RSI is building a VC-funded thin-film solar module manufacturing company in a different way. It's a "virtual turnkey" solar factory, according to the startup's CEO, Ed Grady.

Certainly, the "invest in a hyped 500-megawatt solar module factory before the manufacturing process has been proven out and scrubbed of cost" method has not worked very well in the past. (I could write you a list.)

Instead, the twenty-employee RSI is going after a licensing, franchising, and equipment sales model. (More on that in a bit.)

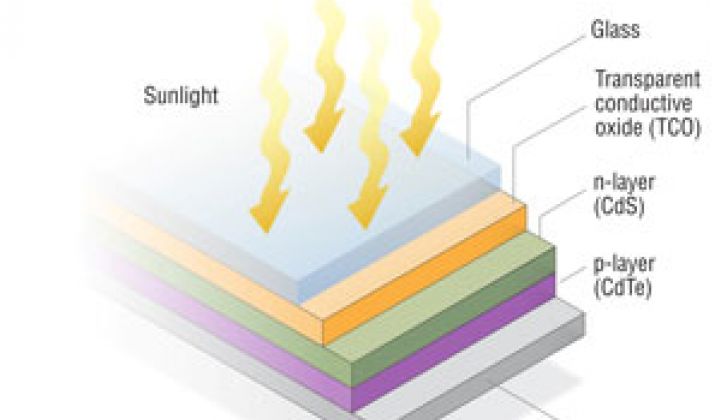

RSI is looking to accomplish this with cadmium telluride (CdTe) as the module's absorber material.

Today, when it comes to volume shipments of CdTe thin-film solar modules, there's First Solar, and then, well, there's not really anyone else. (See list below.) First Solar gives a 2013 revenue guidance of $3.8 billion to $4.0 billion on shipments between 1.6 gigawatts and 1.8 gigawatts. Its "lead line" was producing modules with 13.1 percent efficiency during the fourth quarter at a cost of less than $0.70 per watt.

RSI employs an electroplating process that works at a lower temperature than First Solar's and allows the use of larger glass sizes.

Grady looks to reach parity with First Solar efficiency numbers "with the extra lever that we can go very large in manufacturing." He equated the gains in larger glass sizes with the gains in larger wafer sizes in semiconductors -- moving from 4-inch to 6-inch to 8-inch wafers lowers capex, improves scaling, and better utilizes materials. (Grady was once one of the top execs at KLA.)

RSI contends that a higher-temperature process (like say, for example, First Solar's) does not allow for larger glass sizes because of glass warpage and its impact on processing and yield.

Larger sizes, in the CEO's viewpoint, drive down installed costs. RSI just announced its 1.5-square-meter CdTe panel, which is much larger than conventional 0.72-square-meter panels.

RSI targets $0.40 per watt for its modules. The company has a 12 percent efficiency goal for this year and targets 13 percent to 14 percent for its large module in 2014.

Dr. Kurt Weiner, co-founder and CTO of RSI, said that the company chose CdTe because of its proven manufacturability. He contended that efforts to improve record cell efficiency in CdTe had been minimal until recent work by First Solar and GE, which have pushed the value to 18.7 percent, an increase of 2 percent in the past year.

Weiner noted that CIGS is not repairable, while there is a gap-fill process in CdTe. This is another reason why CdTe might scale better than other thin films. Electroplating's low temperature allows the use of a wider selection of transparent conductive oxides and other materials, according to the company's CTO.

"The roadmap for CdTe is to go thin," said the co-founder. "You need smooth, uniform films. Electroplating gets us to thinner thin films -- and the grain structure is smaller than with high-temperature deposition films." Smoother interfaces make for better device performance, he added.

But the business plan is based on the core IP and the design of the tools. RSI will license the technology, retain a royalty on every module sold, and sell the CdS and CdTe deposition equipment. The other tools (e.g., furnaces, laser scribes, laminators, etc.) are off-the-shelf. That's the "virtual turnkey" solar factory.

Grady said that the company is in active negotiations with licensees in various global regions. RSI sees its customers in diverse regions where there is not a lot of technology. He said, "You need operational expertise and a market -- not cadmium telluride expertise."

Grady and Paul Fox, VP of Corporate Development, envisioned the licensee as a vertically integrated developer that wanted to take on First Solar head-on with manufacturing and solar farm EPC.

In the longer term, the intention is that revenue from licensing fees and equipment sales would finance a U.S.-based RSI CdTe plant.

The CEO suggested that a solar startup better have a good story if it wants Navin Chaddha at Mayfield to back it. CalCEF, CMEA, Pangaea Ventures and Nth Power are also investors in the firm. Peter Darbee, former PG&E CEO, is on the board.

By any measure, it's a solar module play that's capital-light -- and that's intriguing.

(More on new investing models here.)

CdTe firms still in the fight include:

- General Electric's PrimeStar Solar acquisition lies fallow awaiting the market's revival, according to GE. PrimeStar, acquired by GE in 2011, uses a close space sublimation (CSS) process for CdTe (as did Abound).

- Calyxo was acquired by Solar Fields from Q-Cells.

- Lucintech, the former Xunlight 26, is building prototypes on flexible substrates with CdTe and CdS deposited via magnetron sputtering. The company is still in early development, with VC funding from Ohio Third Frontier, NSF-SBIR, and DOE-STTR.

- China's Advanced Solar Power uses a CSS process for CdTe and claims to be shipping 12-percent-efficient panels. The company points out that tariffs on Chinese solar panels only apply to silicon cells.

Firms that have recently lost the battle with cadmium telluride include:

- Abound Solar (DOE loan recipient)

- Alion (formerly known as SunPrint, with funding from Sequoia Capital, DAG Ventures, Bright Capital, and Cleantech Group. The firm was once intent on building utility-size, large-format CdTe panels and has since pivoted to a robotic panel mounting plan)

- Solexant moved from CdTe to CIGS

- Willard & Kelsey closed down last week after burning through more than $60 million in investor and taxpayer money. The founders had roots in the early days of First Solar.