The electric vehicle revolution is underway. The best confirmation of this large-scale shift in transportation of people and goods came last month when Tesla revealed its new Model 3 and received about 400,000 preorders, each with a $1,000 deposit -- and the cars won't even be produced in large quantities until 2018.

Shortly after announcing this massive number of preorders, Tesla also indicated it is ramping up its production goal, moving the target for manufacturing 500,000 vehicles annually from 2020 to 2018.

The Chevy Bolt, the primary competitor for an affordable, long-range (200+ miles) EV, arrives later this year -- and early projections forecast annual sales of 30,000 to 80,000.

Volvo also announced its plans to sell over a million EVs by 2025. Many other manufacturers have made equally encouraging statements about EVs. The revolution is upon us.

For any potentially large-scale technology that is hyped to replace existing systems en masse, it’s important to look at the supply chains and materials to see if these can scale as required. I looked last year at the potential for lithium to scale as the EV revolution takes place and concluded that current reserves and resource numbers suggest that major bottlenecks may occur with lithium supplies. But, because markets can respond to increased demand with increased supplies, sometimes relatively quickly, it was too soon to draw definite conclusions about the adequacy of lithium supplies in the future.

This column looks at a closely related issue: whether cobalt, a key metal in the manufacture of lithium batteries, can scale. Some analysts believe that cobalt is most likely to be the limiting factor for massive lithium-ion battery scaling.

The short answer for those who don’t want to read the whole column: as with lithium supplies, current production, reserves and resources information suggests major bottlenecks may occur in the coming years, but markets may still surprise us by rising to the occasion and producing large amounts of new cobalt sufficient to meet demand. At the same time we are likely to see some technology substitution effects as new technologies are developed to avoid such bottlenecks.

Er, what’s cobalt?

First, a bit of information about cobalt, courtesy of the U.S. Geological Survey:

Cobalt (Co) is a metal used in numerous diverse commercial, industrial, and military applications, many of which are strategic and critical. On a global basis, the leading use of cobalt is in rechargeable battery electrodes. Superalloys, which are used to make parts for gas turbine engines, are another major use for cobalt. Cobalt is also used to make airbags in automobiles; catalysts for the petroleum and chemical industries; cemented carbides (also called hardmetals) and diamond tools; corrosion- and wear-resistant alloys; drying agents for paints, varnishes, and inks; dyes and pigments; ground coats for porcelain enamels; high-speed steels; magnetic recording media; magnets; and steel-belted radial tires.

So, cobalt is “strategic and critical,” and as EVs ramp up around the world, it will become even more strategic and critical. The following image shows cobalt in refined form.

FIGURE 1: Cobalt in Refined Form

Source: Wikipedia

Prices for cobalt have been surprisingly stable in the last few years after rising and falling dramatically (along with almost every other global commodity) amid the 2007-2009 market craziness. Prices are currently at about $10.50 per pound or $25 per kilogram.

Global cobalt supplies

An unusual feature of the global cobalt market is that literally half of global production comes from the Democratic Republic of the Congo in central Africa, a nation of 90 million people with an abundance of natural resources. This is both a blessing and a curse, but history shows that such resources are more curse than blessing. The Congo has been torn by war for decades and while resources like cobalt add to the overall GDP, the effect of such wealth on the country as a whole, and on the average Congolese person, has often been far from positive due to the corruption and violence that has resulted.

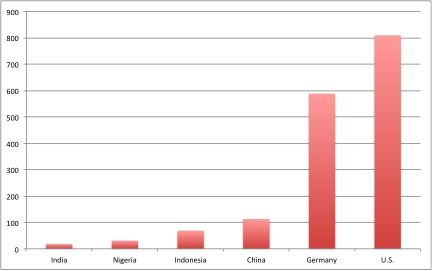

Cobalt is usually produced as a byproduct of mining copper or nickel, so countries that produce these metals in large quantities generally produce a lot of cobalt as well. Figure 2 shows global cobalt production in 2015 and national cobalt reserves, in metric tons (a metric ton is 1,000 kilograms).

FIGURE 2: Global 2015 Cobalt Production and Reserves in Metric Tons

Source: USGS

Tesla's market impact on cobalt supplies

Tesla pledged in 2014 to use only North American resources for its battery production at its Gigafactory. For cobalt, this means that Canada will have to supply Tesla factories, unless U.S. and Mexico cobalt operations ramp up significantly. As Figure 2 shows, Canada is the No. 3 supplier of cobalt in the world, with substantial reserves (enough at current production levels to last for 40 years).

If we assume that Tesla meets its new and even more ambitious goal of 500,000 EVs produced in 2018 (rather than the former target of 2020), and an average of 85 kilowatt-hours per EV (this is the high end of today’s Teslas, but it’s likely that range demands will increase as consumers demand more from their EVs, so even Model 3s may have larger batteries over time), plus an equivalent amount of large and small stationary storage productions like the Powerwall, we reach a total of 85 million kilowatt-hours of storage needed in 2018. The Model S 85 kilowatt-hour battery currently requires about 8 kilograms of cobalt, so 1 million times this amount is 8 million kilograms = 8,000 metric tons by 2018 or so.

Given that global cobalt production in 2015 was about 124,000 metric tons, this is probably well within today’s market capacity to provide. Whether it can all be sourced from North America is a different story.

