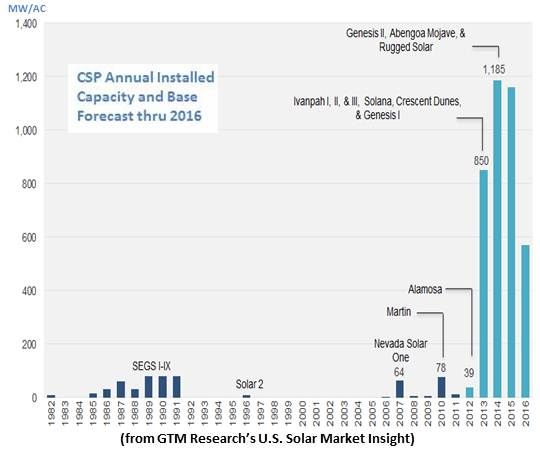

The four major CSP companies kept their PPA-driven flagship projects on track for power production in 2013.

One: Abengoa’s 280-megawatt Solana parabolic trough project with six hours of storage in Arizona;

Two: The BrightSource Energy (BSE) 370-megawatt (cumulative) Ivanpah Units One, Two, and Three pressurized steam solar power tower in California’s Mojave Desert just across the border from Las Vegas;

Three: SolarReserve’s 110-megawatt Crescent Dunes solar power tower outside Tonopah, Nevada, with ten hours of molten salt storage; and

Four: The NextEra Energy (NYSE:NEE) 250-megawatt Genesis trough project in California’s southeastern Mojave region.

President Clinton’s visit to Ivanpah in August spotlighted the excitement CSP developers are feeling, despite BSE’s canceled IPO bid.

Source: GTM Research’s U.S. Solar Market Insight

The Rise of an Alliance

Five: This year’s formation of the CSP Alliance included founding members Abengoa, BSE, and Torresol, as well as Cone Drive, Lointek, and Wilson Solarpower. Former DOE solar programs leader Frank “Tex” Wilkins was named the first Executive Director.

CSP’s International Play

Six: Middle East and Levant heating up.

Saudi Arabia revealed details this year of its King Abdullah City for Atomic and Renewable Energy (K.A. CARE) $109 billion solar development program. They include a CSP target of 25 gigawatts by 2032. The first round will open to bids in 2013 and industry insiders say the Saudis are talking to all major CSP developers.

The Saudi ambitions, it is thought, are at least in part due to the as-yet little-developed CSP supply chain. Because it is largely a manufacturing industry not unlike that for traditional power generation hardware, it offers Saudi Arabia the opportunity to build a blue-collar jobs base.

Abengoa’s 100-megawatt trough project with storage in Abu Dhabi, funded by Abu Dhabi’s Masdar Corporation (60 percent) and Abengoa (40 percent), will be the world’s biggest single-site CSP project when it goes on-line at the end of 2012.

A consortium composed of Saudi-based ACWA Power and Spanish interests was awarded a 25-year PPA by Morocco to build the 160-megawatt Ouarzazate trough project with three hours of storage.

BSE, in partnership with multinational powerhouse Alstom, won a 25-year PPA for a 121-megawatt solar power tower in Israel’s Negev Desert, the first unit of the planned 250-megawatt Megalim Solar Project.

Seven: South Africa was the next most active international CSP market in 2012. Abengoa won Round Two PPAs in Eskom’s procurement program and began construction on the 50-megawatt Khi Solar One solar power tower and the 100-megawatt KaXu Solar One trough projects, both with storage.

The program has targeted 1,000 megawatts of CSP. SolarReserve is preparing a Round Three solar power tower bid. BSE partnered with multinational Sasol on a feasibility study for a solar power tower project.

Eight: Spain’s economic restructuring and austerity program included a reduction of solar incentives and a moratorium on new solar power plants. But the already under construction Torresol-Masdar-SENER funded 50-megawatt Valle One and Valle Two trough projects with a cumulative 7.5 hours of storage joined Spain’s 37 other CSP projects on-line in 2012, bringing Spain’s world-leading cumulative CSP installed capacity to 1,781 megawatts.

Nine: India’s 22,000-megawatt National Solar Mission gave AREVA Solar’s Compact Linear Fresnel Reflector (CLFR) technology a boost when Reliance Power picked CLFR for a 250-megawatt installation, likely to be Asia’s biggest when construction -- started this year and scheduled in two 125-megawatt phases -- is completed.

AREVA’s CLFR technology got a smaller boost early in the year when Tucson Electric Power picked it for a five-megawatt CSP addition to the 156-megawatt Sundt hybrid natural gas and coal power plant. This could be the beginning of bigger things for AREVA in the U.S. if experiments with molten salt storage at Sandia National Lab pay off and the technology can hit the right price point.

China has a 1,000 megawatts by 2015 CSP target but seems presently focused on PV because of its once-skyrocketing PV manufacturing sector’s painful rationalization process.

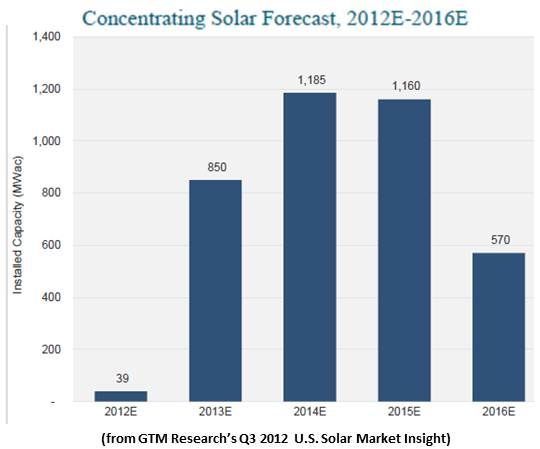

Source: GTM Research’s U.S. Solar Market Insight

Politics and Policy

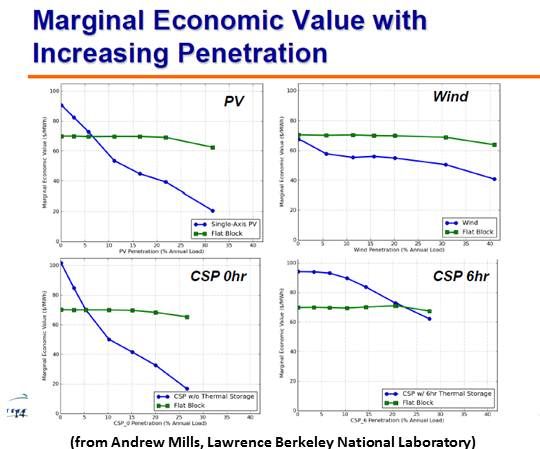

Ten: President Obama’s re-election buoyed the spirits of the renewables industry. The policy that could help CSP along will takes its cues from the California grid operator, NREL, LBNL and others showing CSP to provide power system savings that smoothes transmission load.

Absent such policy, the California Public Utilities Commission in November granted BSE just two of its five proposed PPAs, asking it to use one unit of Rio Mesa to prove its next generation technology and one unit of Sonoran West to prove its storage technology. SolarReserve’s solar power towers in Arizona (Crossroads) and Colorado (Saguache) still lack PPAs as regulators await marketplace verification of CSP’s economic value and viability.