The Department of Commerce found for the petitioner, SolarWorld, and levied substantial tariffs in its just-announced preliminary finding in the Chinese solar module trade investigation.

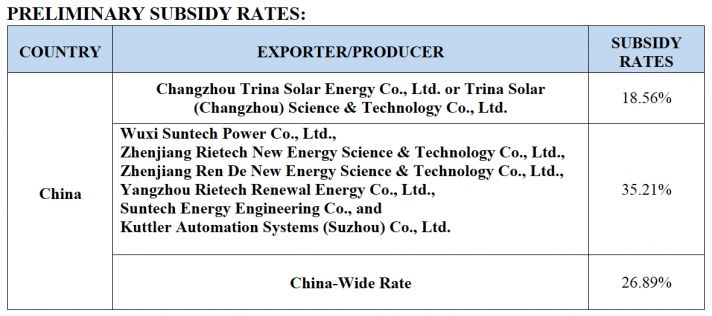

Commerce imposed preliminary duties of 35.21 percent on imports of solar panels made by Suntech, 18.56 percent on imports of Trina Solar, and 26.89 percent on imports of most other Chinese producers. Anti-dumping decisions will be made on July 25.

SolarWorld was looking to broaden the scope of its original claim and has succeeded so far.

This claim closes what SolarWorld called a "loophole" that allowed Chinese module manufacturers to use Taiwanese cells in their modules and circumvent U.S. trade duties.

In a release applauding the decision, SolarWorld "praised today’s preliminary decision by the U.S. Department of Commerce to impose anti-subsidy duties against U.S. imports of Chinese solar technology products and block state-sponsored Chinese solar producers from evading U.S. duties on their solar panels by outsourcing production of photovoltaic cells to third countries, such as Taiwan."

Mukesh Dulani, President of SolarWorld Americas, said, “Today is a strong win for the U.S. solar industry.”

SolarWorld sees this ruling as closing a loophole from the 2012 findings, claiming, "Many Chinese producers evaded the duties by commissioning manufacturers in other countries to partially or fully produce solar photovoltaic cells for assembly into solar panels back in China. State-controlled Chinese media said at least 70 percent of U.S. imports from China contain Taiwanese cells."

SolarWorld's Ben Santarris pointed out one of the items in the Commerce fact sheet: "Because the Government of China failed to respond completely to certain questions, we applied adverse facts available in determining that certain subsidy programs were countervailable."

Another item from the fact sheet: "Commerce will instruct U.S. Customs and Border Protection to require cash deposits based on these preliminary rates."

Here's the scope language: "For purposes of this investigation, subject merchandise also includes modules, laminates and/or panels assembled in the subject country consisting of crystalline silicon photovoltaic cells that are completed or partially manufactured within a customs territory other than that subject country, using ingots that are manufactured in the subject country, wafers that are manufactured in the subject country, or cells where the manufacturing process begins in the subject country and is completed in a non-subject country. Subject merchandise includes crystalline silicon photovoltaic cells of thickness equal to or greater than 20 micrometers, having a p/n junction formed by any means, whether or not the cell has undergone other processing, including, but not limited to, cleaning etching, coating, and/or addition of materials (including, but not limited to, metallization and conductor patterns) to collect and forward the electricity that is generated by the cell. Excluded from the scope of this investigation are thin film photovoltaic products produced from amorphous silicon (a-Si), cadmium telluride (CdTe), or copper indium gallium selenide (CIGS)."

The Coalition for Affordable Solar Energy made the following statement, pleading for a settlement:

“We are deeply disappointed in today’s preliminary determination ruling on countervailing duties by the Department of Commerce. [...] The ruling is a major setback for the entire U.S. solar industry because it will immediately increase the price of solar power and cost American jobs in one of fastest-growing sectors of the U.S. economy.

“By accepting SolarWorld’s request to expand the scope of the solar dispute, although they are continuing to entertain scope comments, the Department of Commerce is disregarding decades of legal precedent that define scope by applying the ‘country of origin’ and ‘substantial transformation’ trade rules. The use of SolarWorld’s proposed scope is also fundamentally inconsistent with the Department’s own previous ‘scope’ determination in the 2012 solar cell dispute.

“This is a global dispute that will not be resolved through litigation alone. The best path forward continues to be a negotiated settlement between the U.S. and Chinese governments to end this dispute and create the conditions for growth. But to achieve this, SolarWorld must come to the table and work with the industry to find a settlement that benefits the entire global supply chain. We ask the White House to help by convening the parties for true negotiations, and we urge SolarWorld to make its conditions known and join the rest of the U.S. industry in support of the Solar Energy Industries Association (SEIA) proposal.”

The Solar Energy Industries Association called for a negotiated settlement in a statement: "Today’s decision by the U.S. Department of Commerce to impose new tariffs on solar modules from China threatens to derail the rapid growth of the U.S. solar industry." SEIA President Rhone Resch said, "These damaging tariffs will increase costs for U.S. solar consumers and, in turn, slow the adoption of solar within the United States. Ironically, the tariffs may provide little to no direct benefit to the sole petitioner SolarWorld, as we saw in the 2012 investigations. It’s time to end this needless litigation with a negotiated solution that addresses SolarWorld’s trade allegations while ensuring the continued growth of the U.S. solar market."

“Over the past few months, SEIA has facilitated settlement discussions between Chinese solar manufacturers and SolarWorld. The goal of these discussions is to develop an industry recommendation to help jump-start government-to-government negotiations. Although we’ve succeeded in establishing direct communications between the parties -- and are working with all segments of the industry to find a consensus solution -- we’re quickly running out of time.

“It's time to get serious about resolving this ongoing dispute, before irreparable damage is done to the U.S. solar industry. We’re strongly urging all parties to set aside their grievances; redouble efforts to find a solution that benefits all segments of the industry; and end this potentially costly and divisive conflict.”

Commerce is scheduled to announce its final determination in this investigation on or about August 18, 2014.