any case and whatever the motivation, it’s going to have to be very passive.

***

Join Greentech Media, Gridco Systems and many other forward-thinking vendors, utilities, policymakers and industry associations at Grid Edge Live on June 24-25 in San Diego, California, as we explore in-depth many of the topics discussed in this article.