Beamreach Solar (known as Solexel for the last nine years) has a new lightweight photovoltaic module, a new CEO, and a new business plan to go along with its new name and the $240 million in venture capital it has spent so far.

The first time the company unstealthed in 2012, it was focusing on its thin-silicon technology and looking to mass-produce 35-micron-thick high-performance, low-cost monocrystalline solar cells using a lift-off technology based on a reusable template and a porous silicon substrate. The startup hit an NREL-certified cell efficiency of 21.2 percent in 2014 with its back contact cell.

Solexel aimed to ship 20-percent-efficient photovoltaic modules at a cost of $0.42 per watt by 2014.

That didn't happen.

The newly christened Beamreach is still a PV cell manufacturer, but the company's initial product is a bit of a pivot. It's going after the (almost-a-cliché-by-now) "underserved" commercial and industrial rooftop market with a lightweight, easy-to-install module. We spoke with the company in advance of its product unveiling at Intersolar Europe this week.

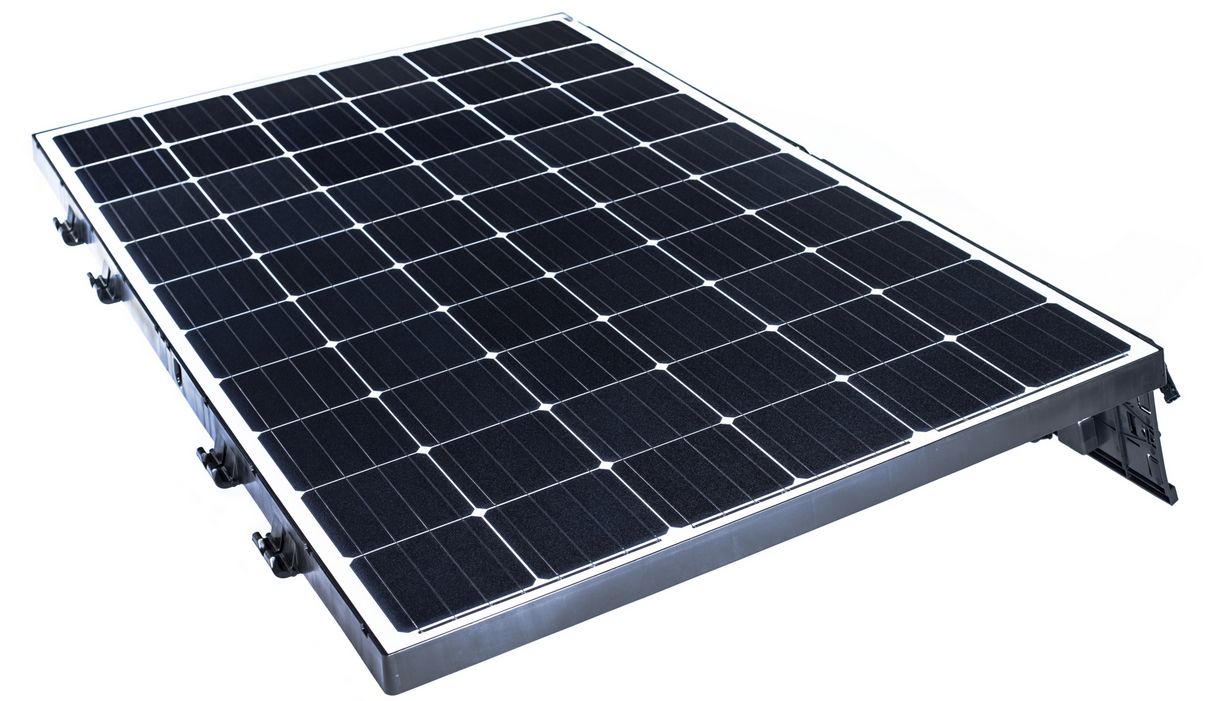

Mark Kerstens, newly promoted to the role of CEO at Beamreach, told GTM the system "is much lighter than...a conventional system, thanks to the use of thinner front sheet glass (2 mm instead of more commonly used 3.2 mm), the use of a composite material for the frame and the integrated mounting structure...and, most importantly, the adhesion method to the low-slope commercial rooftop surface. As a result, there is no need for the use of heavy ballast (pavers, patio blocks, etc.)...or roof penetrations."

