In a tricky U.S. solar market, Sunrun just posted strong financial results for the quarter and year, emerging as the "leading standalone company in the industry," according to CEO Lynn Jurich.

The U.S. solar market had a record-breaking year and is poised to triple in the next five years. Yet, this same buoyant market has SolarCity taking shelter within Tesla, Sungevity on its last legs, and the loss of NRG's residential solar unit.

Sunrun's Q4 and 2016 results:

- The firm deployed 77 megawatts, up 13 percent year-over-year. Last quarter, Sunrun installed 65 megawatts of residential solar systems.

- Sunrun closed out 2016 with 39 percent full-year growth in deployments and over 60 percent growth in customer net present value.

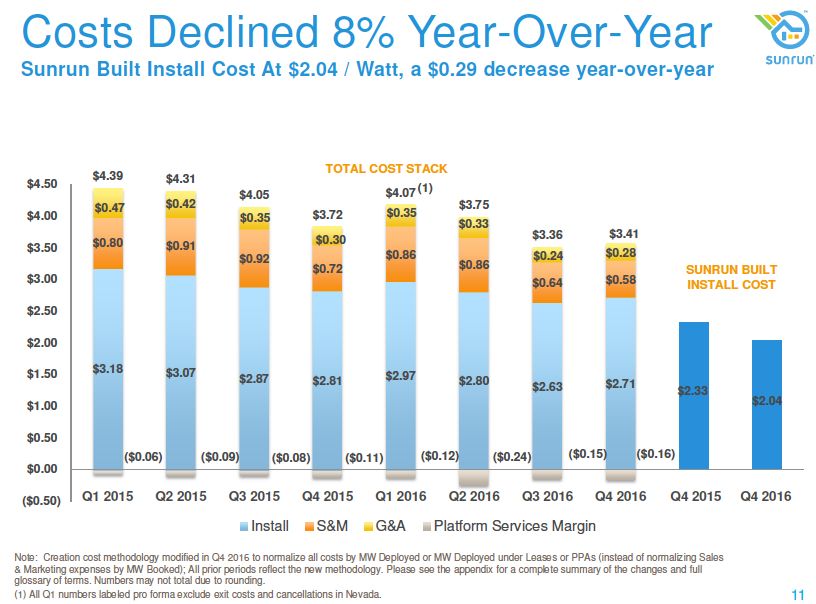

- According to the CEO, "In Q4, we were able to gain market share, increase deployments, reduce our creation cost by 8 percent, and generate $67 million in net present value. In the year, we grew at double the industry growth rate and improved our unit economics, all while maintaining our cash position."

The company missed slightly on its full-year deployment guidance, coming up 3 megawatts, or 1 percent, short of its 2016 goal of 285 megawatts.

A corporate structure that actually works

Whereas SolarCity tries to do everything and Sungevity tried to do nothing, Sunrun's "model makes use of the fragmented local solar industry paired with activities that benefit from our scale."

Jurich noted that her firm had seen demand soften "particularly in the second half of the quarter and in California," but she is confident that "a rebound is occurring, as lead volumes in California registered by our lead-gen business Clean Energy Experts have increased each month from the December lows."

She is also seeing some growth in storage: "Customers have placed more than 1,000 orders for our BrightBox product in Hawaii and California alone. The numbers are not small. These systems represent over 20 megawatt-hours of storage. This will be a massive growth market for us and the industry."

Regulatory optimism

Jurich said, "We believe we are moving from utilities trying to block rooftop solar to them accepting its inevitability and investing time and capital in the sector."

She added, "Just as utilities are switching tactics to embrace distributed energy, so are policymakers. We saw policy advances in Nevada, where the regulator ordered the reinstatement of net metering in northern Nevada and raised the aggregate cap for such systems by 40 percent. This proves that a too-much, too-fast retreat from net metering won’t hold up against public scrutiny."

During last quarter's call, Sunrun's Edward Fenster said, "The Clean Power Plan was...a utility-scale item that didn't really affect rooftops. In fact, you could easily argue that [its dismantling] could be positive and negative for rooftops."

PPAs still rule at Sunrun

The company expects installation costs to continue to decline, driven by panel and inverter prices "likely to deliver more than $0.15 per watt of equipment cost savings in 2017."

Sunrun's CFO Bob Komin noted, "Install cost for systems built by Sunrun remained roughly flat at $2.04 per watt, a reduction of $0.29, or 12 percent year-over-year."

He added, "Our cash and third-party loan mix was 13 percent in Q4, relatively flat with Q3. We expect this to remain at about this level for the year. We believe our PPA and lease product mix of over 80 percent better matches consumer preferences and delivers our customers significant value, which is one of the reasons we have been able to grow faster than the market in 2016."

Jurich said, "And we’re not contorting what we offer as a product based on our capital needs. And so I do believe that we have the purest view of what...customers want, because we’re customer-first oriented. And so it’s no surprise that we grew at double the market share of the rest of the market, despite people arguing that the future is...more loans than leases." Jurich also sees the storage business working more with PPAs rather than loans.

UBS agreed: "In spite of the sharp shift back toward loans by SCTY, we note RUN is sticking with the leasing model and attribute its relative success in market deployment to the continued acceptance of this approach by customers. We note just ~13% loans in Q4, and likely at this level still through 2017. We continue to perceive a higher margin product for RUN, emphasizing that it has consistently opted for improved margin over cash liquidity in contrast to its peers."

The firm ended 2016 with $206 million in unrestricted cash, an increase from 2015 and the sixth consecutive quarter the figure has been above $200 million.

Confident guidance, bullish prospects

Sunrun issued a Q1 guidance of 69 megawatts. For the full year, guidance is 325 megawatts, representing a 15 percent growth rate year-over-year.

Analyst Colin Rusch of Oppenheimer noted, "[Sunrun] continues to march forward with solar quarterly results and guidance for 15 percent megawatt annual deployment growth in 2017. We believe this is a reasonable rate and sustainable. We are encouraged to see the company’s upfront monetization strategy to be growing to ease cash flow along with continued cost declines. We are slowing our lease revenue growth estimates in line with a more conservative view of end-market growth, but offset that with slower spending. We continue to believe the company is well positioned to gain share, leveraging its mixed-channel sales approach, as we expect Tesla Energy (formerly SolarCity) to contract deployments this year."

CEO Jurich is confident, saying, "With our balance sheet strength, we remain on offense in a consolidating and somewhat tentative market. We plan to accelerate our lead."

***

Thanks to SA for the call transcript.