Shunfeng International Clean Energy (SFCE), the owner of 2012's largest solar company, Suntech, is now a 63 percent stakeholder in high-efficiency solar cell and module firm Suniva. Shunfeng joins Suniva investors NEA, Goldman Sachs, Warburg Pincus, and Prelude Ventures.

According to a Hong Kong exchange document, "The Consideration is US$57,760,000, which is to be settled as follows: (a) the Company shall make the Cash Contribution of US$12,000,000 upon Completion; (b) for the remaining portion of the Consideration, the Company shall allot and issue 70,928,000 new Shares at the Issue Price to the Participating Stockholders."

Suniva lost $15 million in 2014, less than the $44 million it lost in 2013, according to the same document.

According to GTM Research's PV Pulse and GTM solar analyst Jade Jones, Suniva is the No. 2 U.S. c-Si manufacturer in terms of total capacity. The investment by SFCE will allow Suniva to expand its capacity to over 400 megawatts.

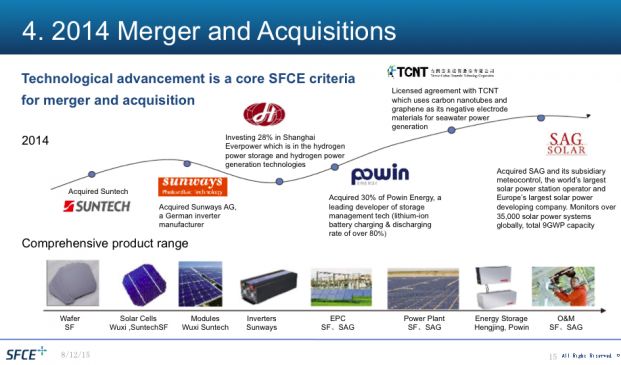

SFCE has the now viable Suntech manufacturing under its roof, as well as ground source heat pumps, PV inverters, energy management and battery storage capabilities, all gained through acquisition. The company has a market cap of approximately $1 billion on the Hong Kong stock exchange.

The once-bankrupt Suntech is now thriving with business in China -- but it can't ship to the U.S.

GTM Research's Jones notes that "Suntech's new anti-dumping tariff rate is 33.08 percent and has a separate countervailing duty of 20.94 percent. That's a cumulative duty of 54.02 percent, which is higher than most major manufacturers (Yingli is at 21.7 percent, most others are at 30.61 percent). Shunfeng, the original company majority producing cells, can't use Suntech's brand in the U.S. [if they want to be competitive]."

Jones suggests that "Suniva gives them that opportunity."

Matt Card, VP of global sales and marketing, spoke with GTM today, a few hours after the deal was signed.

Card suggested that the "power-dense" product from Suniva (with cell efficiencies hitting 21 percent and power ratings up to 330 watts) is best suited for residential, commercial and industrial, and what he called "micro-utility" scale -- up to 15 megawatts. Card pointed out the advantage of American-made solar modules when it comes to government procurement.

Suniva claims that it "employs the highest percentage of American workers among all other major solar module manufacturers." The expansion is supposed to create 300 jobs.

U.S. module manufacturing capacity is now on track to surpass 3.5 gigawatts by 2018, up from 1.6 gigawatts today. Cell manufacturing capacity could increase to 2 gigawatts, up from 0.7 gigawatts, over the same period, according to GTM Research's PV Pulse.