Kerstens added, "This light weight can be achieved both with third-party-sourced cells (such as the front-contact PERC cells that we’re using in the product that we’re planning to start shipping in 3Q16), as well as with our proprietary back-contact monocrystalline silicon cells."

He noted, "The Beamreach product uses four diodes instead of the more commonly used three-diode configuration. The two bottom rows of the panel are each on their own diode -- this reduces the impact of row-to-row shading. We anticipate deploying intra-module electronics in products that are targeting the residential market (e.g., building-integrated solar tiles and shingles) in 2017."

Going commercial, addressing soft costs

Beamreach's module economics and performance goals might have been convincing in 2007, but today, when First Solar, the thin-film solar leader, has manufacturing lines in Malaysia producing panels below $0.40 per watt at more than 16 percent efficiency, Beamreach needs to differentiate, rather than take on FSLR, China Module Inc. or SunPower head-on.

Can light weight make the difference in commercial solar?

The startup claims that up to 40 percent of today’s commercial roofs cannot support conventional PV panels, "resulting in a massive untapped commercial market for solar power."

A report from the Photovoltaic Manufacturing Consortium backs that up: "In 4 selected sub-segments, over 339 million sq. ft. of commercial building roof space in New York state is potentially limited to < 3 psf of additional load. [...] Over 195 million is limited to < 2 psf [of additional load]."

Certainly, the commercial market is finally ready to grow. In the recently published report U.S. Commercial Solar Landscape 2016-2020, GTM Research forecasts the U.S. commercial solar market to "rebound and nearly triple in size by 2020. This growth will be driven by the extension of the federal Investment Tax Credit, the growing adoption of solar among national corporations, the increasing availability of financing for small commercial systems, and an expanding market for community solar."

And rather than take on commodity modules, Beamreach addresses a bigger cost-reduction target: soft costs. Kerstens notes that the installation requires "no tools and no grounding," with the promise of lower labor costs and savings on wire management, grounding, design and shipping.

Kerstens also claims that install time is five times faster than with a conventional system. He said, "No one has seen anything like it," adding, "Labor cost is reduced dramatically."

Here's a video that compares installation time of Beamreach modules to conventional racking.

When Beamreach was a thin-silicon or high-efficiency player, it might have been competing against SunPower, Silevo, Suniva, Tetrasun, 1366 Technologies, or Crystal Solar. But with this shift, Beamreach looks a bit like tenKsolar, which offers high-efficiency photovoltaic systems for commercial rooftops, carports and ground-mount projects, or SunPower with its integrated solution.

Scott Moskowitz, ace solar balance-of-system analyst with GTM Research, had this to say: "The Sprint solution is differentiated by its weight characteristics, but Beamreach is additionally part of a larger trend to integrate PV modules and racking for the purpose of accelerating installation and lowering overall system cost. We've seen integrated commercial rooftop systems from Zep Solar, which pioneered the use of integrated racking, as well as SunPower (an early investor in Solexel), whose Helix solution similarly enables a tool-free installation."

He continued, "Though load constraint is certainly a factor for many customers and Beamreach may enable installations on additional rooftops, it is not clear how often load is the primary bottleneck for commercial installations. Customers with load constraints, age concerns or spatial constraints typically look to ground mounts or carports as alternatives. Carports in particular are typically built when no other suitable solution is available, and these systems typically make up 12 percent to 15 percent of commercial system installations in the United States in any given year."

Beamreach has raised more than $240 million from investors including Riyadh Valley Company, the VC investment arm of King Saud University of Saudi Arabia, and GAF, a large roofing materials manufacturer, along with SunPower, KPCB, Technology Partners, The Westly Group, DAG Ventures, Gentry Ventures, Northgate Capital, GSV Capital, Jasper Ridge Partners, and Spirox. The firm's board of directors includes Ira Ehrenpreis of Technology Partners, Les Vadasz, and Jan van Dokkum of KPCB.