As with my previous analysis looking at how well lithium scales with EV production, let’s assume that by 2040 we have the equivalent of 100 Gigafactories churning out batteries around the world. Under this scenario, we would need 800,000 metric tons of cobalt by 2040 for battery production only.

Total global reserves today are about 7.1 million metric tons, according to the USGS report, so this would last only about nine years at our projected 2040 demand levels, even if all of the world’s cobalt were used for batteries, which would leave the myriad of other important uses for cobalt out in the cold. Houston, we have a problem.

Luckily, markets can and do solve supply problems in creative ways. First, reserves figures change over time so it is not the case that the current reserves figures will remain static as the cobalt market ramps up. As prices rise for cobalt, and as EV demand rises, many countries and companies will surely get more serious about cobalt production.

Second, existing quantified resources are far greater than stated reserves. Reserves are better quantified than resources, so the latter are more speculative. The USGS annual report states that identified global terrestrial cobalt resources are about 25 million tons. If all of this resource base was converted into reserves and eventually production, this could provide another 30 years or so of batteries under our 2040 scenario -- again, assuming that all of the globe’s cobalt is used for batteries.

But this is a lot of ifs. And 39 years of available cobalt supplies is not very comforting when we envision an economy that relies predominantly on EVs and the massive battery demand this change will require.

However, cobalt and other metals are fully recyclable, rather than being an exhaustible resource like oil. If we state more realistically that the estimated 39-year supply of cobalt with today’s stated resource figures should be reduced to about 30 years, thus allowing for other market uses of cobalt, the question becomes: is a 30-year supply of cobalt for 100 Gigafactories enough to transition the world’s transportation fleet over to EVs?

Answering this question relies on too much speculation even for my stomach, so I’ll leave this as a question only at this time. But my gut feeling is that we’ll need to look elsewhere than cobalt mines as the EV revolution really gets going in the late 2020s and early 2030s.

Substitution effects?

Substitution may be a better long-term solution than scouring the earth for limited cobalt supplies. There are already efforts to produce different types of battery chemistries that don’t rely on cobalt or other relatively rare metals and minerals.

CRU, an information service for mining and related activities, projects an undersupply of cobalt globally from 2015 onward. With the potential for Tesla and other EV and stationary battery manufacturers possibly straining cobalt supplies in the coming few years, let alone in the long term in a more serious way, there may well be a shift away from cobalt-intensive batteries.

Rebecca Gordon of CRU states in a 2015 piece that several R&D efforts for new and improved batteries “are well advanced and are not planning on using cobalt, so the concern is that if one or two [of these non-cobalt battery] projects come to market in the next two to three years, Tesla could switch from cobalt to one of the other chemistries relatively easily.”

That said, most lithium-ion battery chemistries use substantial amounts of cobalt, so it is unlikely that the market will shift entirely away from cobalt anytime soon.

What happens when 'Chindia' nears Western levels of car ownership?

The not-so-well-hidden elephant(s) in the room in the resource limits debate are China and India and the rest of the developing world. China’s population of 1.3 billion already has about half the number of cars as the U.S., despite the fact that it's far less economically developed. India has even lower rates of car ownership than China and a population almost as large. Figure 3 shows the stark disparity in car ownership per capita (“car” does not include motorcycles or other two-wheelers, which are very common in these countries).

What happens when China and India and the rest of the developing world push en masse for personal car ownership and all the privileges that this brings? Well, the world definitely can’t handle that transformation under today’s fossil-fuel system, and it very likely can’t handle it under an EV-focused alternative system either, due to the resource constraints discussed above. We need to think hard about alternatives to passenger cars, even as we recognize that EVs are far better than petroleum internal-combustion engine vehicles. We face a real conundrum as the developing world races to become more like the developed world.

Technologies like the hyperloop, commuter trains, neighborhood electric vehicles, traditional bikes and walking will be able to take up a lot of the slack, but we’ll also need to design cities around these alternatives -- not, as we do today, around the personal automobile.

FIGURE 3: Car Ownership per Capita

Source: Wikipedia compilation of various sources

In a previously published article, I looked at the geopolitics of lithium production, examining how the balance of global power may change if lithium becomes the new oil. A future piece will do the same for cobalt supplies, which as we’ve already seen above, carry serious ramifications for Africa and Australia as the EV market ramps up, both good and bad.

In closing, it seems that we are likely to suffer numerous pinch points with respect to the adequacy of cobalt supplies in the coming decades, but it’s still a fairly nascent global market, so things may change dramatically as the EV revolution heats up.

We will likely see other battery chemistries come to the fore as lithium or cobalt supplies become tight, but this roller coaster of resource limitations prompts the obvious question: how do we get off the roller coaster in terms of such limits and reach a sustainable or -- better yet -- a regenerative economy that works well not only for humans but also for other species on this blue-green orb of ours?

***

Tam Hunt is a lawyer and owner of Community Renewable Solutions LLC, a renewable energy project development and policy advocacy firm based in Santa Barbara, California and Hilo, Hawaii, co-founder of Solar Trains LLC, and author of the new book, Solar: Why Our Energy Future Is So Bright. Disclosure: Hunt owns some Tesla shares.