Like star-crossed lovers, Britain and the European Union could not last. Their relationship’s demise has left onlookers wondering what will become of their shared plans, including the push for a cleaner electrical grid.

The global stock markets plunged into turmoil and the pound sank to a 31-year low. The Brexit vote has thrown off all sorts of expert prognosticators, so it's hard to say anything for certain, but initial evidence indicates Britain’s energy future will be less chaotic than its politics. At best, the country’s long-term plans to cut carbon from electricity production will proceed as unfazed as a Buckingham Palace guard. At worst, the unraveling of the major political parties could elevate climate skeptics who want to roll back the climate agenda that has enjoyed widespread consensus in both Europe and the U.K.

Even as a member of the EU, Britain largely decided its own energy policy, including an ambitious goal of cutting greenhouse gases 80 percent by 2050. Since that’s a domestic law, rather than an EU policy, it still stands despite Brexit. As if to quell doubts thereof, the government is expected to adopt the latest iteration of its carbon budget before the week ends. Domestic market trends already afoot, like the swift decline of the British solar industry, will likely continue unabated with perhaps marginal changes due to the exit.

“The result of the vote will have few direct impacts on clean energy -- domestic and not European-level policy has been a stronger driver for the sector in the U.K.,” said Kieron Stopforth, an associate at Bloomberg New Energy Finance, in an email Wednesday. “Recent cuts to levels of renewables support will prove far more significant than the decision to leave the EU.”

Double, double toil and trouble

It’s possible, though, that the political turmoil following the vote, which has seen a collapse in the leadership of both the ruling Conservative Party and the opposition Labour Party, could lead to the rise of previously fringe political forces that will unravel the climate-change agenda. Indeed, The Guardian reported that the advocates for cutting ties with European bureaucracy share philosophical common ground with opponents of state-mandated climate change policies: “It is already clear that the Brexit vote will be used as a rallying cry for an agenda that frequently includes climate scepticism among its tenets, alongside curbs to immigration and to government regulation.”

In the meantime, the lack of both a coherent strategy forward and the leadership to guide the way means investment across the board is likely to stall. Prime Minister David Cameron has said he won’t initiate the official exit procedure -- invoking Article 50, in Euro-bureaucratese -- so the timeline depends on the disposition of whoever replaces him in September. The referendum isn’t legally binding, so that person doesn’t necessarily have to follow the stated will of the people, but if he or she does, the negotiations with the EU must conclude within two years.

“From an investment perspective, you’re going to see things freeze up a bit exactly because there is this kind of uncertainty,” said Phil Levy, senior fellow on the global economy at the Chicago Council on Global Affairs. “If you know all this stuff is in flux, the most likely approach is that businesses and actors in this market will just wait until they have more clarity.”

Siemens, for instance, announced it will do just that. The German energy company is halting new wind power investments in the U.K. until the relationship to the EU is clarified. Investors need to see what the new political leaders decide about the pace of the exit, the new relationship with the continent, and the new domestic rules that must be written.

The next few years will be slow for new projects, but there's reason to believe regulatory continuity will reappear after the Brexit disequilibrium. Access to EU markets is vital for Britain's economy: that's where 47 percent of its exports went in 2015. Favorable trade terms won't come free, though. "The powers of the European Union have made it quite clear that they don’t feel much compulsion to offer the U.K. special deals where they get lots of access without having to meet obligations," Levy said.

To maintain favorable trading terms, then, the U.K. will probably have to accept a certain level of EU regulation. The U.K. may even have to pay into the system and allow free movement of people from within the bloc, as Norway does. If the Britons pursue their economic self-interest, then, their stance on climate change and energy shouldn't deviate far from the status quo before Brexit.

