When the polar vortex swept down from the Arctic last winter -- plunging temperatures to levels 25 degrees Fahrenheit below the seasonal average -- schools closed, skin froze, and the electric grid took a severe beating.

Natural gas pipelines were interrupted, piles of coal froze over, gas igniters failed, and trucks were unable to make fuel deliveries to backup oil plants. As a result, ratepayers across the Midwest, South Central and East Coast regions saw prices spike, and tens of thousands lost power completely.

PJM Interconnection, the largest grid operator in the United States, was hit hard. The evening of January 7, as people came home from work and cranked up the heat, the grid operator set a new winter peak record of 141,846 megawatts. The previous winter peak record of 136,675 megawatts was set in February 2007.

At the peak demand hour, PJM experienced 40,200 megawatts of forced outages, or 22 percent of total PJM capacity. A third of that was from coal and nearly half was from gas-fired power plants.

With another cold winter settling in, the grid operator, which serves 62 million people and supports 21 percent of the U.S. GDP, insists it’s prepared to handle it.

“To ensure reliability, we’re doing everything humanly possible,” said PJM CEO Terry Boston, speaking at an energy event yesterday in Washington, D.C., just as the city was hit with an ominous cold front. “If the lights aren’t on, nothing else matters.”

Figure 1: Causes of Forced Outages

Source: PJM Interconnection

Last year’s gas plant outages are “very troubling,” Boston added, particularly as PJM makes a move from coal to gas driven by the availability of low-cost domestic natural gas supplies and the requirements of the EPA Clean Power Plan (PJM is expected to release new figures on the cost of compliance with the EPA regulations as soon as today).

“I’m actually more worried about the winter of 2016 than the winter of 2015, primarily because there will be 8,000 megawatts of coal plants shuttered between now and then,” he said.

PJM has limited natural gas storage east of the Allegheny Mountains, and the gas only moves at a rate of 23 miles per hour, which can put a strain on supply. In contrast, coal power plants generally have a 30-day supply on the ground; nuclear reactors have eighteen months' worth of fuel in reserve.

Since the polar vortex hit, PJM has made a concerted effort to improve coordination with the gas industry and pipelines, according to Boston. PJM has also rebuilt certain power lines to improve voltage regulation and power throughput, and it is testing generators that haven’t run since last year. Some natural gas users, such as Calpine Corp., have announced they’re adding dual fuel to their plants for backup capacity.

In addition, PJM has proposed major reforms to its capacity market that include incentivizing generators to take steps to ensure they can run during extreme weather events, an approach known as a pay-for-performance program. The PJM board of directors is currently considering the proposal and is expected to make a decision in the next couple of weeks, said Boston.

The push for change comes at a time when the energy sector is seeing increasing adoption of renewable energy, energy-efficiency technologies, and greater consumer involvement, at the same time as more frequent and severe extreme weather. All of these factors prompted PJM to propose revising its capacity markets, but the action didn’t take place until after the polar vortex hit.

Part of the plan includes changes to address a court ruling voiding the Federal Energy Regulatory Commission’s Order 745. PJM recently released a separate white paper with alternative approaches that would allow demand response to continue in its market.

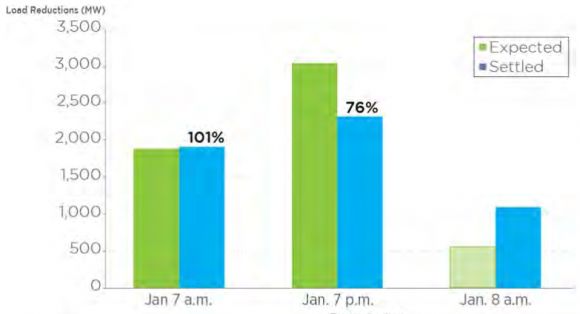

In a review of the polar vortex event, PJM determined that demand response helped to manage the grid at peak times, despite the fact it was a voluntary program.

“We’ve always had [demand response] focused on summer, because historically we’ve had about 40 percent reserve margins in the winter, but we didn’t have the gas in play,” said Boston. “Going forward, I would hope that we could encourage through the economics and the pay for performance [incentive]...more annual demand response, not just summer,” he added.

Figure 2: Polar Vortex Demand Response Performance

Source: PJM Interconnection

Some have said the PJM capacity market proposal amounts to giving coal a boost. Others argue it’s excessively costly and ultimately unjustified. Meanwhile, even if passed by the PJM board, the proposal won’t do much to avoid outages and price spikes this winter. If the board votes in favor of the proposal, FERC has 60 days for review. If FERC approves it, the plan would only come into effect for PJM’s next capacity auction in May, which has a delivery date of three years in the future.

Some utilities in New England have preemptively raised their prices in anticipation of a supply crunch this winter. Last week, NStar, which serves more than 1 million customers in Massachusetts, asked state regulators to increase electricity rates by 29 percent starting January. Massachusetts’ other major utility, National Grid, received permission to raise rates by 37 percent earlier this month.

Boston said PJM states are in a better position because there are 32 gas pipelines serving PJM territory versus just two in New England. But, he admitted, it will still take a couple of years to firm up those gas pipelines against future interruptions.

And so it remains an open question: Will all of PJM’s preparatory measures be enough to help the system survive the next polar vortex?