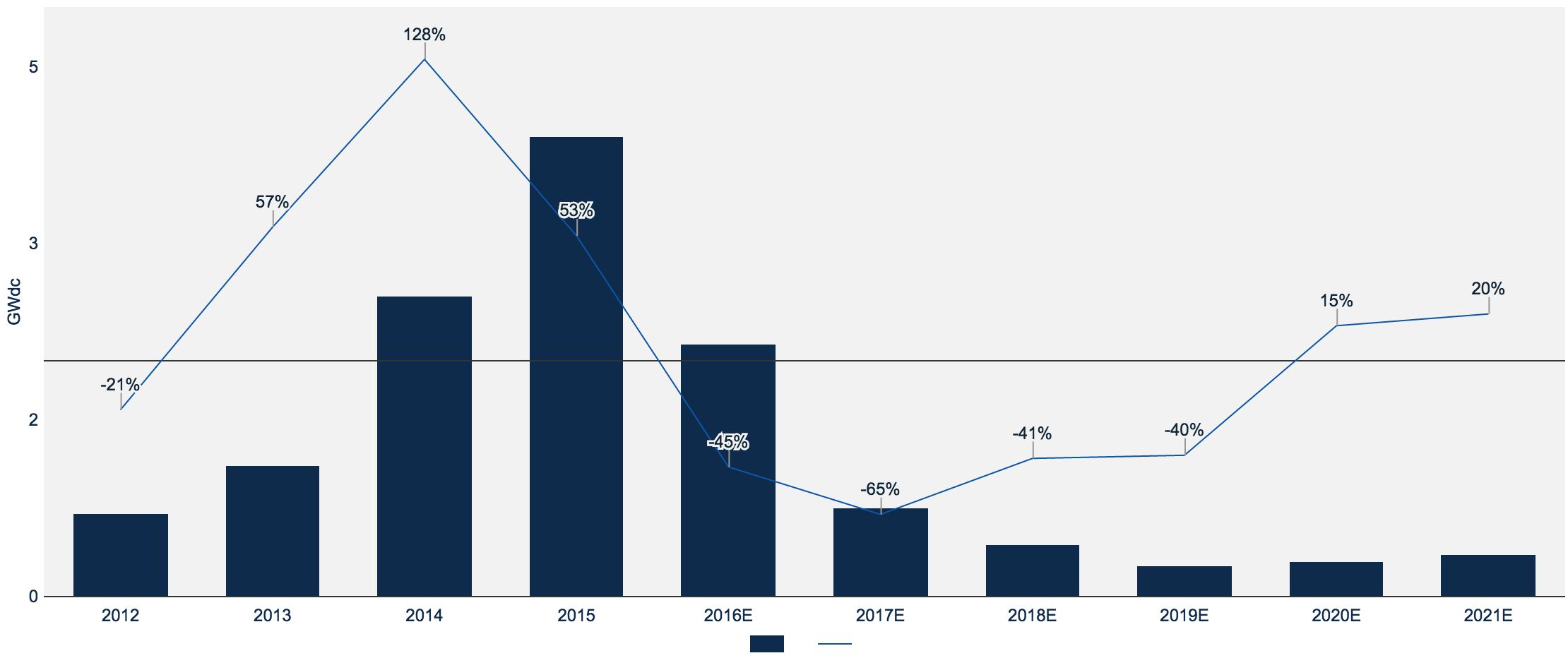

The blue bars represent annual installed solar PV in the U.K., with the blue line showing annual growth. (GTM Research)

Alas, poor solar!

Brexit can’t inflict much harm on Britain’s solar industry, though, because it’s already dead. The famously soggy island didn’t have much sunlight working for it in the first place, but the government only worsened things for its solar providers by slashing renewables subsidies in February. That move made it extremely difficult for small-scale PV projects to pencil out, even as the utility-scale market struggles to eke by.

“Solar demand in the U.K. was doomed anyway,” said Mohit Anand, GTM Research’s senior analyst for global solar markets. “Its obituary has already been written.”

The British solar market will fall by nearly 50 percent this year compared to last year, and continue declining by 40 percent to 60 percent in the following years, according to GTM Research predictions. When the industry is plummeting that fast, there’s just not much damage left for Brexit to do. That's not to say solar won't be a significant part of the energy mix -- solar generation surpassed coal for the month of May, a big symbolic victory for British renewables. The U.K. is trying to phase out coal power by 2025 and has been ramping up renewables generation to prepare. That said, wind and bioenergy generate far more overall than solar PV.

The retreat from the continent offers one point of hope for British solar: an escape from protectionist European import policies. The EU imposes a floor price for solar modules imported from foreign manufacturers, preventing cost declines even as manufacturing abroad gets cheaper. That’s intended to benefit local manufacturers. But Britain doesn’t have any -- the policy just blocks potential savings from cheaper foreign suppliers.

Anand calls the potential elimination of the minimum import pricing a “a small silver lining,” noting that savings of even 5 percent or 10 percent could make a difference for solar installers that are struggling to get by. The government has plenty of more pressing issues to tackle, Stopforth noted; this wouldn’t happen until after the exit proceedings wrap up.